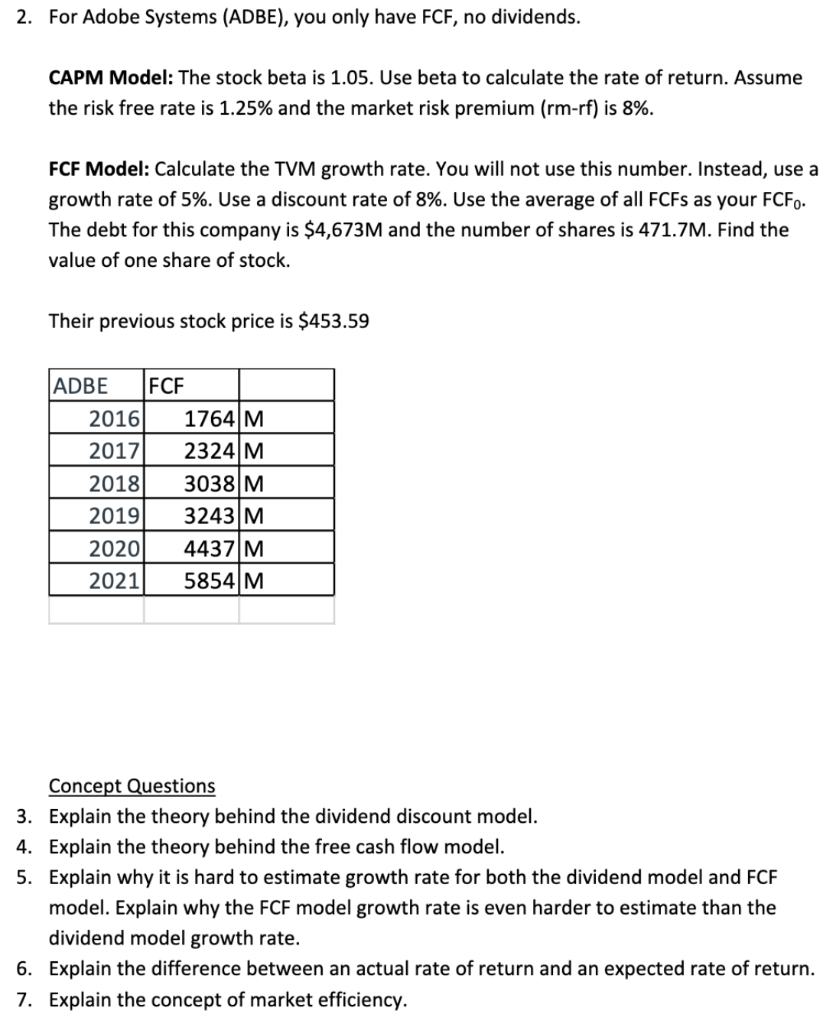

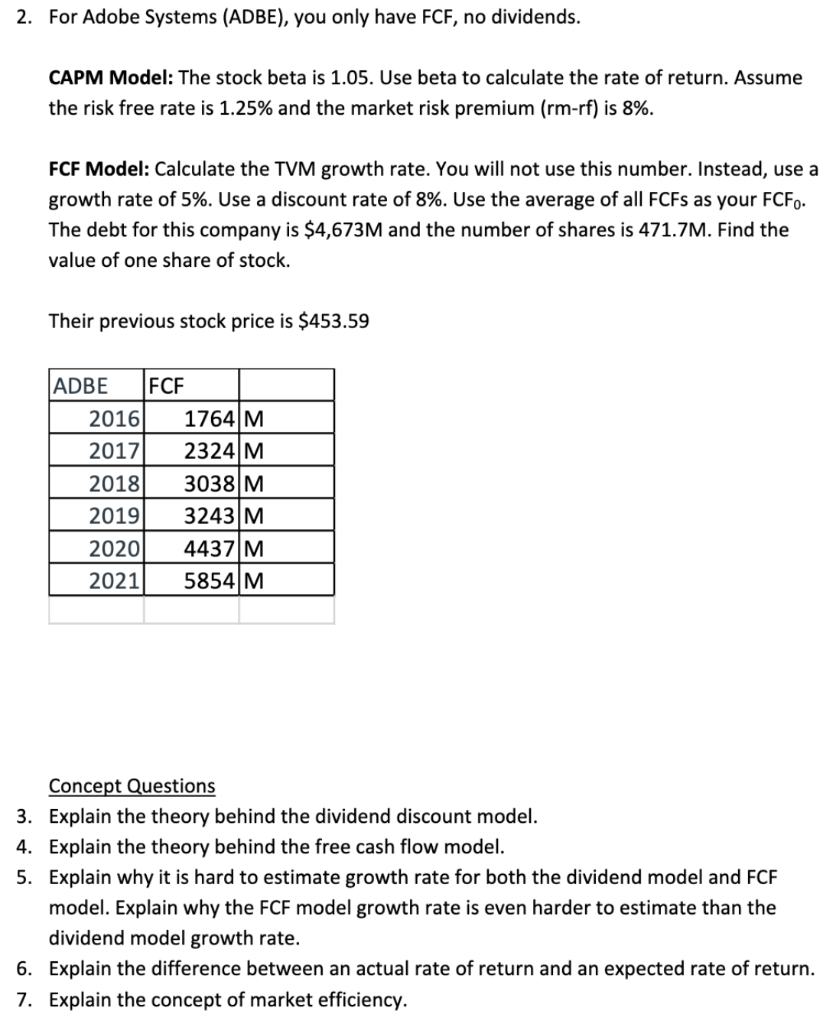

2. For Adobe Systems (ADBE), you only have FCF, no dividends. CAPM Model: The stock beta is 1.05. Use beta to calculate the rate of return. Assume the risk free rate is 1.25% and the market risk premium (rm-rf) is 8%. FCF Model: Calculate the TVM growth rate. You will not use this number. Instead, use a growth rate of 5%. Use a discount rate of 8%. Use the average of all FCFs as your FCF. a The debt for this company is $4,673M and the number of shares is 471.7M. Find the value of one share of stock. Their previous stock price is $453.59 ADBE FCF 2016 2017 2018 2019 2020 2021 1764 M 2324M 3038M 3243M 4437 M 5854M Concept Questions 3. Explain the theory behind the dividend discount model. 4. Explain the theory behind the free cash flow model. 5. Explain why it is hard to estimate growth rate for both the dividend model and FCF model. Explain why the FCF model growth rate is even harder to estimate than the dividend model growth rate. 6. Explain the difference between an actual rate of return and an expected rate of return. 7. Explain the concept of market efficiency. 2. For Adobe Systems (ADBE), you only have FCF, no dividends. CAPM Model: The stock beta is 1.05. Use beta to calculate the rate of return. Assume the risk free rate is 1.25% and the market risk premium (rm-rf) is 8%. FCF Model: Calculate the TVM growth rate. You will not use this number. Instead, use a growth rate of 5%. Use a discount rate of 8%. Use the average of all FCFs as your FCF. a The debt for this company is $4,673M and the number of shares is 471.7M. Find the value of one share of stock. Their previous stock price is $453.59 ADBE FCF 2016 2017 2018 2019 2020 2021 1764 M 2324M 3038M 3243M 4437 M 5854M Concept Questions 3. Explain the theory behind the dividend discount model. 4. Explain the theory behind the free cash flow model. 5. Explain why it is hard to estimate growth rate for both the dividend model and FCF model. Explain why the FCF model growth rate is even harder to estimate than the dividend model growth rate. 6. Explain the difference between an actual rate of return and an expected rate of return. 7. Explain the concept of market efficiency