Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. For each cost element, calculate cost per equivalent unit of beginning work in process and of work done in October 2017. Cari Colors is

2. For each cost element, calculate cost per equivalent unit of beginning work in process and of work done in October 2017.

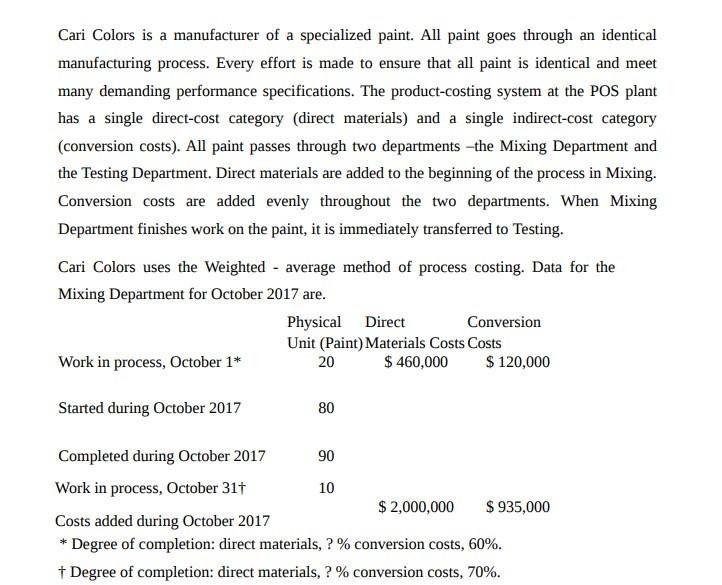

Cari Colors is a manufacturer of a specialized paint. All paint goes through an identical manufacturing process. Every effort is made to ensure that all paint is identical and meet many demanding performance specifications. The product-costing system at the POS plant has a single direct-cost category (direct materials) and a single indirect-cost category (conversion costs). All paint passes through two departments -the Mixing Department and the Testing Department. Direct materials are added to the beginning of the process in Mixing. Conversion costs are added evenly throughout the two departments. When Mixing Department finishes work on the paint, it is immediately transferred to Testing. Cari Colors uses the Weighted - average method of process costing. Data for the Mixing Department for October 2017 are. Physical Direct Conversion Unit (Paint) Materials Costs Costs Work in process, October 1* 20 $ 460,000 $ 120,000 Started during October 2017 80 Completed during October 2017 90 Work in process, October 317 10 $ 2,000,000 $935,000 Costs added during October 2017 * Degree of completion: direct materials, 2 % conversion costs, 60%. Degree of completion: direct materials, 2 % conversion costs, 70%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started