Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. The dividend policy

2. For the following problems, use Exhibit A. For exhibit A, the amount of sales depends on the production volume shown below. The dividend policy is to pay 28% in dividends. Construct the Production volume table based on your student ID number as per the instructions shown below.

a. What will be the accounts payable for 2021?

b. Imagine that the corporation decides to use debt for any external financing, what would be the amount of debt in 2020? (If no net new financing is needed, then answer with a negative number)

please answer as soon as posible

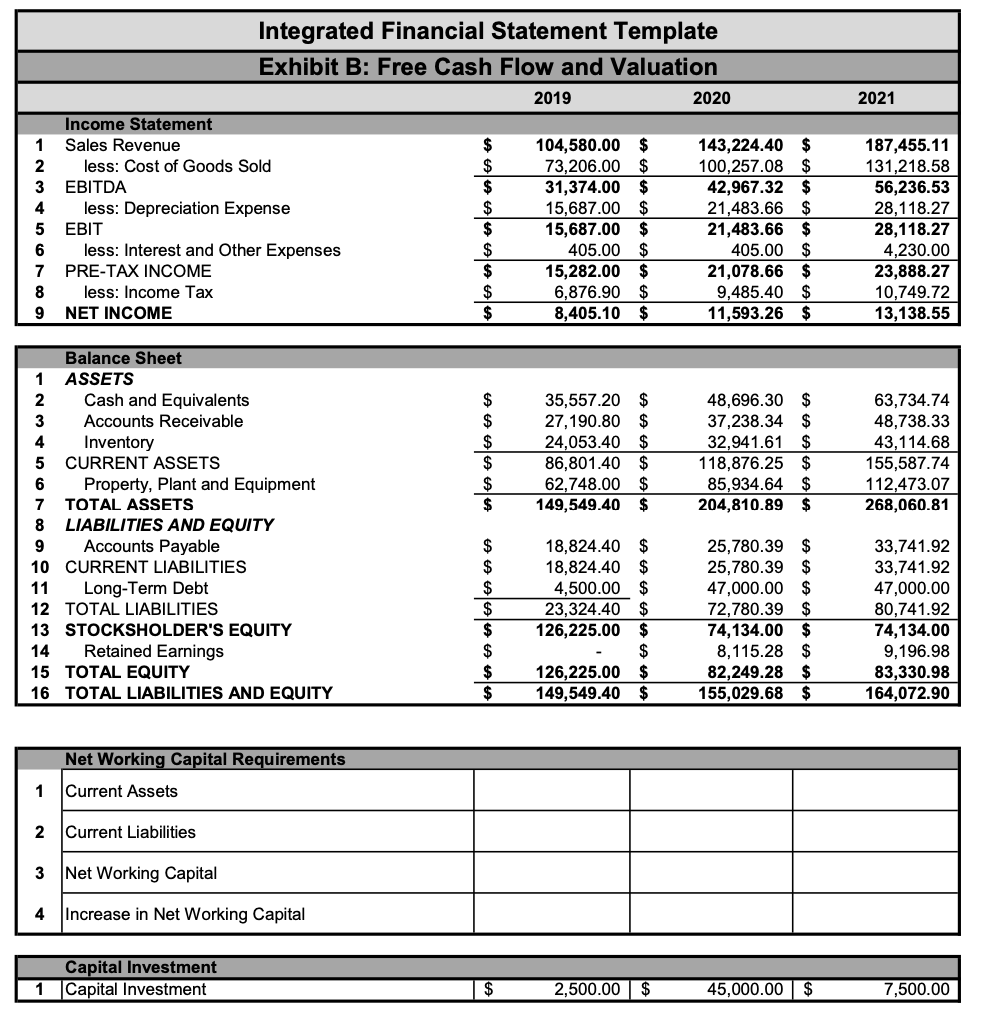

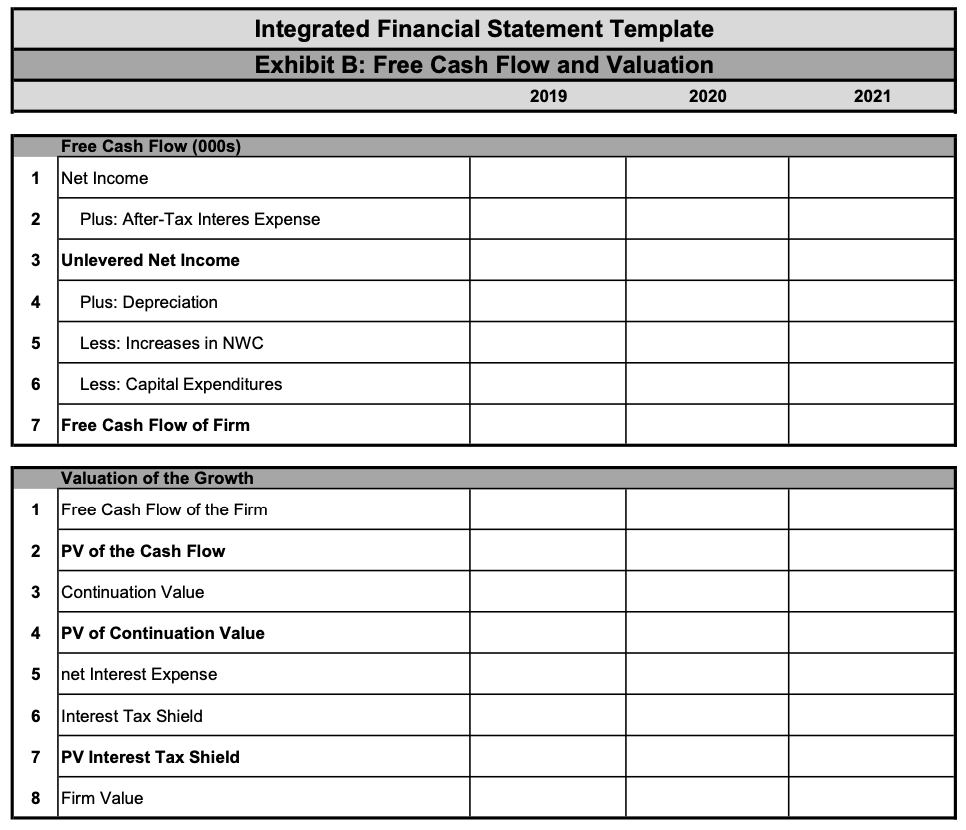

Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Income Statement 1 Sales Revenue 2 less: Cost of Goods Sold 3 EBITDA 4 less: Depreciation Expense 5 EBIT 6 less: Interest and Other Expenses 7 PRE-TAX INCOME 8 less: Income Tax 9 NET INCOME $ $ $ $ $ A A A A 104,580.00 73,206.00 $ 31,374.00 $ 15,687.00 $ 15,687.00 $ 405.00 $ 15,282.00 $ 6,876.90 $ 8,405.10 $ 143,224.40 $ 100,257.08 $ 42,967.32 $ 21,483.66 $ 21,483.66 $ 405.00 $ 21,078.66 $ 9,485.40 $ 11,593.26 $ 187,455.11 131,218.58 56,236.53 28,118.27 28,118.27 4,230.00 23,888.27 10,749.72 13,138.55 $ $ $ $ $ $ $ $ 35,557.20 $ 27.190.80 $ 24,053.40 $ 86,801.40 $ 62,748.00 $ 149,549.40 $ 48,696.30 $ 37,238.34 $ 32,941.61 $ 118,876.25 $ 85,934.64 $ 204,810.89 $ 63,734.74 48,738.33 43,114.68 155,587.74 112,473.07 268,060.81 Balance Sheet 1 ASSETS 2 Cash and Equivalents 3 Accounts Receivable 4 Inventory 5 CURRENT ASSETS 6 Property, Plant and Equipment 7 TOTAL ASSETS 8 LIABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY 14 Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY A A A A A A A 18,824.40 $ 18,824.40 $ 4,500.00 $ 23,324.40 $ 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 $ 25,780.39 $ 47,000.00 $ 72,780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33,741.92 33,741.92 47,000.00 80,741.92 74,134.00 9,196.98 83,330.98 164,072.90 Net Working Capital Requirements 1 Current Assets 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital Capital Investment 1 Capital Investment $ 2,500.00 $ 45,000.00 $ 7,500.00 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow (000s) 1 Net Income 2 Plus: After-Tax Interes Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Income Statement 1 Sales Revenue 2 less: Cost of Goods Sold 3 EBITDA 4 less: Depreciation Expense 5 EBIT 6 less: Interest and Other Expenses 7 PRE-TAX INCOME 8 less: Income Tax 9 NET INCOME $ $ $ $ $ A A A A 104,580.00 73,206.00 $ 31,374.00 $ 15,687.00 $ 15,687.00 $ 405.00 $ 15,282.00 $ 6,876.90 $ 8,405.10 $ 143,224.40 $ 100,257.08 $ 42,967.32 $ 21,483.66 $ 21,483.66 $ 405.00 $ 21,078.66 $ 9,485.40 $ 11,593.26 $ 187,455.11 131,218.58 56,236.53 28,118.27 28,118.27 4,230.00 23,888.27 10,749.72 13,138.55 $ $ $ $ $ $ $ $ 35,557.20 $ 27.190.80 $ 24,053.40 $ 86,801.40 $ 62,748.00 $ 149,549.40 $ 48,696.30 $ 37,238.34 $ 32,941.61 $ 118,876.25 $ 85,934.64 $ 204,810.89 $ 63,734.74 48,738.33 43,114.68 155,587.74 112,473.07 268,060.81 Balance Sheet 1 ASSETS 2 Cash and Equivalents 3 Accounts Receivable 4 Inventory 5 CURRENT ASSETS 6 Property, Plant and Equipment 7 TOTAL ASSETS 8 LIABILITIES AND EQUITY 9 Accounts Payable 10 CURRENT LIABILITIES 11 Long-Term Debt 12 TOTAL LIABILITIES 13 STOCKSHOLDER'S EQUITY 14 Retained Earnings 15 TOTAL EQUITY 16 TOTAL LIABILITIES AND EQUITY A A A A A A A 18,824.40 $ 18,824.40 $ 4,500.00 $ 23,324.40 $ 126,225.00 $ $ 126,225.00 $ 149,549.40 $ 25,780.39 $ 25,780.39 $ 47,000.00 $ 72,780.39 $ 74,134.00 $ 8,115.28 $ 82,249.28 $ 155,029.68 $ 33,741.92 33,741.92 47,000.00 80,741.92 74,134.00 9,196.98 83,330.98 164,072.90 Net Working Capital Requirements 1 Current Assets 2 Current Liabilities 3 Net Working Capital 4 Increase in Net Working Capital Capital Investment 1 Capital Investment $ 2,500.00 $ 45,000.00 $ 7,500.00 Integrated Financial Statement Template Exhibit B: Free Cash Flow and Valuation 2019 2020 2021 Free Cash Flow (000s) 1 Net Income 2 Plus: After-Tax Interes Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm Valuation of the Growth 1 Free Cash Flow of the Firm 2 PV of the Cash Flow 3 Continuation Value 4 PV of Continuation Value 5 net Interest Expense 6 Interest Tax Shield 7 PV Interest Tax Shield 8 Firm Value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started