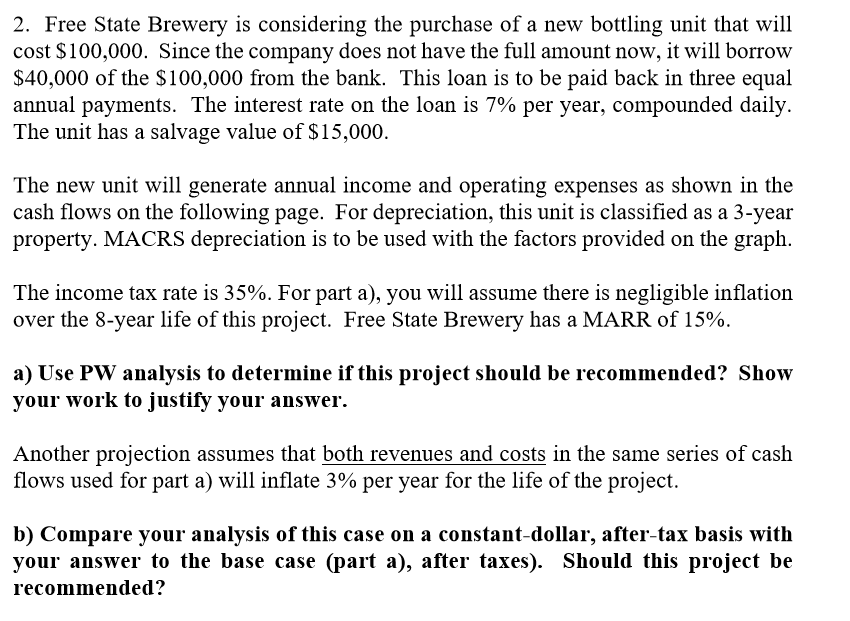

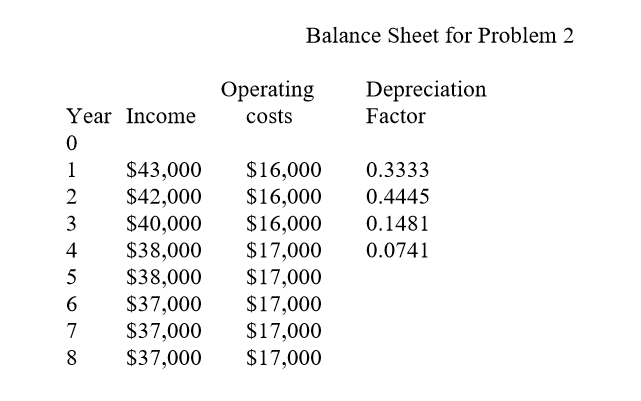

2. Free State Brewery is considering the purchase of a new bottling unit that will cost $100,000. Since the company does not have the full amount now, it will borrow $40,000 of the $100,000 from the bank. This loan is to be paid back in three equal annual payments. The interest rate on the loan is 7% per year, compounded daily. The unit has a salvage value of $15,000. The new unit will generate annual income and operating expenses as shown in the cash flows on the following page. For depreciation, this unit is classified as a 3-year property. MACRS depreciation is to be used with the factors provided on the graph. The income tax rate is 35%. For part a), you will assume there is negligible inflation over the 8-year life of this project. Free State Brewery has a MARR of 15%. a) Use PW analysis to determine if this project should be recommended? Show your work to justify your answer. Another projection assumes that both revenues and costs in the same series of cash flows used for part a) will inflate 3% per year for the life of the project. b) Compare your analysis of this case on a constant-dollar, after-tax basis with your answer to the base case (part a), after taxes). Should this project be recommended? Balance Sheet for Problem 2 Operating costs Depreciation Factor Year Income 0.3333 0.4445 0.1481 0.0741 $43,000 $42,000 $40,000 $38,000 $38,000 $37,000 $37,000 $37,000 $16,000 $16,000 $16,000 $17,000 $17,000 $17,000 $17,000 $17,000 2. Free State Brewery is considering the purchase of a new bottling unit that will cost $100,000. Since the company does not have the full amount now, it will borrow $40,000 of the $100,000 from the bank. This loan is to be paid back in three equal annual payments. The interest rate on the loan is 7% per year, compounded daily. The unit has a salvage value of $15,000. The new unit will generate annual income and operating expenses as shown in the cash flows on the following page. For depreciation, this unit is classified as a 3-year property. MACRS depreciation is to be used with the factors provided on the graph. The income tax rate is 35%. For part a), you will assume there is negligible inflation over the 8-year life of this project. Free State Brewery has a MARR of 15%. a) Use PW analysis to determine if this project should be recommended? Show your work to justify your answer. Another projection assumes that both revenues and costs in the same series of cash flows used for part a) will inflate 3% per year for the life of the project. b) Compare your analysis of this case on a constant-dollar, after-tax basis with your answer to the base case (part a), after taxes). Should this project be recommended? Balance Sheet for Problem 2 Operating costs Depreciation Factor Year Income 0.3333 0.4445 0.1481 0.0741 $43,000 $42,000 $40,000 $38,000 $38,000 $37,000 $37,000 $37,000 $16,000 $16,000 $16,000 $17,000 $17,000 $17,000 $17,000 $17,000