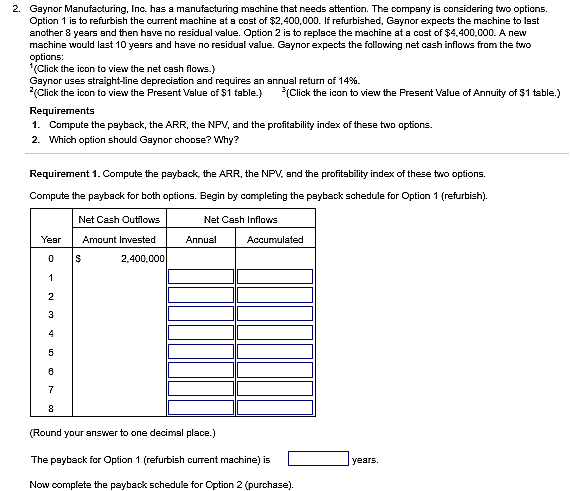

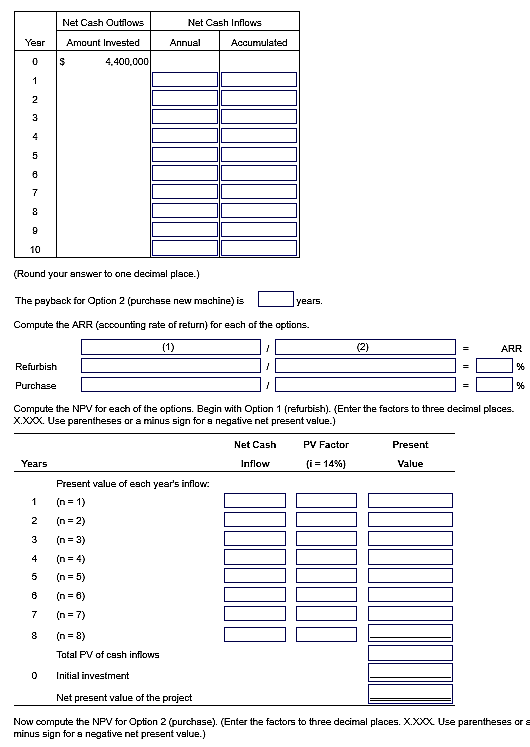

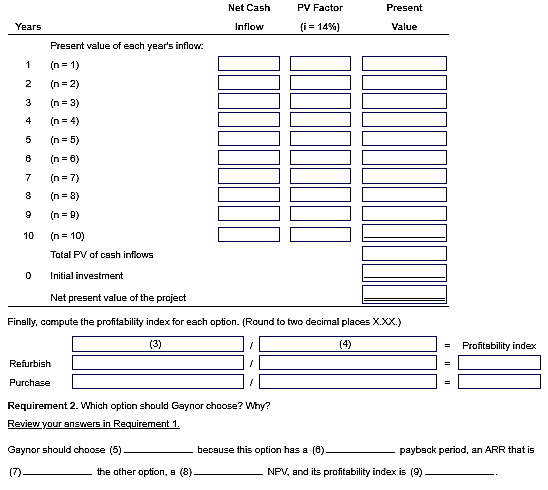

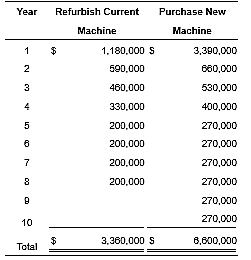

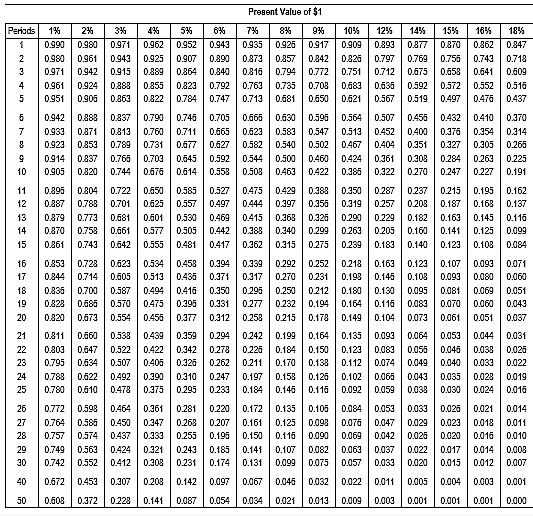

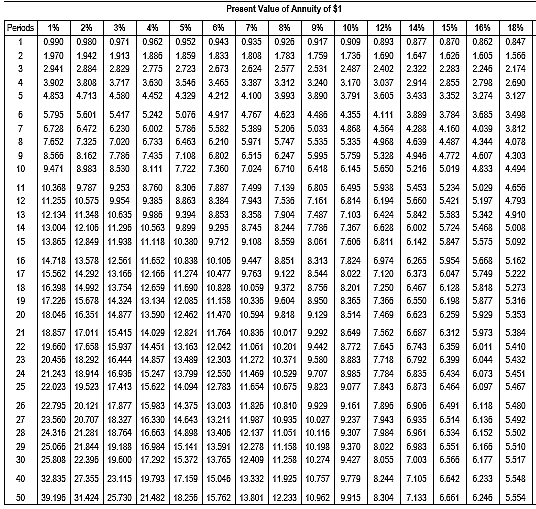

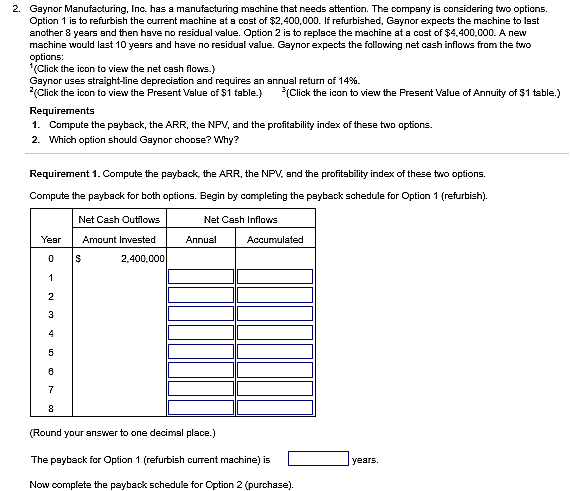

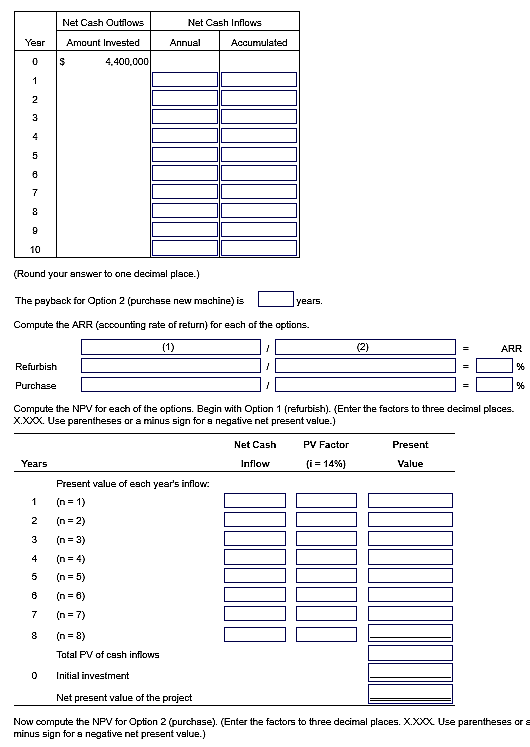

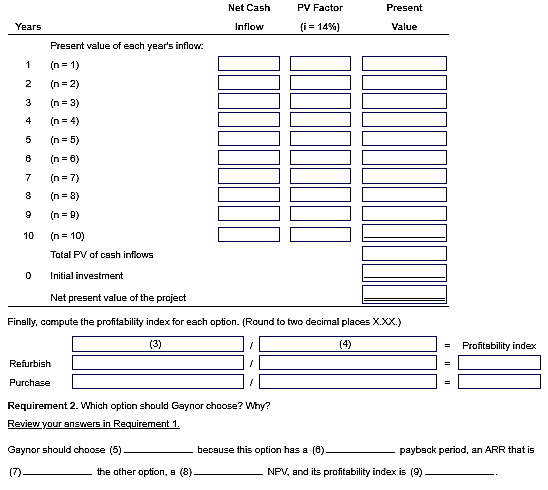

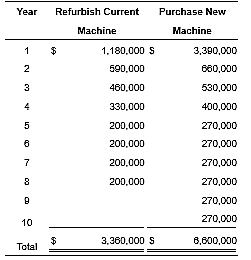

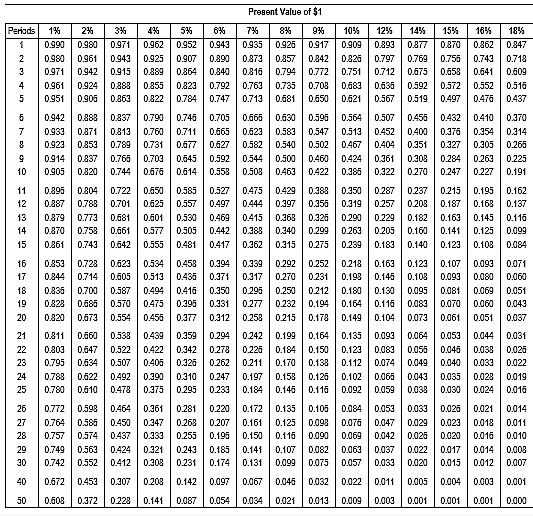

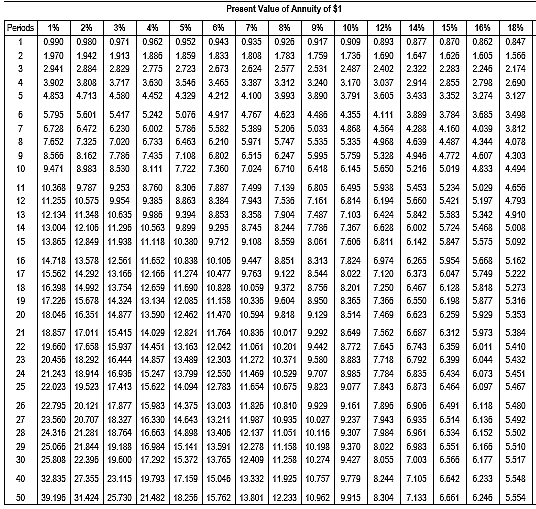

2. Gaynor Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering to options. Option 1 is to refurbish the current machine at s cost of $2,400,000. If refurbished, Gaynor expects the machine to lest another 8 years and then have no residual value. Option 2 is to replsce the machine at a cost of $4,400,000. A new machine wauld last 10 years and have no residual value. Gaynor expects the following net cash inflows from the two optians Click the icon to view the net cash flows.) Gaynor uses straight-line depreciation and requires an annual return of 14%. (Click the icon to view the Present Value of $1 table.) (Click the ican to view the Present Value of Annuity of $1 table.) Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these tvo options. 2. Which option should Gaynor choose? Why? Requirement 1. Compute the payback, the ARR, the NPV and the profitability index of these two options. Compute te payback for both options. Begin by completing the payback schedule for Option 1 (refurbish) Net Cash Outilows Net Cash Inflows Yesr Amount Invested Annual Accumulated 2.400,000 (Round your answer to one decimal place.) The psyback for Option 1 (refurbish current machine) is Now complete the payback schedule for Option 2 (purchase) years. 2. Gaynor Manufacturing, Inc. has a manufacturing machine that needs attention. The company is considering to options. Option 1 is to refurbish the current machine at s cost of $2,400,000. If refurbished, Gaynor expects the machine to lest another 8 years and then have no residual value. Option 2 is to replsce the machine at a cost of $4,400,000. A new machine wauld last 10 years and have no residual value. Gaynor expects the following net cash inflows from the two optians Click the icon to view the net cash flows.) Gaynor uses straight-line depreciation and requires an annual return of 14%. (Click the icon to view the Present Value of $1 table.) (Click the ican to view the Present Value of Annuity of $1 table.) Requirements 1. Compute the payback, the ARR, the NPV, and the profitability index of these tvo options. 2. Which option should Gaynor choose? Why? Requirement 1. Compute the payback, the ARR, the NPV and the profitability index of these two options. Compute te payback for both options. Begin by completing the payback schedule for Option 1 (refurbish) Net Cash Outilows Net Cash Inflows Yesr Amount Invested Annual Accumulated 2.400,000 (Round your answer to one decimal place.) The psyback for Option 1 (refurbish current machine) is Now complete the payback schedule for Option 2 (purchase) years