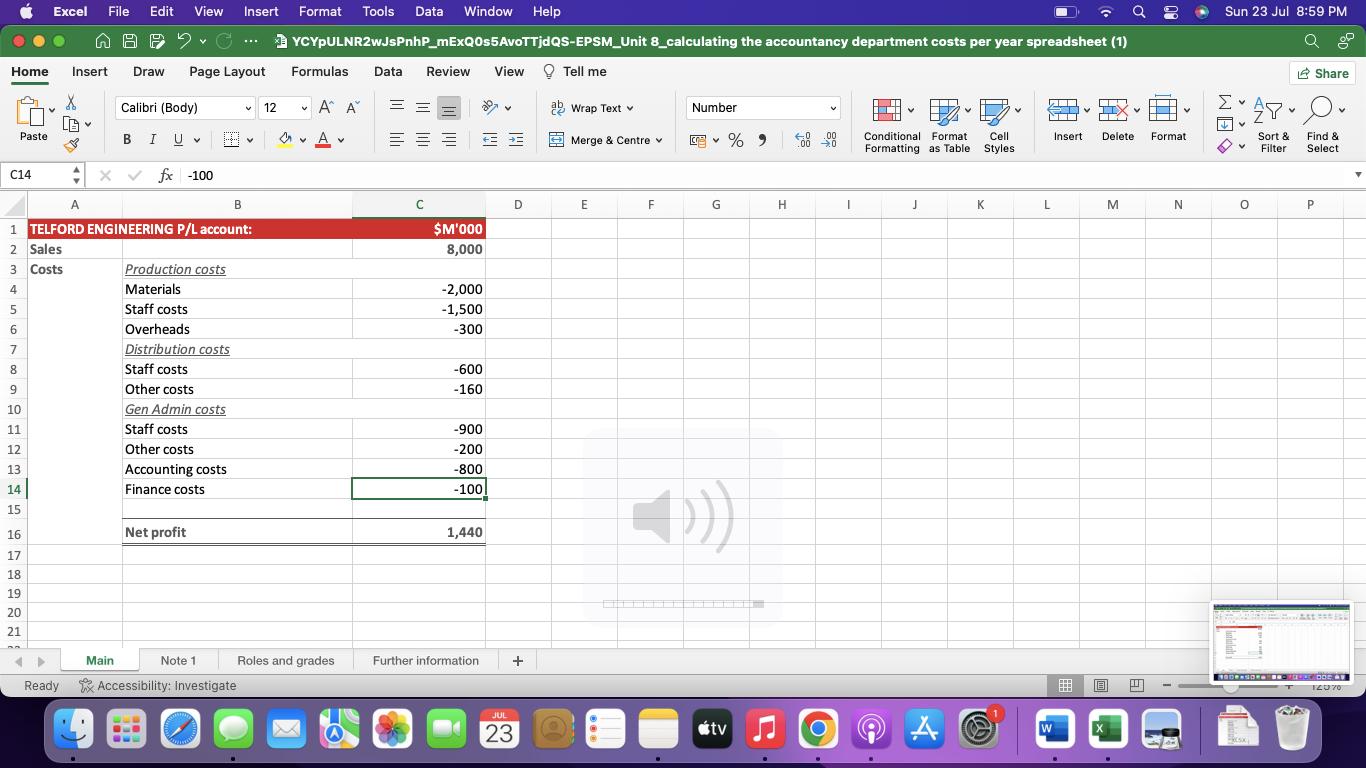

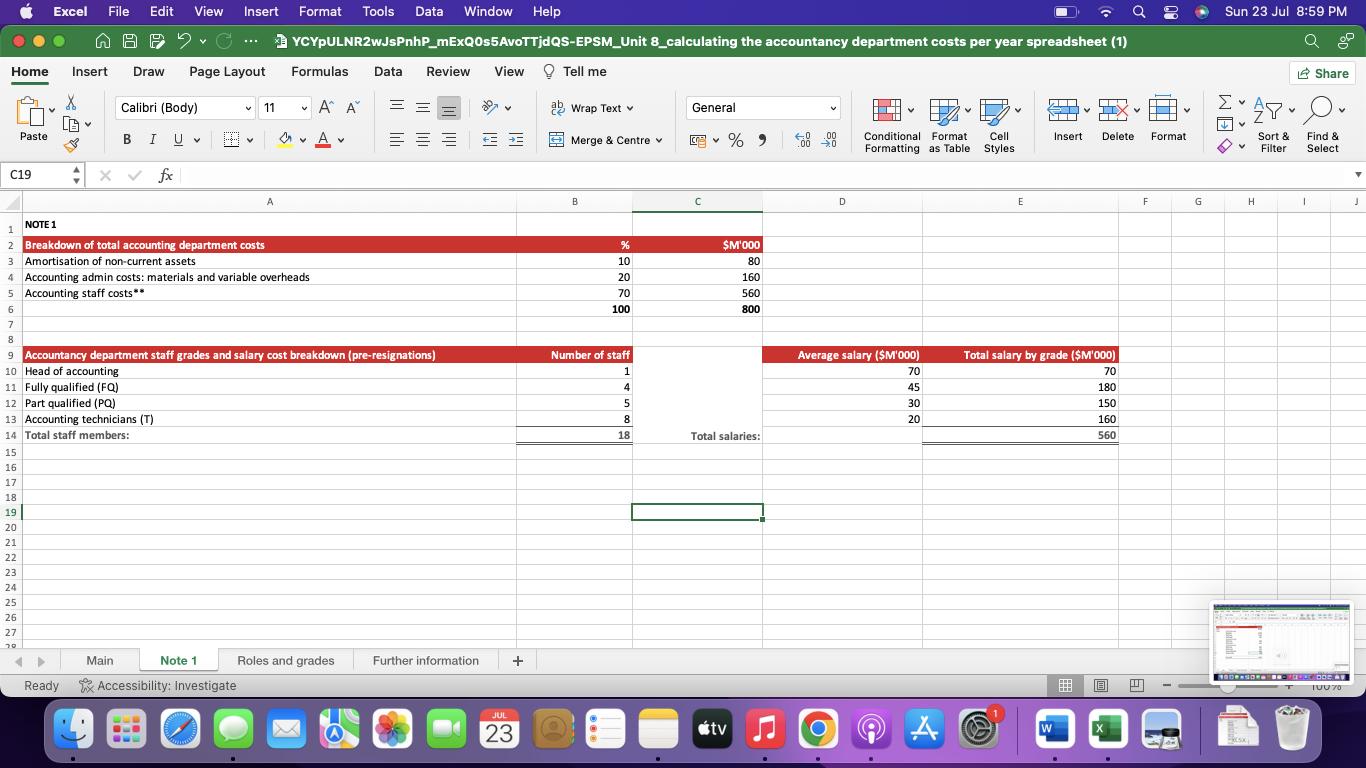

1 - Calculate and compare the forecast total accounting costs in the year following MEXIT under the restructured in-house option (A); to assess which option

1 - Calculate and compare the forecast total accounting costs in the year following MEXIT under the restructured in-house option (A); to assess which option will be most economical for Telford Engineering in the future.

Enter the accountancy department costs for Option A (to the nearest $M'000)

2- Calculate and compare the forecast total accounting costs in the year following MEXIT under the outsource option (B); to assess which option will be most economical for Telford Engineering in the future.

Enter the accountancy department costs for Option B (to the nearest $M'000)

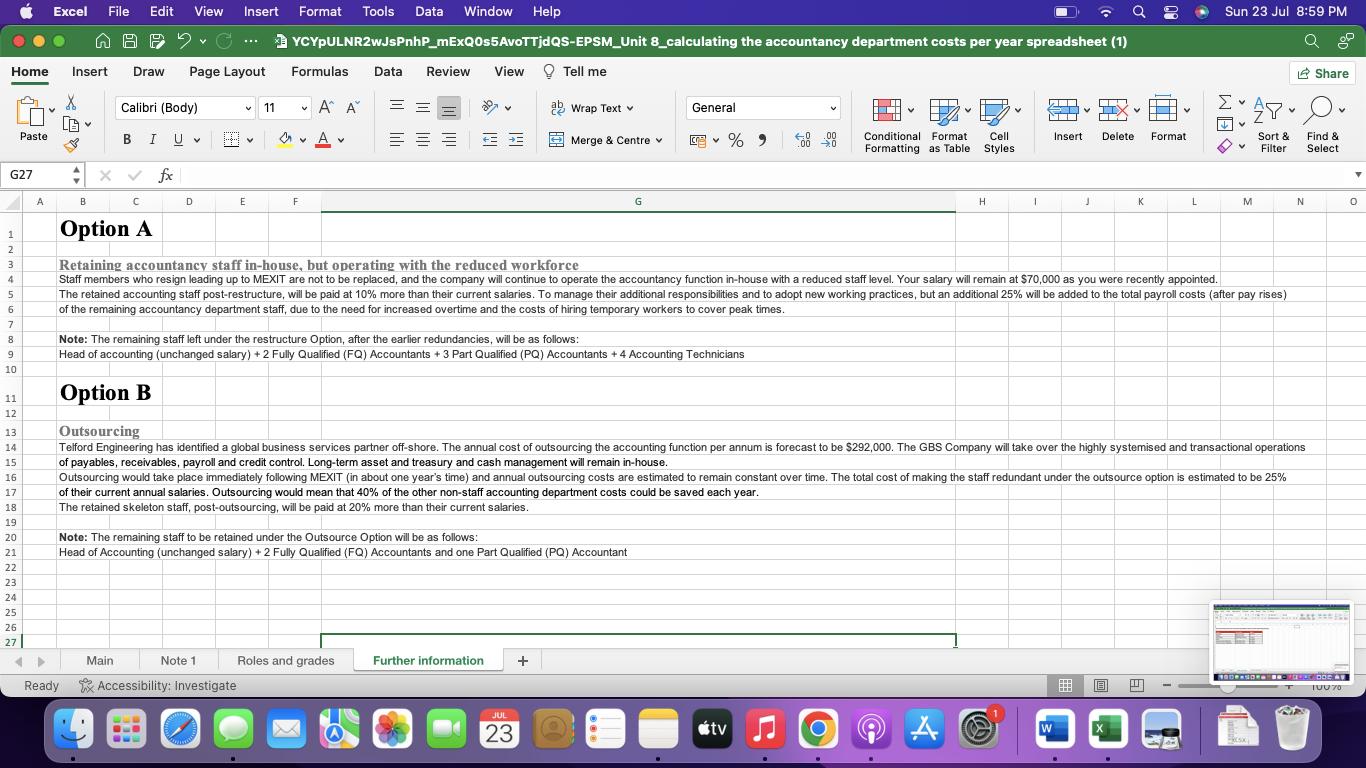

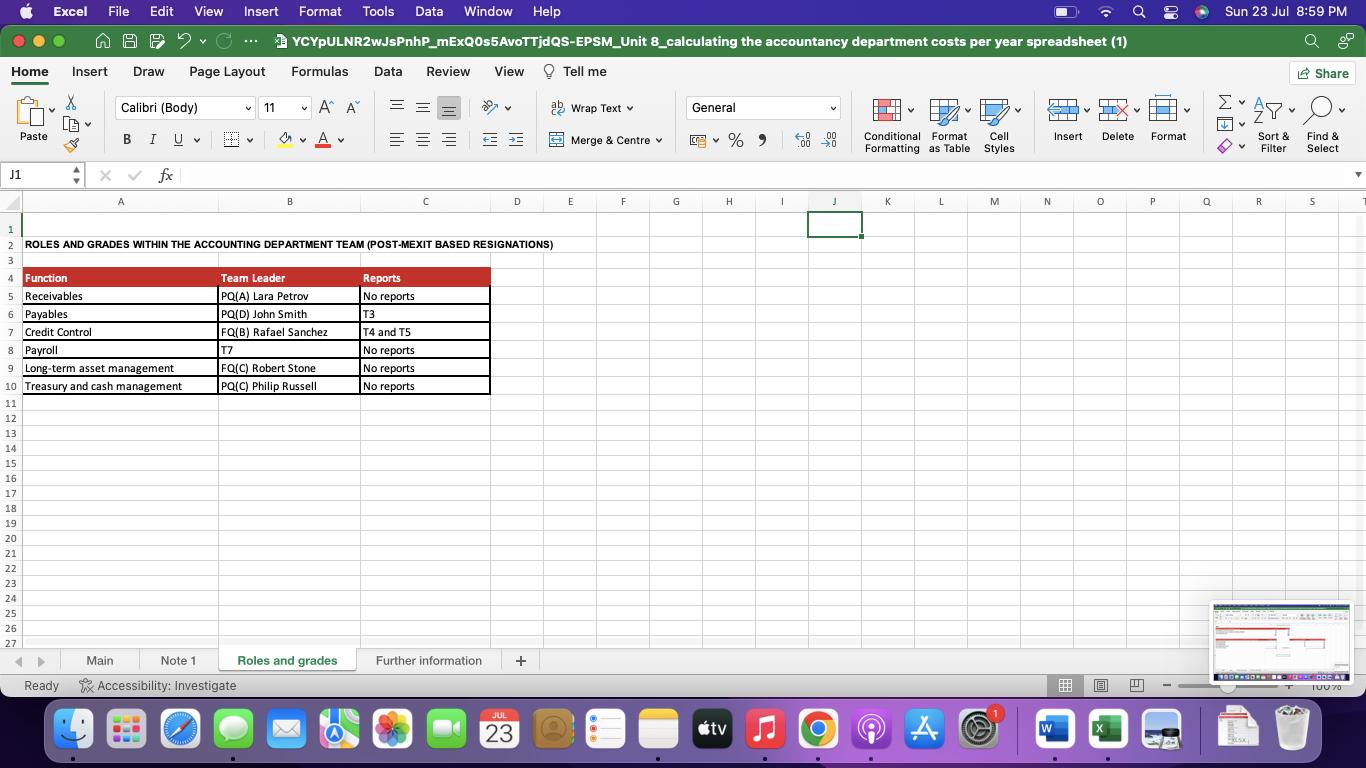

Excel File Edit View Insert Format Tools Data Window Help Sun 23 Jul 8:59 PM YCYpULNR2wJsPnhP_mExQ0s5AvoTTjdQS-EPSM_Unit 8 calculating the accountancy department costs per year spreadsheet (1) Home Insert Draw Page Layout Formulas Data Review View Tell me Share Calibri (Body) 11 Paste BIU ' A Wrap Text General 2-98-0- Merge & Centre %" .000 Conditional Format Cell Formatting as Table Styles Insert Delete Format Sort & Filter Find & Select G27 A B fx C D E F G H 1 J K L M 1 Option A 2 3 Retaining accountancy staff in-house, but operating with the reduced workforce 4 5 6 Staff members who resign leading up to MEXIT are not to be replaced, and the company will continue to operate the accountancy function in-house with a reduced staff level. Your salary will remain at $70,000 as you were recently appointed. The retained accounting staff post-restructure, will be paid at 10% more than their current salaries. To manage their additional responsibilities and to adopt new working practices, but an additional 25% will be added to the total payroll costs (after pay rises) of the remaining accountancy department staff, due to the need for increased overtime and the costs of hiring temporary workers to cover peak times. 7 8 Note: The remaining staff left under the restructure Option, after the earlier redundancies, will be as follows: 9 Head of accounting (unchanged salary) +2 Fully Qualified (FQ) Accountants + 3 Part Qualified (PQ) Accountants + 4 Accounting Technicians 10 Option B Outsourcing Telford Engineering has identified a global business services partner off-shore. The annual cost of outsourcing the accounting function per annum is forecast to be $292,000. The GBS Company will take over the highly systemised and transactional operations of payables, receivables, payroll and credit control. Long-term asset and treasury and cash management will remain in-house. Outsourcing would take place immediately following MEXIT (in about one year's time) and annual outsourcing costs are estimated to remain constant over time. The total cost of making the staff redundant under the outsource option is estimated to be 25% of their current annual salaries. Outsourcing would mean that 40% of the other non-staff accounting department costs could be saved each year. The retained skeleton staff, post-outsourcing, will be paid at 20% more than their current salaries. 11 12 13 14 15 16 17 18 19 20 Note: The remaining staff to be retained under the Outsource Option will be as follows: 21 Head of Accounting (unchanged salary) +2 Fully Qualified (FQ) Accountants and one Part Qualified (PQ) Accountant 22 23 24 25 26 27 Main Note 1 Roles and grades Further information + Ready Accessibility: Investigate JUL 23 tv A W TUU70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve these questions lets go stepbystep to calculate and compare the accounting costs under Option A Inhouse restructuring and Option B Outsourcin...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started