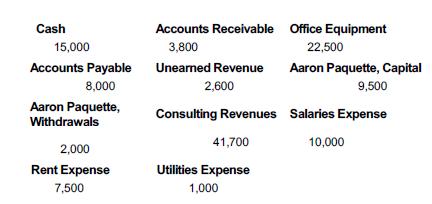

After its first month of operations, Paquette Advisors showed the following account balances in its general ledger

Question:

After its first month of operations, Paquette Advisors showed the following account balances in its general ledger accounts (T-accounts) as at January 31, 2023.

During February, the following transactions occurred:

Feb. 1 Performed work for a client and received cash of $8,500.

5 Paid $5,000 regarding outstanding accounts payable.

10 Received cash of $3,600 for work to be done in March.

12 Called FasCo Rentals to book the use of some equipment next month. The $400 rental fee will be paid in full when the equipment is returned.

17 The owner withdrew cash of $3,000 for personal use.

28 Paid salaries of $10,000.

Required

1. Record the journal entries for the month of February.

2. Post the journal entries to the general ledger (T-accounts above). Include the date next to each posting.

3. Prepare a trial balance based on the balances in your T-accounts.

4. Prepare an income statement for the two months ended February 28, 2023.

5. Prepare a statement of changes in equity for the two months ended February 28, 2023.

6. Prepare the balance sheet as at February 28, 2023.

Analysis Component:

Paquette Advisors shows Unearned Revenue on its February 28, 2023, balance sheet. Explain what Unearned Revenue is. As part of your answer, be sure to address why Unearned Revenue is reported as a liability.

Step by Step Answer:

Fundamental Accounting Principles Volume 1

ISBN: 9781260881325

17th Canadian Edition

Authors: Kermit D. Larson, Heidi Dieckmann, John Harris