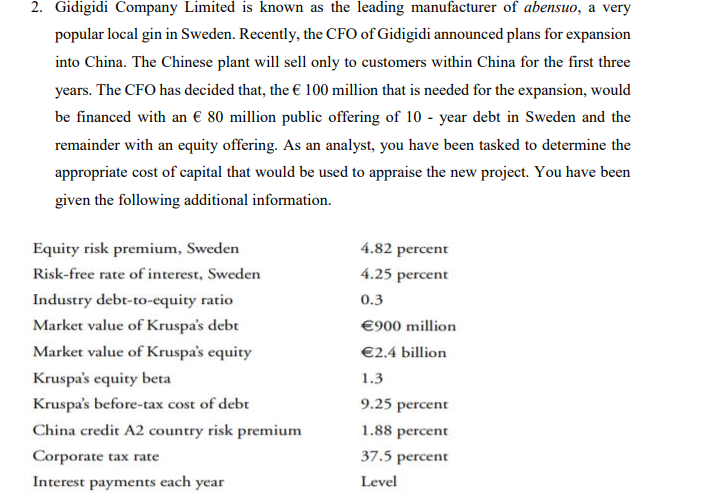

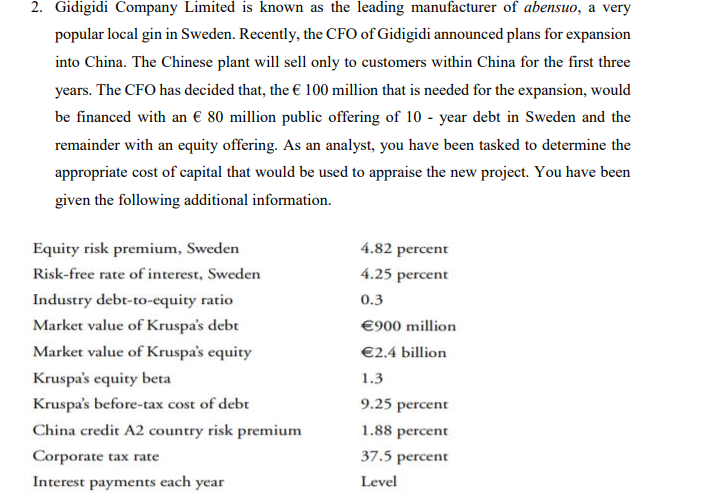

2. Gidigidi Company Limited is known as the leading manufacturer of abensuo, a very popular local gin in Sweden. Recently, the CFO of Gidigidi announced plans for expansion into China. The Chinese plant will sell only to customers within China for the first three years. The CFO has decided that, the 100 million that is needed for the expansion, would be financed with an 80 million public offering of 10 year debt in Sweden and the remainder with an equity offering. As an analyst, you have been tasked to determine the appropriate cost of capital that would be used to appraise the new project. You have been given the following additional information. Equity risk premium, Sweden 4.82 percent 4.25 percent Risk-free rate of interest, Sweden Industry debt-to-equity ratio 0.3 Market value of Kruspa's debt 900 million Market value of Kruspa's equity 2.4 billion Kruspa's equity beta 1.3 Kruspa's before-tax cost of debt 9.25 percent China credit A2 country risk premium 1.88 percent Corporate tax rate 37.5 percent Interest payments each year Level 2. Gidigidi Company Limited is known as the leading manufacturer of abensuo, a very popular local gin in Sweden. Recently, the CFO of Gidigidi announced plans for expansion into China. The Chinese plant will sell only to customers within China for the first three years. The CFO has decided that, the 100 million that is needed for the expansion, would be financed with an 80 million public offering of 10 year debt in Sweden and the remainder with an equity offering. As an analyst, you have been tasked to determine the appropriate cost of capital that would be used to appraise the new project. You have been given the following additional information. Equity risk premium, Sweden 4.82 percent 4.25 percent Risk-free rate of interest, Sweden Industry debt-to-equity ratio 0.3 Market value of Kruspa's debt 900 million Market value of Kruspa's equity 2.4 billion Kruspa's equity beta 1.3 Kruspa's before-tax cost of debt 9.25 percent China credit A2 country risk premium 1.88 percent Corporate tax rate 37.5 percent Interest payments each year Level