Answered step by step

Verified Expert Solution

Question

1 Approved Answer

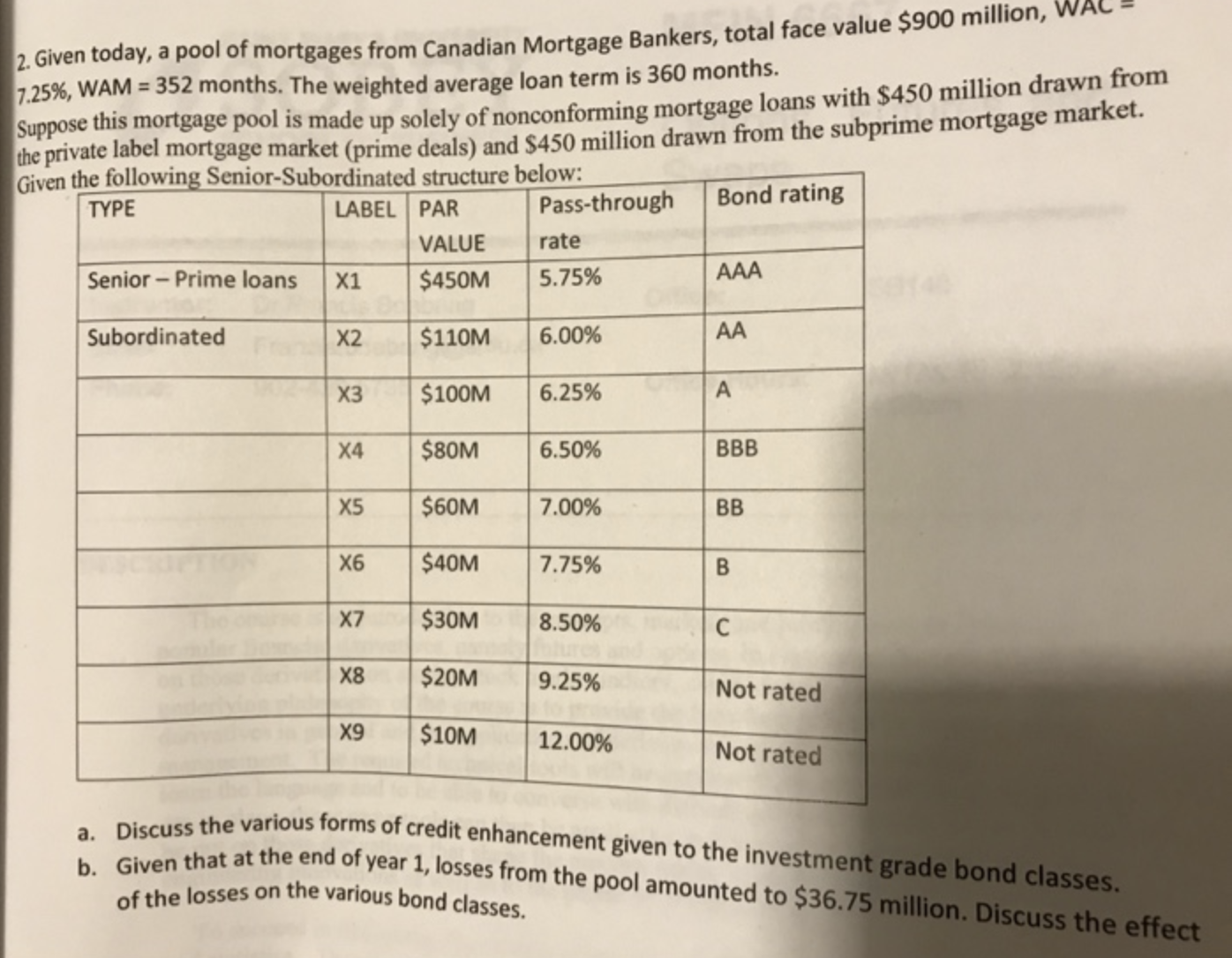

2. Given today, a pool of mortgages from Canadian Mortgage Bankers, total face value $900 million, W 7.25%, WAM = 352 months. The weighted

2. Given today, a pool of mortgages from Canadian Mortgage Bankers, total face value $900 million, W 7.25%, WAM = 352 months. The weighted average loan term is 360 months. Suppose this mortgage pool is made up solely of nonconforming mortgage loans with $450 million drawn from the private label mortgage market (prime deals) and $450 million drawn from the subprime mortgage market. Given the following Senior-Subordinated structure below: TYPE LABEL PAR VALUE Senior-Prime loans X1 $450M $110M $100M $80M $60M $40M 7.75% $30M $20M $10M Subordinated X2 X3 X4 X5 X6 X7 X8 Pass-through X9 rate 5.75% 6.00% 6.25% 6.50% 7.00% 8.50% 9.25% 12.00% Bond rating AAA AA A BBB BB B C Not rated Not rated a. Discuss the various forms of credit enhancement given to the investment grade bond classes. 1. Given that at the end of year 1, losses from the pool amounted to $36.75 million. Discuss the effect of the losses on the various bond classes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The various forms of credit enhancement provided to the investmentgrade bond classes in the given SeniorSubordinated structure include 1 Subordinati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started