Question

2) Google has just paid a dividend of $5.00 on its stock. Its dividends are expected to grow at a 20 percent rate for

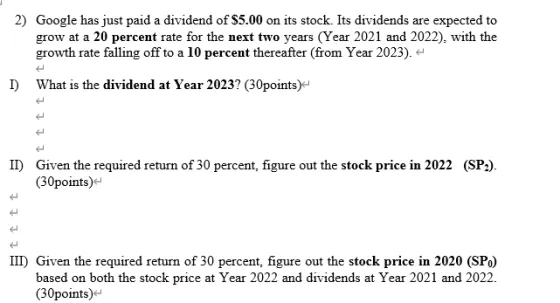

2) Google has just paid a dividend of $5.00 on its stock. Its dividends are expected to grow at a 20 percent rate for the next two years (Year 2021 and 2022), with the growth rate falling off to a 10 percent thereafter (from Year 2023). < 4 I) What is the dividend at Year 2023? (30points) II) Given the required return of 30 percent, figure out the stock price in 2022 (SP). (30points) 4 4 III) Given the required return of 30 percent, figure out the stock price in 2020 (SPO) based on both the stock price at Year 2022 and dividends at Year 2021 and 2022. (30points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I To calculate the dividend at Year 2023 we need to determine the growth rate and the dividend at Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Institutions, Markets And Money

Authors: David S. Kidwell, David W. Blackwell, David A. Whidbee, Richard W. Sias

12th Edition

1119386489, 1119386483, 978-1-119-3303, 978-1119330363

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App