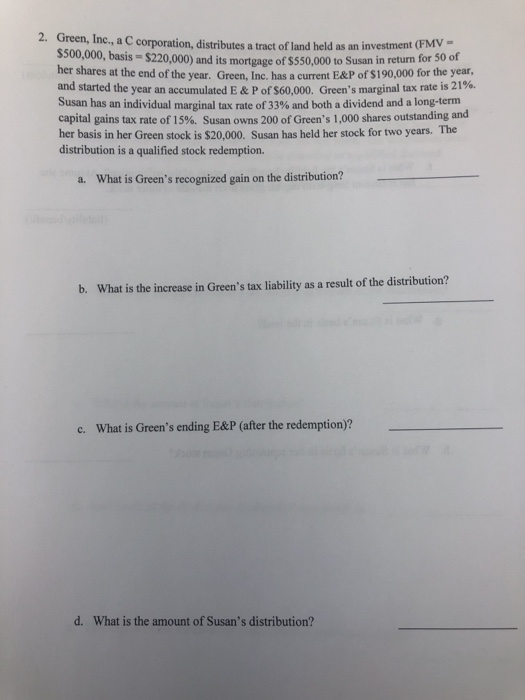

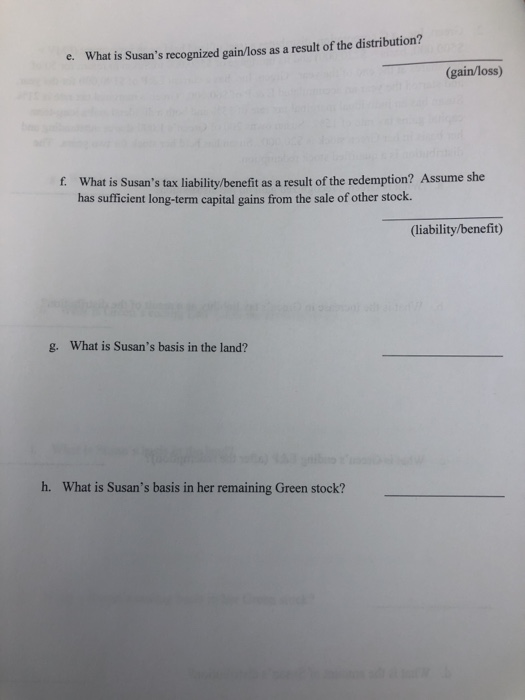

2. Green, Inc., a C corporation, distributes a tract of land held as an investment (FMV $500,000, basis = $220,000) and its mortgage of $550,000 to Susan in return for 50 of her shares at the end of the year. Green, Inc. has a current E&P of $190,000 for the year, and started the year an accumulated E&P of $60,000. Green's marginal tax rate is 21% Susan has an individual marginal tax rate of 33% and both a dividend and a long-term capital gains tax rate of 15%. Susan owns 200 of Green's 1,000 shares outstanding and her basis in her Green stock is $20,000. Susan has held her stock for two years. The distribution is a qualified stock redemption. a. What is Green's recognized gain on the distribution? b. What is the increase in Green's tax liability as a result of the distribution? c. What is Green's ending E&P (after the redemption)? d. What is the amount of Susan's distribution? e. What is Susan's recognized gain/loss as a result of the distribution? (gain/loss) f. What is Susan's tax liability/benefit as a result of the redemption? Assume she has sufficient long-term capital gains from the sale of other stock. (liability/benefit) g. What is Susan's basis in the land? h. What is Susan's basis in her remaining Green stock? 2. Green, Inc., a C corporation, distributes a tract of land held as an investment (FMV $500,000, basis = $220,000) and its mortgage of $550,000 to Susan in return for 50 of her shares at the end of the year. Green, Inc. has a current E&P of $190,000 for the year, and started the year an accumulated E&P of $60,000. Green's marginal tax rate is 21% Susan has an individual marginal tax rate of 33% and both a dividend and a long-term capital gains tax rate of 15%. Susan owns 200 of Green's 1,000 shares outstanding and her basis in her Green stock is $20,000. Susan has held her stock for two years. The distribution is a qualified stock redemption. a. What is Green's recognized gain on the distribution? b. What is the increase in Green's tax liability as a result of the distribution? c. What is Green's ending E&P (after the redemption)? d. What is the amount of Susan's distribution? e. What is Susan's recognized gain/loss as a result of the distribution? (gain/loss) f. What is Susan's tax liability/benefit as a result of the redemption? Assume she has sufficient long-term capital gains from the sale of other stock. (liability/benefit) g. What is Susan's basis in the land? h. What is Susan's basis in her remaining Green stock