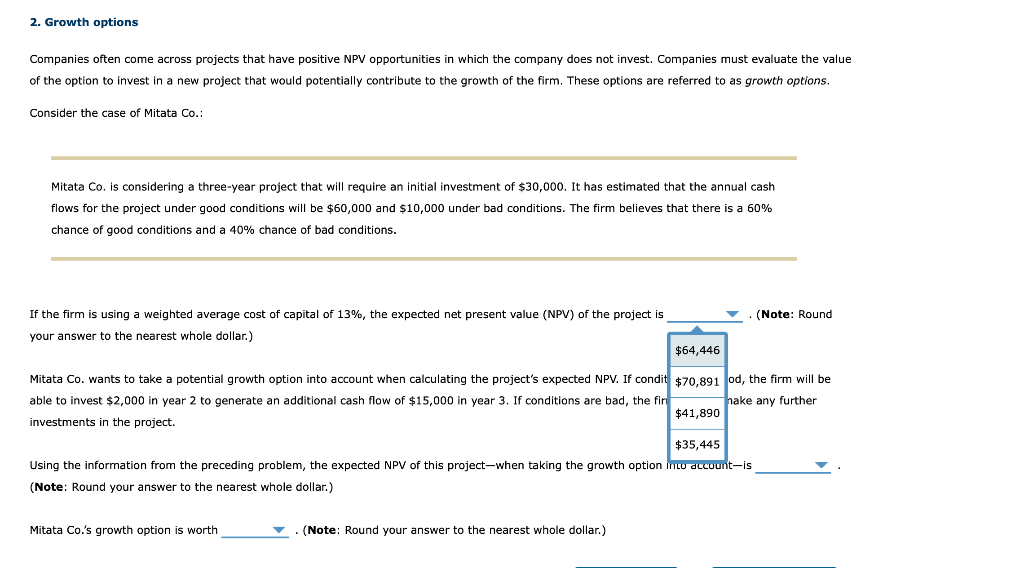

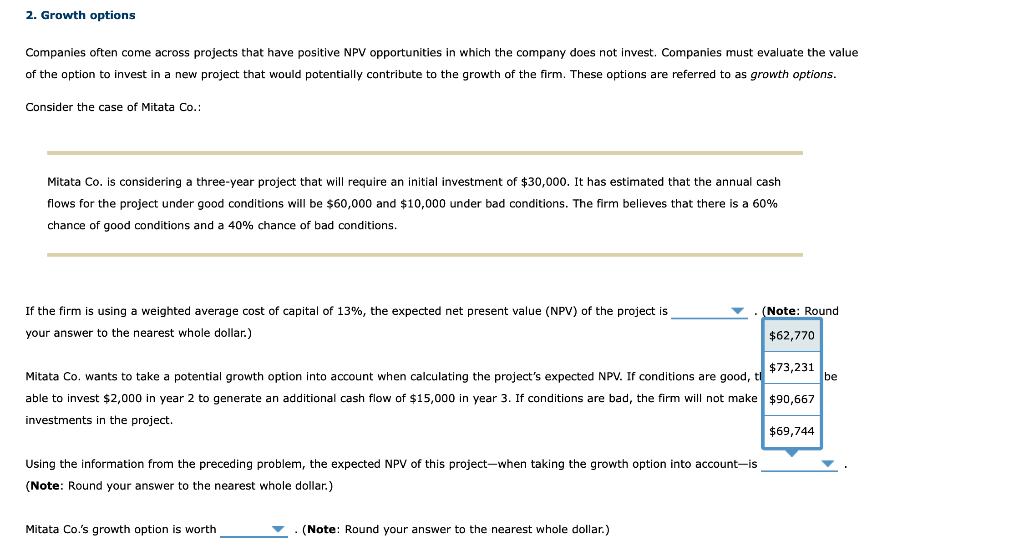

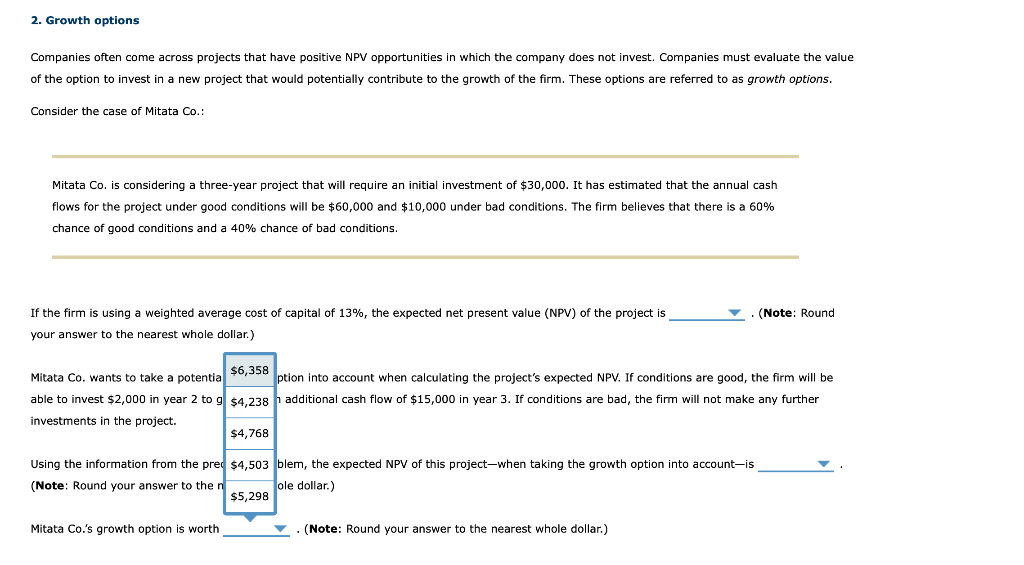

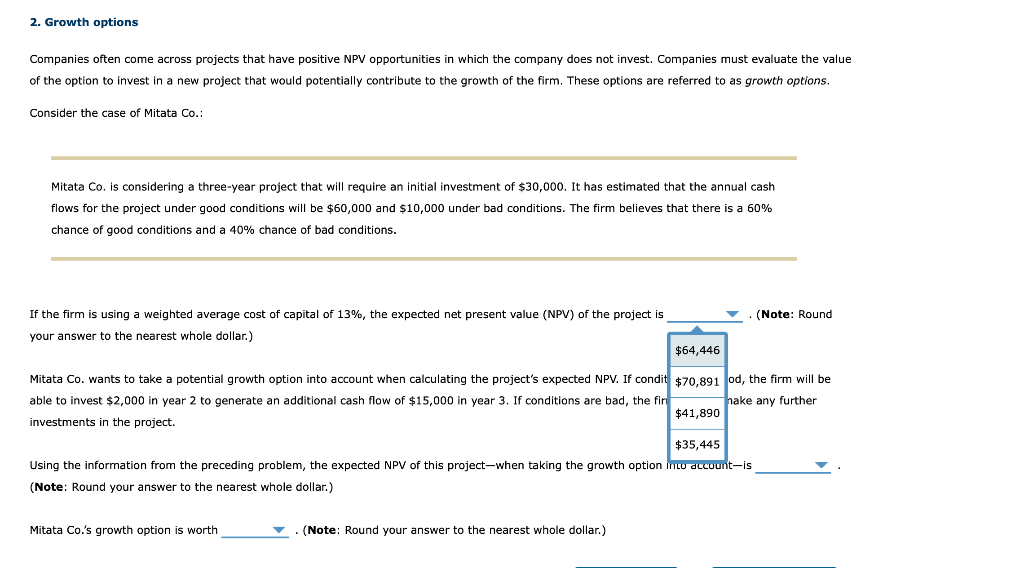

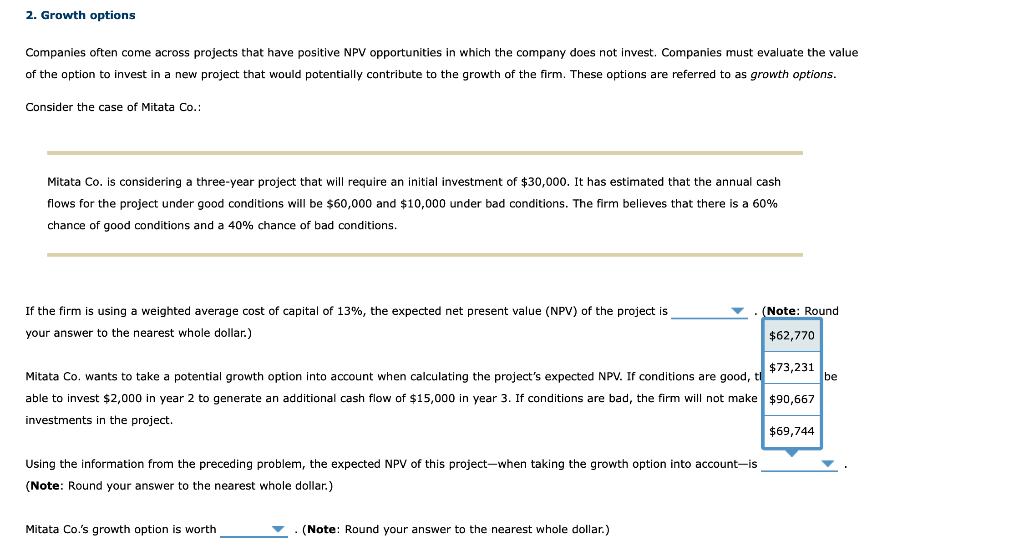

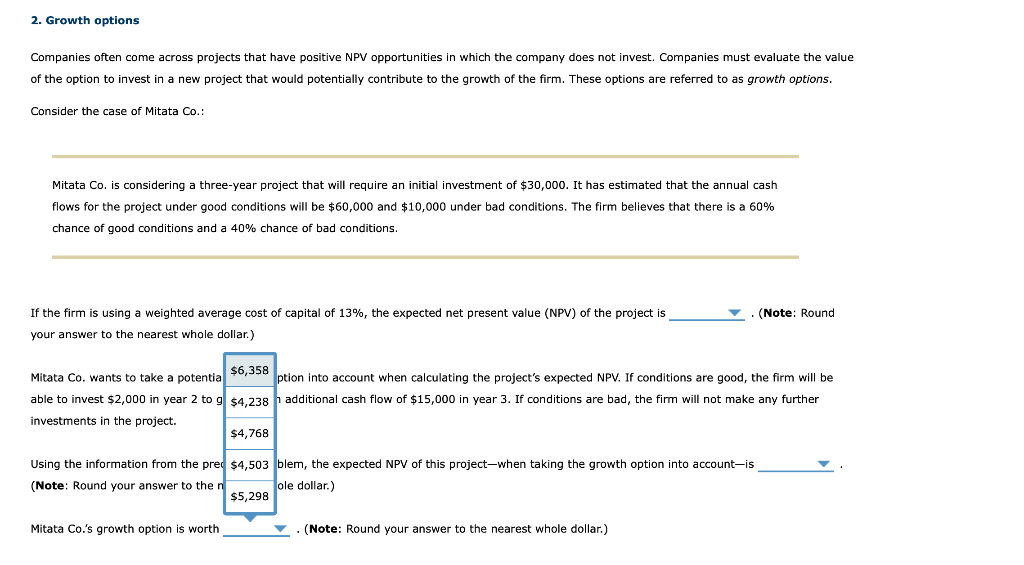

2. Growth options Companies often come across projects that have positive NPV opportunities in which the company does not invest. Companies must evaluate the value of the option to invest in a new project that would potentially contribute to the growth of the firm. These options are referred to as growth options. Consider the case of Mitata Co.: Mitata Co. is considering a three-year project that will require an initial investment of $30,000. It has estimated that the annual cash flows for the project under good conditions will be $60,000 and $10,000 under bad conditions. The firm believes that there is a 60% chance of good conditions and a 40% chance of bad conditions. (Note: Round If the firm is using a weighted average cost of capital of 13%, the expected net present value (NPV) of the project is your answer to the nearest whole dollar.) $64,446 Mitata Co. wants to take potential growth option into account when calculating the project's expected NPV. If condit $70,891 od, the firm will be able to invest $2,000 in year 2 to generate an additional cash flow of $15,000 in year 3. If conditions are bad, the fin hake any further $41,890 investments in the project. $35,445 Using the information from the preceding problem, the expected NPV of this project-when taking the growth option into account-is (Note: Round your answer to the nearest whole dollar.) Mitata Co.'s growth option is worth (Note: Round your answer to the nearest whole dollar.) 2. Growth options Companies often come across projects that have positive NPV opportunities in which the company does not invest. Companies must evaluate the value of the option to invest in a new project that would potentially contribute to the growth of the firm. These options are referred to as growth options. Consider the case of Mitata Co.: Mitata Co. is considering a three-year project that will require an initial investment of $30,000. It has estimated that the annual cash flows for the project under good conditions will be $60,000 and $10,000 under bad conditions. The firm believes that there is a 60% chance of good conditions and a 40% chance of bad conditions. (Note: Round If the firm is using a weighted average cost of capital of 13%, the expected net present value (NPV) of the project is your answer to the nearest whole dollar.) $62,770 be Mitata Co. wants to take a potential growth option into account when calculating the project's expected NPV. If conditions are good, ti $73,231 able to invest $2,000 in year 2 to generate an additional cash flow of $15,000 in year 3. If conditions are bad, the firm will not make $90,667 investments in the project. $69,744 Using the information from the preceding problem, the expected NPV of this project,when taking the growth option into account,is (Note: Round your answer to the nearest whole dollar.) Mitata Co.'s growth option is worth (Note: Round your answer to the nearest whole dollar.) 2. Growth options Companies often come across projects that have positive NPV opportunities in which the company does not invest. Companies must evaluate the value of the option to invest in a new project that would potentially contribute to the growth of the firm. These options are referred to as growth options. Consider the case of Mitata Co.: Mitata Co. is considering a three-year project that will require an initial investment of $30,000. It has estimated that the annual cash flows for the project under good conditions will be $60,000 and $10,000 under bad conditions. The firm believes that there is a 60% chance of good conditions and a 40% chance of bad conditions. (Note: Round If the firm is using a weighted average cost of capital of 13%, the expected net present value (NPV) of the project is your answer to the nearest whole dollar.) $6,358 Mitata Co. wants to take a potential ption into account when calculating the project's expected NPV. If conditions are good, the firm will be able to invest $2,000 in year 2 to 9 $4,238 additional cash flow of $15,000 in year 3. If conditions are bad, the firm will not make any further investments in the project. $4,768 Using the information from the pred $4,503 blem, the expected NPV of this project,when taking the growth option into account-is (Note: Round your answer to the n ole dollar.) $5,298 Mitata Co.'s growth option is worth (Note: Round your answer to the nearest whole dollar.)