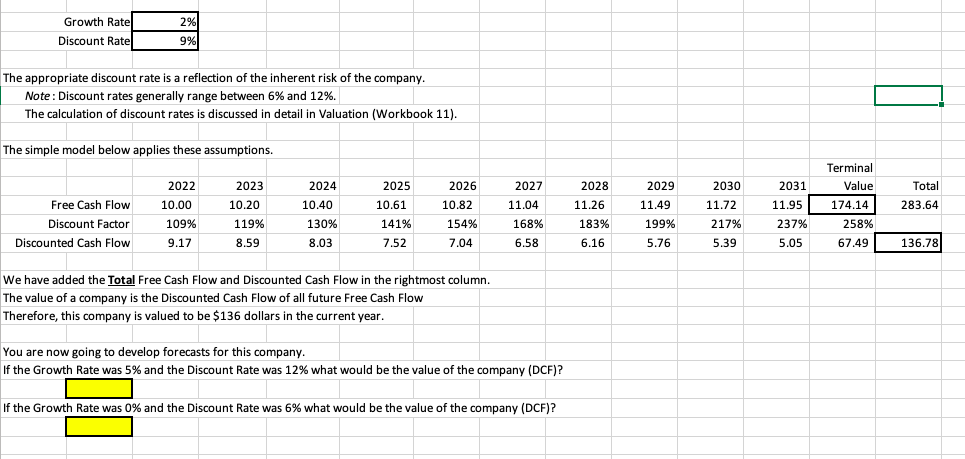

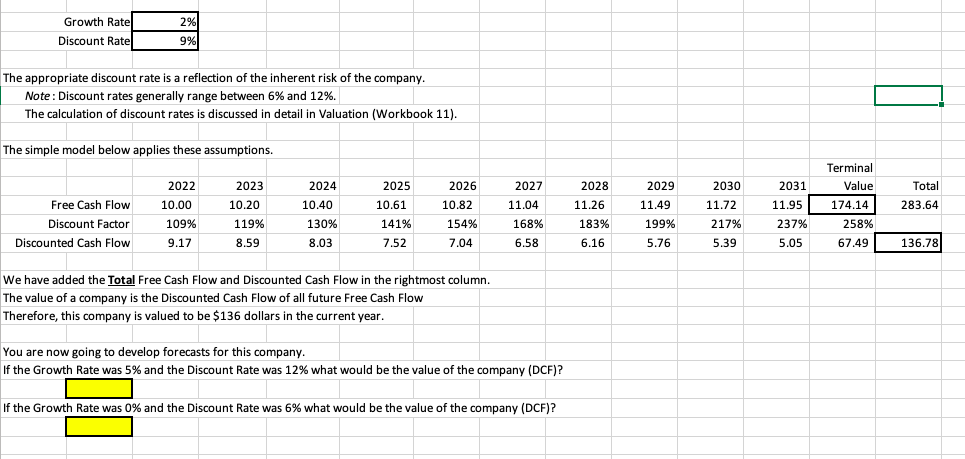

2% Growth Ratel Discount Rate 9% The appropriate discount rate is a reflection of the inherent risk of the company. Note: Discount rates generally range between 6% and 12%. The calculation of discount rates is discussed in detail in Valuation (Workbook 11). The simple model below applies these assumptions. 2024 2025 2026 2029 11.49 10.61 10.82 Total 283.64 Free Cash Flow Discount Factor Discounted Cash Flow 2022 10.00 109% 9.17 2023 10.20 119% 8.59 2028 11.26 183% 10.40 130% 8.03 2027 11.04 168% 6.58 2030 11.72 217% 5.39 2031 11.95 237% Terminal Value 174.14 258% 67.49 141% 7.52 154% 7.04 199% 5.76 6.16 5.05 136.78] We have added the Total Free Cash Flow and Discounted Cash Flow in the rightmost column. The value of a company is the Discounted Cash Flow of all future Free Cash Flow Therefore, this company is valued to be $136 dollars in the current year. You are now going to develop forecasts for this company. If the Growth Rate was 5% and the Discount Rate was 12% what would be the value of the company (DCF)? If the Growth Rate was 0% and the Discount Rate was 6% what would be the value of the company (DCF)? 2% Growth Ratel Discount Rate 9% The appropriate discount rate is a reflection of the inherent risk of the company. Note: Discount rates generally range between 6% and 12%. The calculation of discount rates is discussed in detail in Valuation (Workbook 11). The simple model below applies these assumptions. 2024 2025 2026 2029 11.49 10.61 10.82 Total 283.64 Free Cash Flow Discount Factor Discounted Cash Flow 2022 10.00 109% 9.17 2023 10.20 119% 8.59 2028 11.26 183% 10.40 130% 8.03 2027 11.04 168% 6.58 2030 11.72 217% 5.39 2031 11.95 237% Terminal Value 174.14 258% 67.49 141% 7.52 154% 7.04 199% 5.76 6.16 5.05 136.78] We have added the Total Free Cash Flow and Discounted Cash Flow in the rightmost column. The value of a company is the Discounted Cash Flow of all future Free Cash Flow Therefore, this company is valued to be $136 dollars in the current year. You are now going to develop forecasts for this company. If the Growth Rate was 5% and the Discount Rate was 12% what would be the value of the company (DCF)? If the Growth Rate was 0% and the Discount Rate was 6% what would be the value of the company (DCF)