Question

2. Historically, Baker projects have had an average beta of 1.2, which indicates the higher risk levels for the firm. Assuming the market risk premium

2. Historically, Baker projects have had an average beta of 1.2, which indicates the higher risk levels for the firm. Assuming the market risk premium (MRP) currently estimated to be 7.0% and the risk-free rate is 5.15%, what is the required return for an "average" Baker project using based on its average project beta? Show the average required return to 2 decimal places (x.xx%).

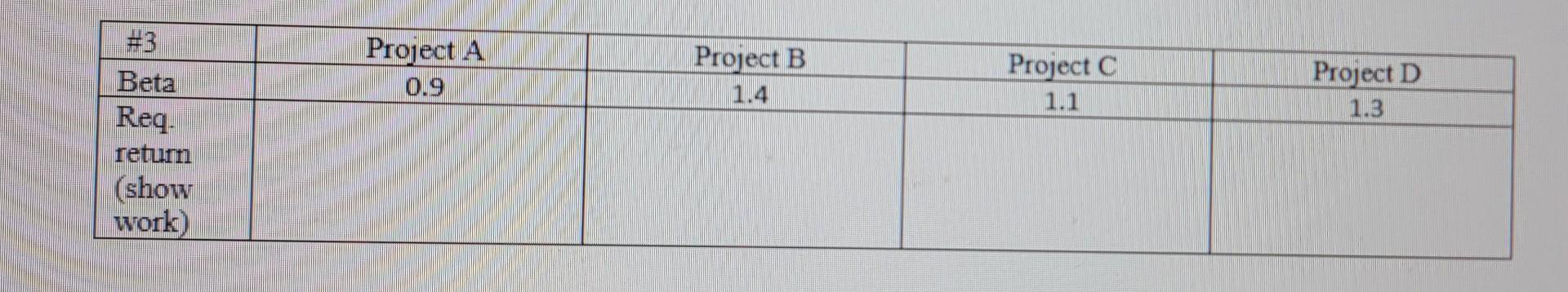

3. The potential projects that Baker is considering have the following expected cash flows. Each project has its own unique risk and as such, the beta on each project is given. Using the data from #2 for the risk-free rate and market risk premium, what is the required percentage return for each of the projects? Show the required returns to 2 decimals, that is xx.xx%.

\begin{tabular}{|l|c|c|c|c|} \hline#3 & Project A & Project B & Project C & Project D \\ \hline Beta & 0.9 & 1.4 & 1.1 & 1.3 \\ \hline Req. & & & & \\ return & & & & \\ (show & & & & \\ work) & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started