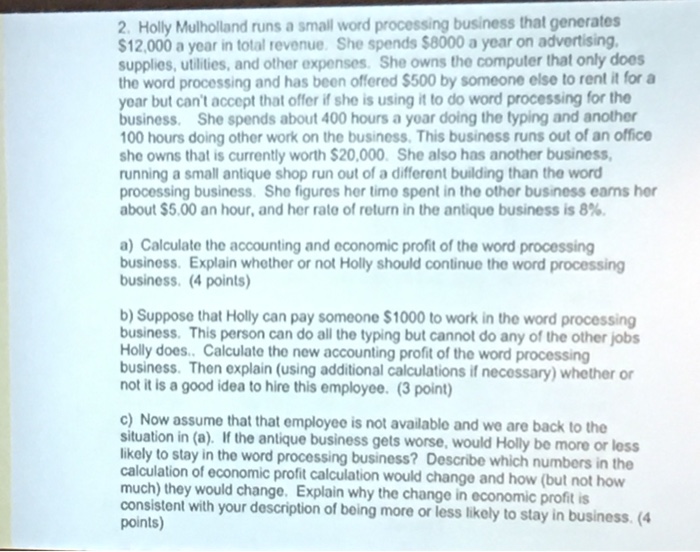

2. Holly Mulholland runs a small word processing business that generates $12,000 a year in total revenue She spends $8000 a year on advertising supplies, utilities, and other expenses. She owns the computer that only does the word processing and has been offered $500 by someone else to rent it fora year but can't accept that offer if she is using it to do word processing for the business. She spends about 400 hours a year doing the typing and another 100 hours doing other work on the business. This business runs out of an office she owns that is currently worth $20,000. She also has another business running a small antique shop run out of a different building than the word processing business. She figures her time spent in the other business eans her about $5.00 an hour, and her rate of return in the antique business is 8%. a) Calculate the accounting and economic profit of the word processing business. Explain whether or not Holly should continue the word processing business. (4 points) b) Suppose that Holly can pay someone $1000 to work in the word processing business. This person can do all the typing but cannot do any of the other jobs Holly does. Calculate the new accounting profit of the word processing business. Then explain (using additional calculations if necessary) whether or not it is a good idea to hire this employee. (3 point) c) Now assume that that employee is not available and we are back to the situation in (a). If the antique business gets worse, would Holly be more or less likely to stay in the word processing business? Describe which numbers in the lation of economic profit calculation would change and how (but not how much) they would change. Explain why the change in economic profit is consistent with your description of being more or less likely to stay in business. (4 points) 2. Holly Mulholland runs a small word processing business that generates $12,000 a year in total revenue She spends $8000 a year on advertising supplies, utilities, and other expenses. She owns the computer that only does the word processing and has been offered $500 by someone else to rent it fora year but can't accept that offer if she is using it to do word processing for the business. She spends about 400 hours a year doing the typing and another 100 hours doing other work on the business. This business runs out of an office she owns that is currently worth $20,000. She also has another business running a small antique shop run out of a different building than the word processing business. She figures her time spent in the other business eans her about $5.00 an hour, and her rate of return in the antique business is 8%. a) Calculate the accounting and economic profit of the word processing business. Explain whether or not Holly should continue the word processing business. (4 points) b) Suppose that Holly can pay someone $1000 to work in the word processing business. This person can do all the typing but cannot do any of the other jobs Holly does. Calculate the new accounting profit of the word processing business. Then explain (using additional calculations if necessary) whether or not it is a good idea to hire this employee. (3 point) c) Now assume that that employee is not available and we are back to the situation in (a). If the antique business gets worse, would Holly be more or less likely to stay in the word processing business? Describe which numbers in the lation of economic profit calculation would change and how (but not how much) they would change. Explain why the change in economic profit is consistent with your description of being more or less likely to stay in business. (4 points)