Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 hours, 30 minutes remaining 1. On the 1 July 2018, Sheela disposed of a piece of plant and machinery The machine had originally cost

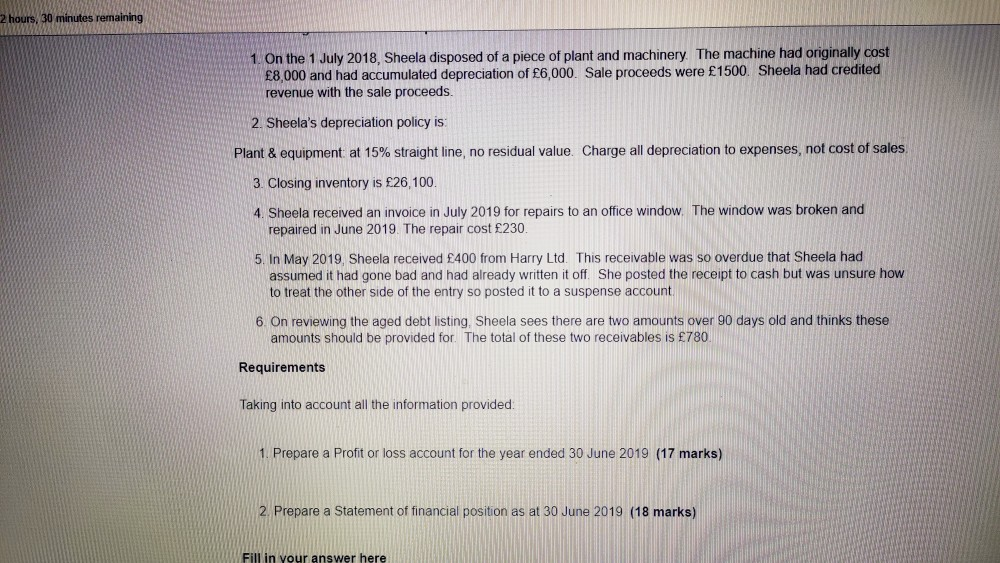

2 hours, 30 minutes remaining 1. On the 1 July 2018, Sheela disposed of a piece of plant and machinery The machine had originally cost 8,000 and had accumulated depreciation of 6,000. Sale proceeds were 1500. Sheela had credited revenue with the sale proceeds. 2. Sheela's depreciation policy is Plant & equipment at 15% straight line, no residual value Charge all depreciation to expenses, not cost of sales. 3. Closing inventory is 26, 100. 4 Sheela received an invoice in July 2019 for repairs to an office window. The window was broken and repaired in June 2019. The repair cost 230 5. In May 2019, Sheela received 400 from Harry Ltd. This receivable was so overdue that Sheela had assumed it had gone bad and had already written it off. She posted the receipt to cash but was unsure how to treat the other side of the entry so posted it to a suspense account 6. On reviewing the aged debt listing, Sheela sees there are two amounts over 90 days old and thinks these amounts should be provided for The total of these two receivables is 780. Requirements Taking into account all the information provided 1. Prepare a profit or loss account for the year ended 30 June 2019 (17 marks) 2. Prepare a statement of financial position as at 30 June 2013 (18 marks) Fill in your answer here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started