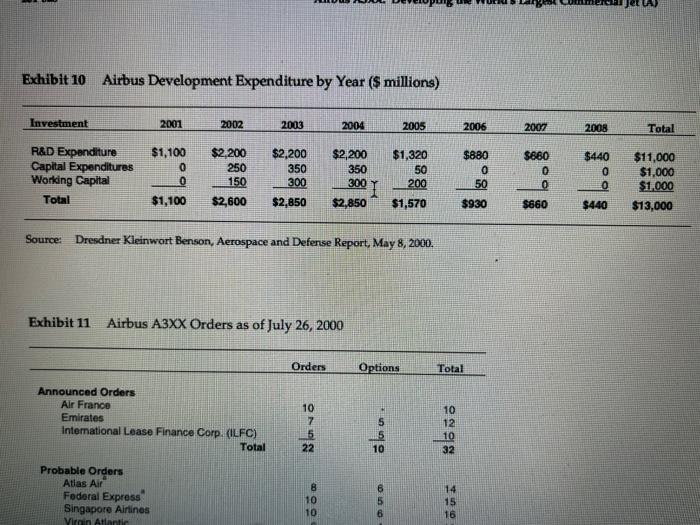

2. How many aircraft does Airbus need to sells per year in order to make a profil brithe nvestment is this number greater or less than your estimate of total demand for very large aircraft (VLA) over the next 20 years? This is the main question of the case, please spend 80% of your time on this Hints Conilder all capital providers as a single entity and calculate the NPV (this means that you may assume that it is an all equity firm). To calculate the number of planes per year, find the present value of the following cash flows Find the cash flows of the required Investment during the "ramp-up period of development . During the ramp-up periodi assume that any planes sold are sold of cour(we know they are sold at a discount until they are in full production) . Once they are ar full production in 2008). The rest of the con flows will be a growing perpetuity, Alternatively, if you prefer you can just do a straight DCF analysis To compute the discount rate necessary for you to do the valuation, please asume a market risk premium of 6% The goal is to find the number of planes that Airbus should build per year so that the project has a positive NPV. Be careful about Capex and Depreciation in 2008. You may need to include these in the growing perpetully, but you should not double count them. You may assume straight-line depreciation over ten years, and that R&D is an expensenot capitalized), 3. How should Boeing respond to the potential launch of this project by Airbus? (No calculations Assuming the development went as planned and the cost remained at $13 billion-skeptics cautioned the total cost might reach $15 billion or more Airbus expected to deliver the first planes in 2006. When it reached full production capacity of just over four planes per month in 2008, the A3XX would have an average realized price of approximately $225 million and operating margins of ranging from 15% to 20%. These margins were based on earnings before repayment of launch aid and risk sharing capital. In other words, they were potential returns to all capital providers collectively. The project would likely have an effective tax rate equal to 38%, the standard French rate including "social contribution." The analysts, however, disagreed in many areas. Besides total demand, they disagreed on the magnitude and composition of up-front investment (how much of the development cost was R&D that had to be expensed and how much could be capitalized and depreciated). They also disagreed on the appropriate tax rate, AIC's tax status (could the fism use the initial operating losses or would it have to use them to off-set future income), and the project's operating margins. For example, Lehman Brothers and CS First Boston predicted the A3XX would generate operating margins ranging from 20% to 30% (again before repayment of launch aid and risk sharing capital). Both were well above the 15% to 20% operating margins Boeing was thought to earn on its 747's. In general. however, larger planes earned bigger margins leading some analysts to claim that the companies made virtually all of their profits on wide body jets. Among other factors, financial success depended on getting enough early sales to drive down costs through learning curve effects. The concept of the learning curve originated in the 1930s based on studies of aircraft assembly. The basic idea was that unit costs, such as direct labor, declined as a function of cumulative output. As a result, the faster Airbus could sell planes, the more profitable it would become. This was especially true in the early years when cumulative output doubled relatively quickly Based on these assumptions, Airbus had a target pre-tax IRR of 15%, but thought the actual IRR might be as much as 20%. As reference points, yields on long-term U.S. government bonds were approximately 6.0%, inflation was 2.0%, and aircraft manufacturers like Boeing and Canada's Bombardier had asset betas of 0.84 for their commercial aviation divisions. In addition to the direct profits from the A3XX, there were other sources of potential value. Foremost among them was the fact that the A3XX would eliminate Boeing's monopolistic control of the VLA market and its ability to cross-subsidize smaller jets in its product line. According to the Dresdner Kleinwort Benson, this benefit could add an additional 1.5% to the project's IRR. A final, though smaller source of income would be the support services related to the sale, maintenance, and repair of planes. Exhibit 10 Airbus Development Expenditure by Year ($ millions) Investment 2001 2002 2003 2004 2005 2006 2007 2008 Total R&D Expenditure Capital Expenditures Working Capital Total $1,100 0 0 $2,200 250 150 $2,200 350 300 $2,200 350 2001 $1,320 50 200 $1,570 $880 0 50 $660 0 0 $440 0 0 $11,000 $1.000 $1.000 $13,000 $1,100 $2,600 $2,850 $2.850 $930 $660 $440 Source: Dresdner Kleinwort Benson, Aerospace and Defense Report, May 8, 2000. Exhibit 11 Airbus A3XX Orders as of July 26, 2000 Orders Options Total . Announced Orders Air France Emirates International Lease Finance Corp. (LFC) Total 10 7 5 22 10 12 10 32 10 Probable Orders Atlas Air Federal Express Singapore Airlines Virgin Atlantic 8 10 10 UOD 14 15 16 6