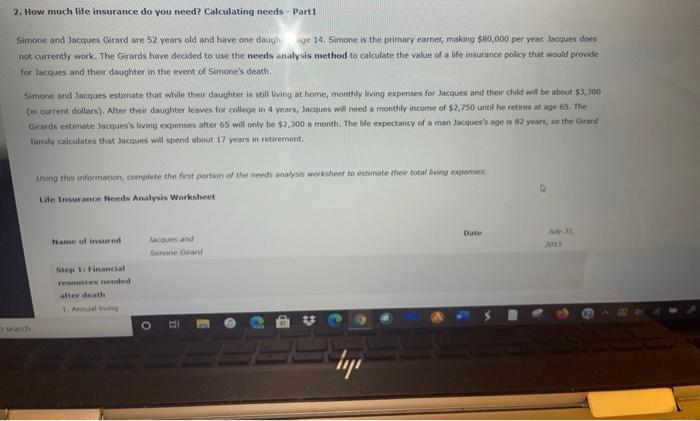

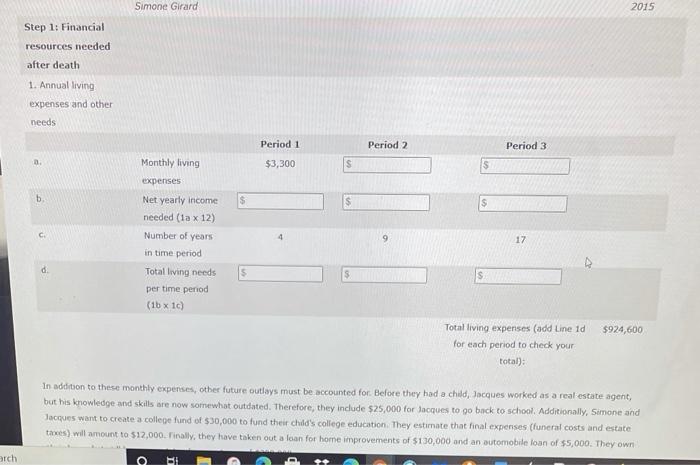

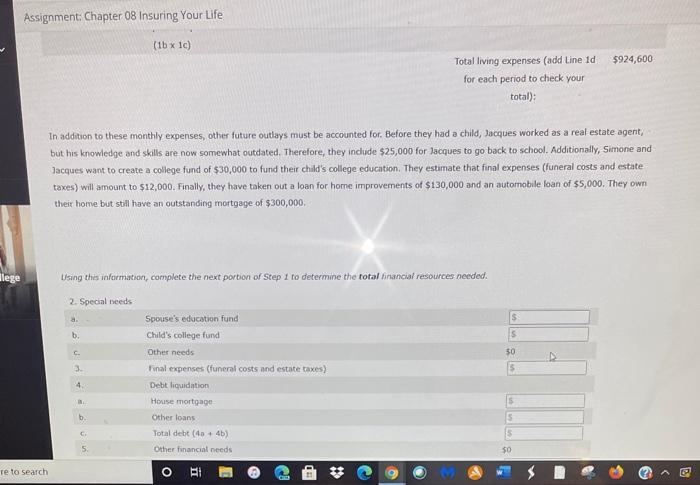

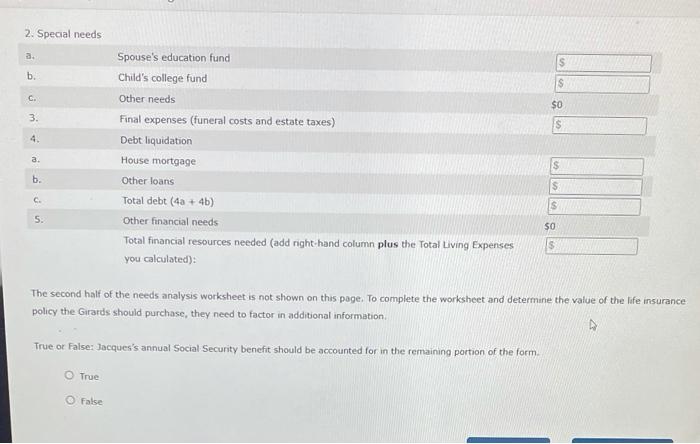

2. How much life insurance do you need? Calculating needs Parti Simone and James Girard are S2 years old and have one daugh age 14. Simone is the primary earner, making $80,000 per year. Jacques does not currently work. The Girards have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Jacques and their daughter in the event of Simone's death, Simone and Jacques estimate that while their daughter is still living at home, monthly living expenses for Jacques and their child will be about $3,300 (in current dollars). After their daughter leaves for college in 4 years, Jacques will need a monthly income of $2,750 until he retires at age 63. The Guards estimate Jacques's living expenses after 6 will only be $2,300 a month. The We expectancy of a man Jacques's age is 82 ynars, so the Grand Conwly calculates that Jacques will spend about 17 years in retirement, Using this information, complete the first portion of the needs analyses worksheet to estimate their total ng expenses Life Insurance Needs Analysis Worksheet Datu Name o insured Jacques and Sumane Grand Step 1 financial mended 1. A big O i lui Simone Girard 2015 Step 1: Financial resources needed after death 1. Annual living expenses and other needs Period 1 Period 2 Period 3 $3,300 b $ C Monthly living expenses Net yearly income needed (1a x 12) Number of years in time period Total living needs per time period (16 x 1c) 17 d $924,600 Total living expenses (add Line 1d for each period to check your total): In addition to these monthly expenses, other future outlays must be accounted for. Before they had a child, Jacques worked as a real estate agent, but his knowledge and skills are now somewhat outdated. Therefore, they include $25,000 for Jacques to go back to school. Additionally, Simone and Jacques want to create a college fund of $30,000 to fund their child's college education. They estimate that hinal expenses (funeral costs and estate taxes) will amount to $12,000. Finally, they have taken out a loan for home improvements of $130,000 and an automobile loan of $5,000. They own arch BI Assignment: Chapter 08 Insuring Your Life (1b x 10) $924,600 Total living expenses (add Line id for each period to check your total): In addition to these monthly expenses, other future outlays must be accounted for. Before they had a child, Jacques worked as a real estate agent, but his knowledge and skills are now somewhat outdated. Therefore, they include $25,000 for Jacques to go back to school. Additionally, Simone and Jacques want to create a college fund of $30,000 to fund their child's college education. They estimate that final expenses (funeral costs and estate taxes) will amount to $12,000. Finally, they have taken out a loan for home improvements of $130,000 and an automobile loan of $5,000. They own their home but still have an outstanding mortgage of $300,000 lege Using this information, complete the next portion of Step I to determine the total hinancial resources needed. 2. Special needs a S b. s c 30 3 4 Spouse's education fund Child's college fund Other needs Fonal expenses (funeral costs and estate taxes) Debt liquidation House mortgage Other loans Total debt (da + 4b) Other financial needs 5 b. 5 $0 re to search O O BI # 9 > B . 2. Special needs a. S b S C. $0 3. $ 4. a. Spouse's education fund Child's college fund Other needs Final expenses (funeral costs and estate taxes) Debt liquidation House mortgage Other loans Total debt (4a + 4b) Other financial needs Total financial resources needed (add right-hand column plus the Total Living Expenses you calculated): S b. $ C. $ 5. $0 IS The second half of the needs analysis worksheet is not shown on this page. To complete the worksheet and determine the value of the life insurance policy the Girards should purchase, they need to factor in additional information True or False: Jacques's annual Social Security benefit should be accounted for in the remaining portion of the form True O False