Question

2. (i) An investment has the an initial outlay of $50,000 followed by $25,000 and $30,000 in the first and second years respectively and

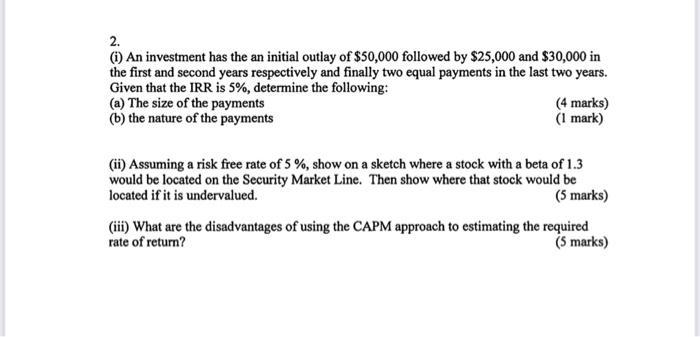

2. (i) An investment has the an initial outlay of $50,000 followed by $25,000 and $30,000 in the first and second years respectively and finally two equal payments in the last two years. Given that the IRR is 5%, determine the following: (a) The size of the payments (b) the nature of the payments (4 marks) (1 mark) (ii) Assuming a risk free rate of 5 %, show on a sketch where a stock with a beta of 1.3 would be located on the Security Market Line. Then show where that stock would be located if it is undervalued. (5 marks) (iii) What are the disadvantages of using the CAPM approach to estimating the required rate of return? (5 marks)

Step by Step Solution

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

step...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones Of Cost Management

Authors: Don R. Hansen, Maryanne M. Mowen

3rd Edition

9781305147102, 1285751787, 1305147103, 978-1285751788

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App