Answered step by step

Verified Expert Solution

Question

1 Approved Answer

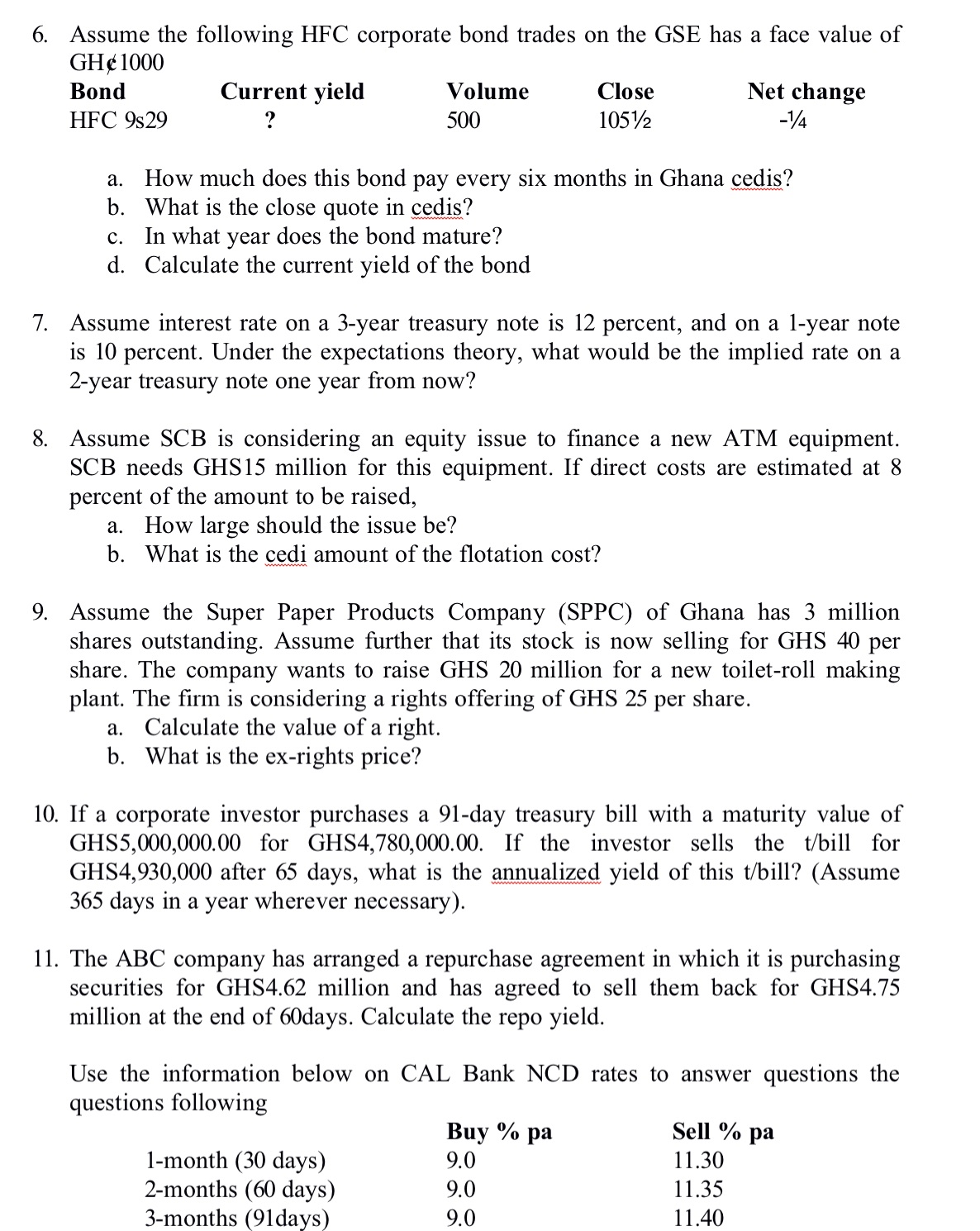

6. Assume the following HFC corporate bond trades on the GSE has a face value of GH1000 Bond HFC 9s29 Current yield ? Volume

6. Assume the following HFC corporate bond trades on the GSE has a face value of GH1000 Bond HFC 9s29 Current yield ? Volume 500 Close 10512 Net change -14 a. How much does this bond pay every six months in Ghana cedis? b. What is the close quote in cedis? c. In what year does the bond mature? d. Calculate the current yield of the bond 7. Assume interest rate on a 3-year treasury note is 12 percent, and on a 1-year note is 10 percent. Under the expectations theory, what would be the implied rate on a 2-year treasury note one year from now? 8. Assume SCB is considering an equity issue to finance a new ATM equipment. SCB needs GHS15 million for this equipment. If direct costs are estimated at 8 percent of the amount to be raised, a. How large should the issue be? b. What is the cedi amount of the flotation cost? 9. Assume the Super Paper Products Company (SPPC) of Ghana has 3 million shares outstanding. Assume further that its stock is now selling for GHS 40 per share. The company wants to raise GHS 20 million for a new toilet-roll making plant. The firm is considering a rights offering of GHS 25 a. Calculate the value of a right. b. What is the ex-rights price? per share. 10. If a corporate investor purchases a 91-day treasury bill with a maturity value of GHS5,000,000.00 for GHS4,780,000.00. If the investor sells the t/bill for GHS4,930,000 after 65 days, what is the annualized yield of this t/bill? (Assume 365 days in a year wherever necessary). 11. The ABC company has arranged a repurchase agreement in which it is purchasing securities for GHS4.62 million and has agreed to sell them back for GHS4.75 million at the end of 60days. Calculate the repo yield. Use the information below on CAL Bank NCD rates to answer questions the questions following Buy % pa 1-month (30 days) 9.0 2-months (60 days) 9.0 3-months (91days) 9.0 Sell % pa 11.30 11.35 11.40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

6 HFC Corporate Bond Given Face Value GH 1000 Bond Current Yield Information not provided directly but we need to calculate it in part d Volume 500 Close 105 this means 1055 of face value Net Change N...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started