Answered step by step

Verified Expert Solution

Question

1 Approved Answer

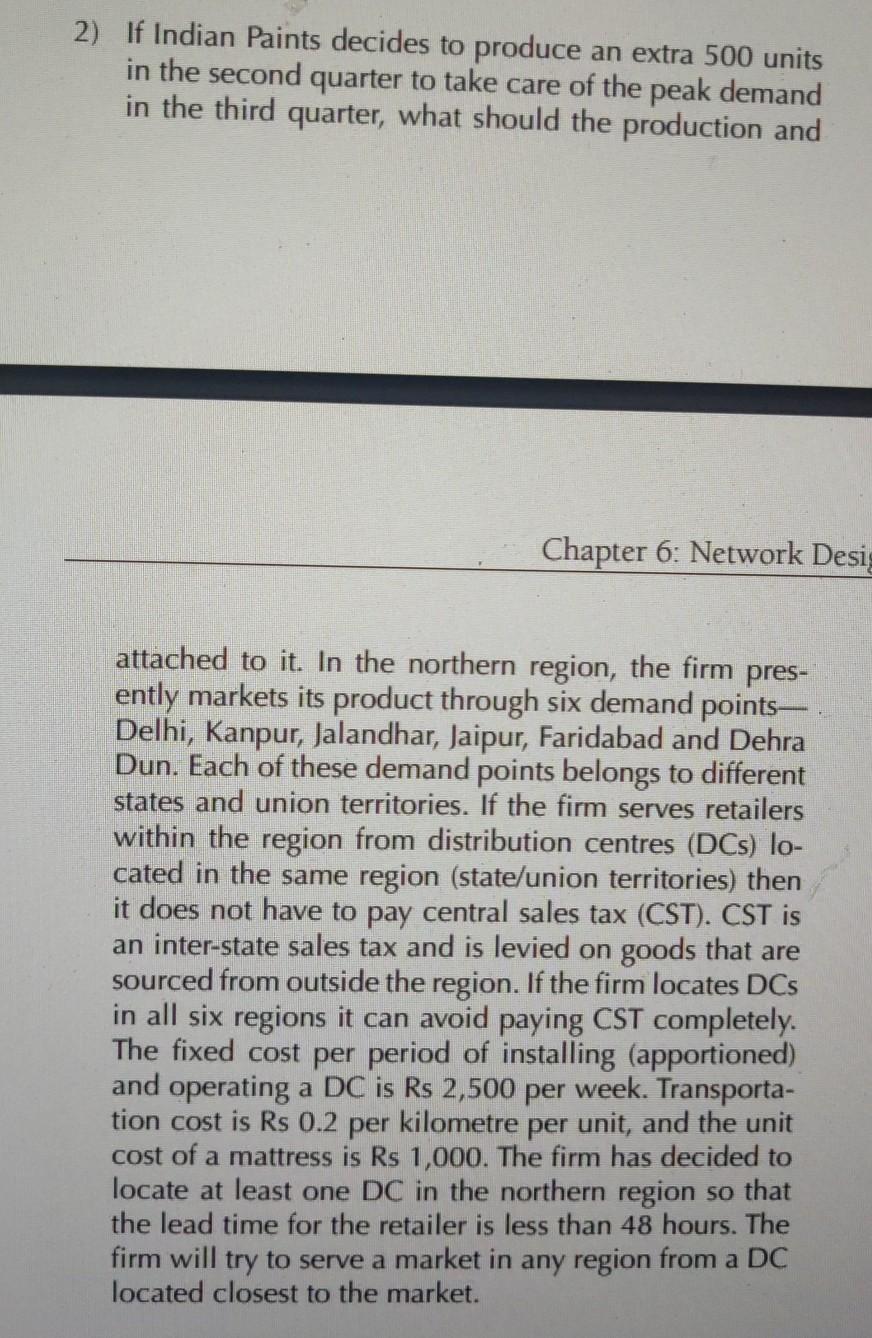

2) If Indian Paints decides to produce an extra 500 units in the second quarter to take care of the peak demand in the third

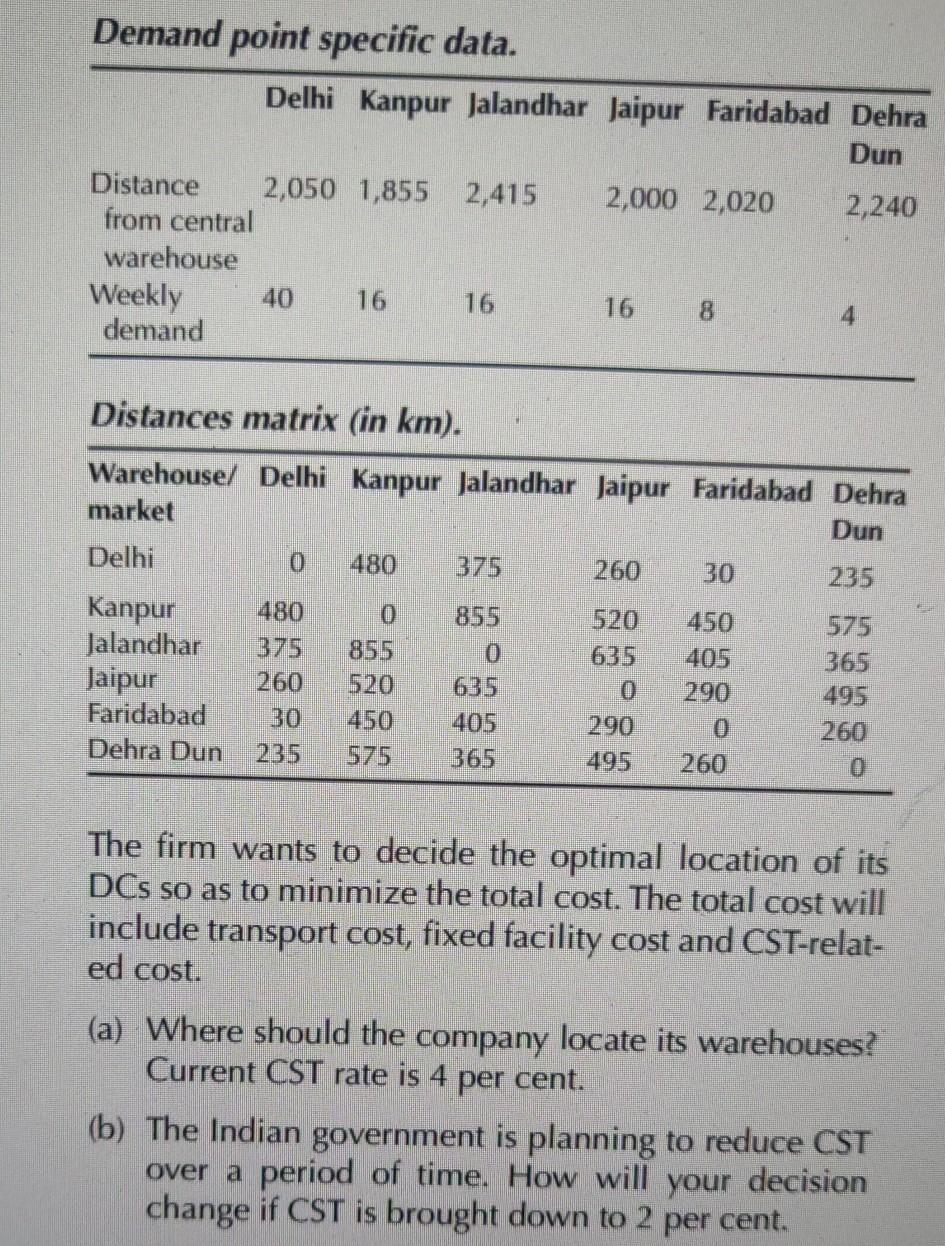

2) If Indian Paints decides to produce an extra 500 units in the second quarter to take care of the peak demand in the third quarter, what should the production and Chapter 6: Network Desig attached to it. In the northern region, the firm pres- ently markets its product through six demand points Delhi, Kanpur, Jalandhar, Jaipur, Faridabad and Dehra Dun. Each of these demand points belongs to different states and union territories. If the firm serves retailers within the region from distribution centres (DCs) lo- cated in the same region (state/union territories) then it does not have to pay central sales tax (CST). CST is an inter-state sales tax and is levied on goods that are sourced from outside the region. If the firm locates DCS in all six regions it can avoid paying CST completely. The fixed cost per period of installing (apportioned) and operating a DC is Rs 2,500 per week. Transporta- tion cost is Rs 0.2 per kilometre per unit, and the unit cost of a mattress is Rs 1,000. The firm has decided to locate at least one DC in the northern region so that the lead time for the retailer is less than 48 hours. The firm will try to serve a market in any region from a DC located closest to the market. Demand point specific data. Delhi Kanpur Jalandhar Jaipur Faridabad Dehra Dun Distance 2,050 1,855 2,415 2,000 2,020 2,240 from central warehouse Weekly 40 16 8 demand 4 Distances matrix (in km). Warehouse/ Delhi Kanpur Jalandhar Jaipur Faridabad Dehra market Dun Delhi 0 480 375 260 30 235 0 520 855 Kanpur Jalandhar Jaipur Faridabad Dehra Dun 480 375 260 30 855 0 635 405 365 520 450 405 290 0 575 365 495 260 290 495 575 260 The firm wants to decide the optimal location of its DCs so as to minimize the total cost. The total cost will include transport cost, fixed facility cost and CST-relat- ed cost. (a) Where should the company locate its warehouses? Current CST rate is 4 per cent. (b) The Indian government is planning to reduce CST over a period of time. How will your decision change if CST is brought down to 2 per cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started