Question

2) If today is your 35th birthday, and you decide, starting next year and on every birthday up to and including your 65th birthday (30

2) If today is your 35th birthday, and you decide, starting next year and on every birthday up to and including your 65th birthday (30 years total), you will invest the same amount. How much must you invest annually to meet the retirement savings goal you have set in problem above? Again the fair interest rate is 7% annually.

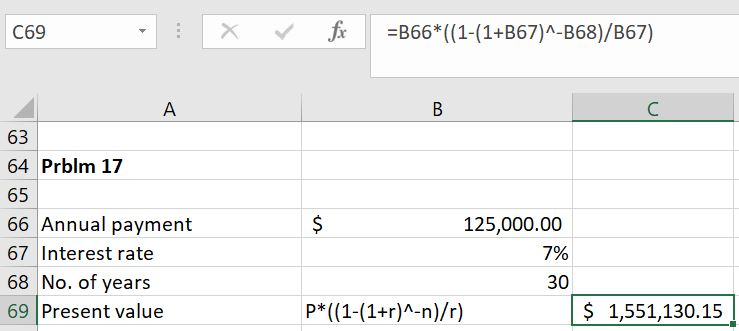

Above problem for reference : (1) You believe you will need $125,000 annually to live comfortably while retired. You plan on retiring when you are 65 and will begin withdrawing funds from your retirement account on your 66th birthday. If you expect to need 30 years of retirement income how much money will you need at retirement (when you are 65) to meet this goal assuming the fair interest rate is 7%?

Solution for problem 1:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started