Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. In 2011, you purchased a $1,000 par value semi-annual bond at a price of $1,450. The bond will mature in 2041 and has

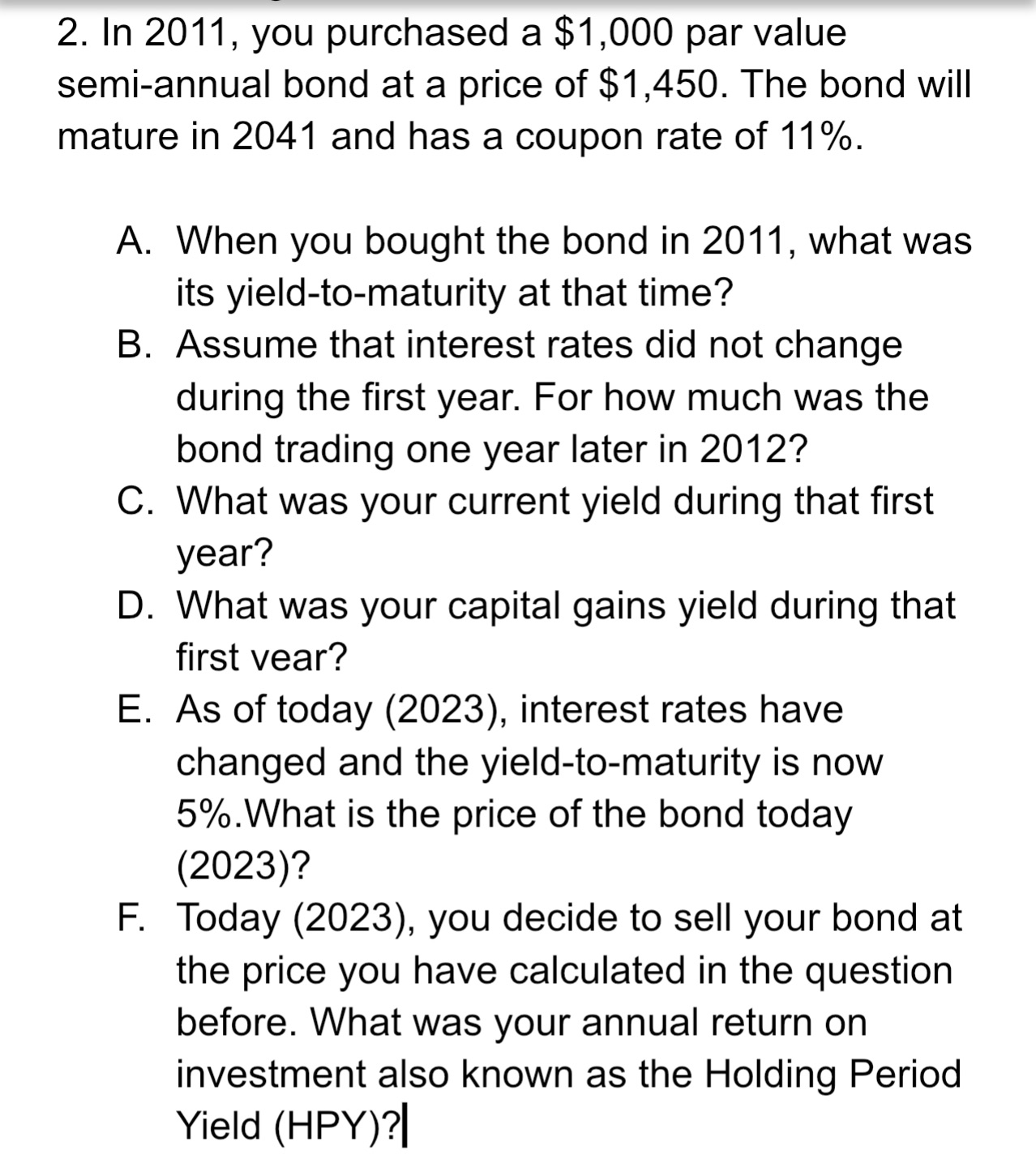

2. In 2011, you purchased a $1,000 par value semi-annual bond at a price of $1,450. The bond will mature in 2041 and has a coupon rate of 11%. A. When you bought the bond in 2011, what was its yield-to-maturity at that time? B. Assume that interest rates did not change during the first year. For how much was the bond trading one year later in 2012? C. What was your current yield during that first year? D. What was your capital gains yield during that first vear? E. As of today (2023), interest rates have changed and the yield-to-maturity is now 5%. What is the price of the bond today (2023)? F. Today (2023), you decide to sell your bond at the price you have calculated in the question before. What was your annual return on investment also known as the Holding Period Yield (HPY)?|

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Here are the answers to each question A To calculate the yieldtomaturity at the time of purchase we need to use the bonds coupon rate and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started