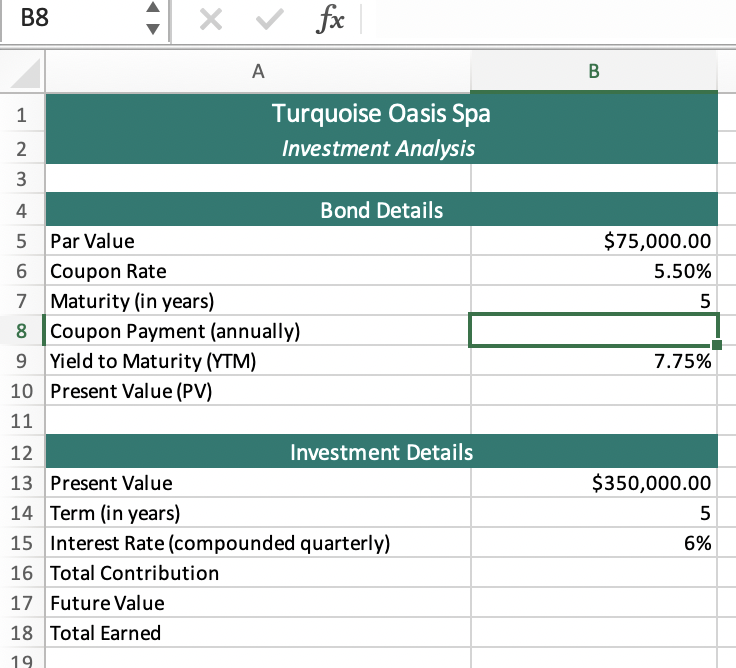

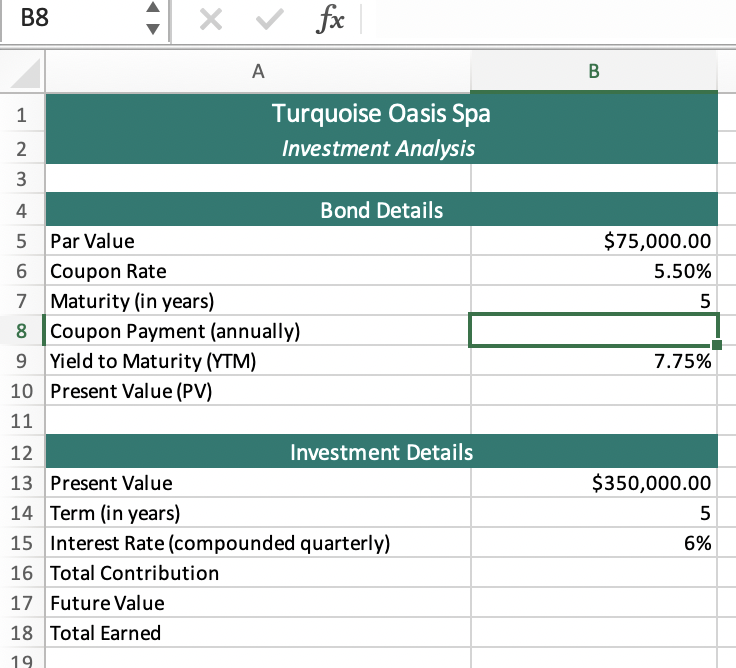

2 In addition to analyzing possible expansion finance options from a bank, managers at the Turquoise Oasis Spa would like to analyze some possible investment opportunities to help finance the expansion and generate revenue in the long term. On the PresentAndFutureValue worksheet, in cell B8 calculate the Coupon Payment (annually) of the investment from the bank's perspective. 3 The first step in determining whether or not this is a worthy investment is to calculate the present value of the investment. In cell B10, calculate the present value of the investment from the bank's perspective. 4 In cell B16, reference the present value cell, as the total investment will be a one time, lump- sum investment. 5 The future value function, or FV function, is used to calculate the value of an investment with a fixed interest rate and term, as well as to calculate periodic payments over a specific period of. time. In cell B17, calculate the future value of the investment from the bank's perspective. 6 In cell B18, enter a formula to calculate the total amount earned by subtracting the total contribution from the future value. B8 fx A B B 1 2 N $75,000.00 5.50% 5 7.75% Turquoise Oasis Spa 2 Investment Analysis 3 4 Bond Details 5 Par Value 6 Coupon Rate 7 Maturity (in years) 8 Coupon Payment (annually) Yield to Maturity (YTM) 10 Present Value (PV) 11 12 Investment Details 13 Present Value 14 Term (in years) 15 Interest Rate (compounded quarterly) 16 Total Contribution 17 Future Value 18 Total Earned 19 $350,000.00 5 6% 2 In addition to analyzing possible expansion finance options from a bank, managers at the Turquoise Oasis Spa would like to analyze some possible investment opportunities to help finance the expansion and generate revenue in the long term. On the PresentAndFutureValue worksheet, in cell B8 calculate the Coupon Payment (annually) of the investment from the bank's perspective. 3 The first step in determining whether or not this is a worthy investment is to calculate the present value of the investment. In cell B10, calculate the present value of the investment from the bank's perspective. 4 In cell B16, reference the present value cell, as the total investment will be a one time, lump- sum investment. 5 The future value function, or FV function, is used to calculate the value of an investment with a fixed interest rate and term, as well as to calculate periodic payments over a specific period of. time. In cell B17, calculate the future value of the investment from the bank's perspective. 6 In cell B18, enter a formula to calculate the total amount earned by subtracting the total contribution from the future value. B8 fx A B B 1 2 N $75,000.00 5.50% 5 7.75% Turquoise Oasis Spa 2 Investment Analysis 3 4 Bond Details 5 Par Value 6 Coupon Rate 7 Maturity (in years) 8 Coupon Payment (annually) Yield to Maturity (YTM) 10 Present Value (PV) 11 12 Investment Details 13 Present Value 14 Term (in years) 15 Interest Rate (compounded quarterly) 16 Total Contribution 17 Future Value 18 Total Earned 19 $350,000.00 5 6%