Answered step by step

Verified Expert Solution

Question

1 Approved Answer

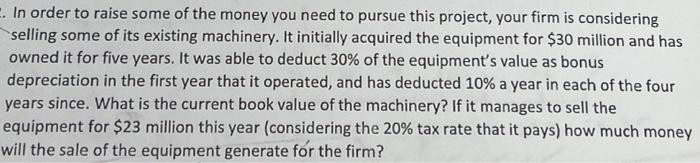

2. In order to raise some of the money you need to pursue this project, your firm is considering selling some of its existing machinery.

2. In order to raise some of the money you need to pursue this project, your firm is considering selling some of its existing machinery. It initially acquired the equipment for $30 million and has owned it for five years. It was able to deduct 30% of the equipment's value as bonus depreciation in the first year that it operated, and has deducted 10% a year in each of the four years since. What is the current book value of the machinery? If it manages to sell the equipment for $23 million this year (considering the 20% tax rate that it pays) how much money will the sale of the equipment generate for the firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started