Question

2. In the valuation of Fabricare, Roy is trying to decide the price he is willing to pay for the firm. In a proper valuation

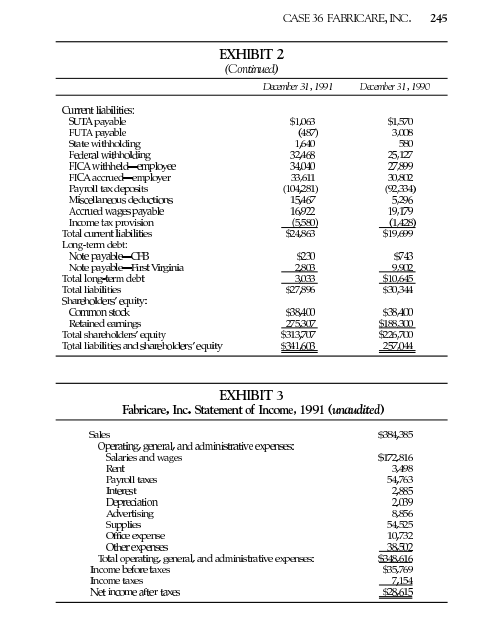

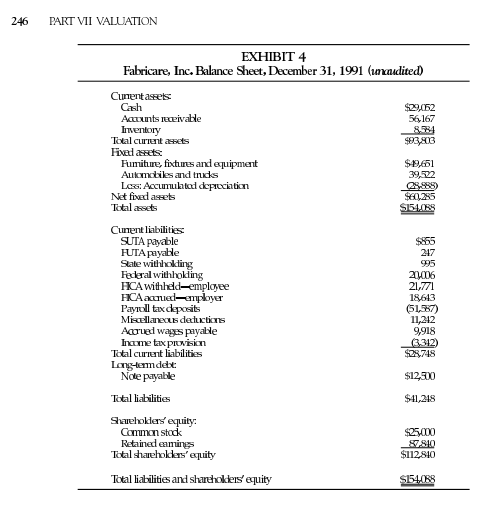

2. In the valuation of Fabricare, Roy is trying to decide the price he is willing to pay for the firm. In a proper valuation of Fabricare, what role should each of the following play in the analysis? (a) the liquidation value (b) the book value of the assets to be acquired from Fabricare; (c) price-to-earnings ratio for publicly-traded maintenance firms; (d) market value as a percentage of sales analysis for publicly-traded firms; and (e) an estimate of the value of Fabricare under current management. In addition to explaining the roles, if any, for each option, be sure to provide the dollar value under each option, and explain how you determined each number. Note: The value of Fabricare under current management can be estimated using the formula for the present value of a growing perpetuity (see Chapter 6), also known as the constant growth model. Also note that the C in the growing perpetuity model must be the next cash flow. Hint: Dont assume that all five of the methods would play useful roles. Hint for c, d, and e: The purchase of Fabricare is to be for 1993, not 1991 or 1992.

4. If Roy Tyson were to acquire Fabricare, what is the maximum amount that he should pay for the firm, assuming that the acquisition is effective at the beginning of 1993? Note: Use the best valuation method.

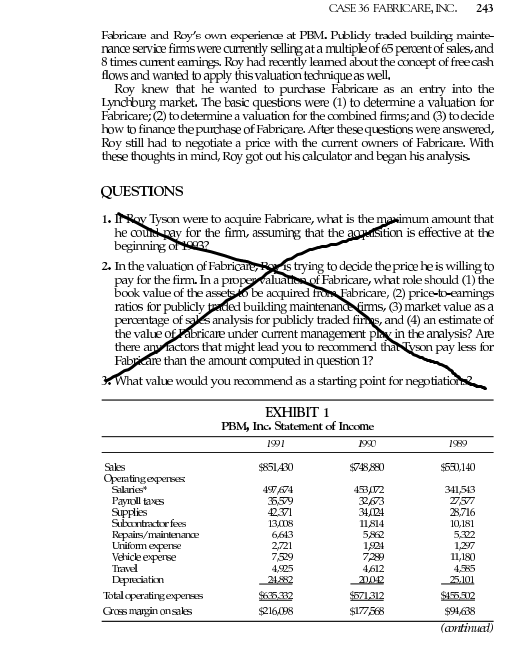

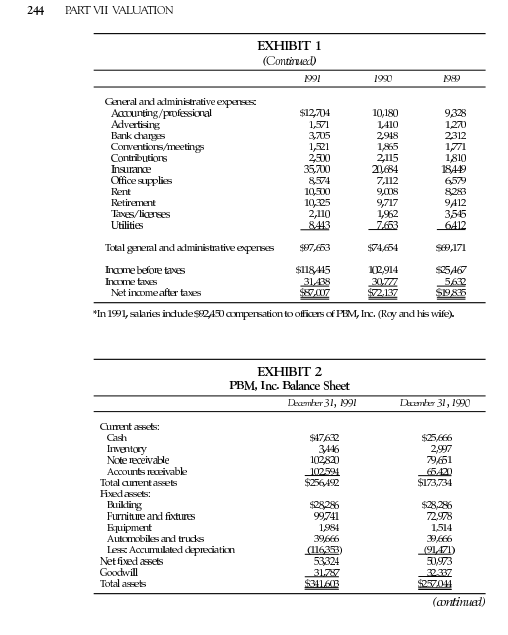

CASE 36 FABRICARE, INC. VALUATION In early 1986, Roy Tyson purchased Professional Building Maintenance, Inc. (PBM), a building maintenance and cleaning firm located and operating in the Danville, Virginia area. The firm specialized in providing cleaning services in commercial and professional offices, such as banks, law offices, and medical practices. Over the next 5 years, revenues increased more than 400 percent, from $212,100 to $851,430 in 1991 (see Exhibit 1 and 2). The revenue growth rate slowed in 1991 as PBM's market share (currently 40 percent) in the area expanded and the potential new prospect pool declined. Roy was confident that the expertise he had gained while operating PBM could be applied successfully to similar firms in other geographical markets that possessed greater growth potential than Danville. In 1992, he learned that a building maintenance firm, Fabricare, Inc., located in Lynchburg, Virginia, was for sale. Fabricare's most recent (year- end 1991) revenues were less than one-half of those of PBM, but Roy believed the growth potential to be much greater because Fabricare had only a small share (approximately 10 percent) of the Lynchburg market. As he looked over the 1991 income statement and balance sheet for Fabricare, Roy was try- ing to decide (1) if he should purchase the company and (2) if so, at what price. Fabricare, like PBM, was in the building maintenance business, but approxi- mately one-half of its revenues came from commercial establishment carpet cleaning. The owner of Fabricare was approaching retirement age and no prepa- ration had been made for management succession in the small firm. On investigation, Roy learned that Fabricare had about $384,000 in revenues in 1991, a figure that had grown only modestly over the previous three years. (Exhibit 3 is a 1991 income statement, derived from Fabricare's 1991 tax return. Exhibit 4 is an unaudited 1991 balance sheet for Fabricare). Fabricare's current owners were not much on keeping careful records. Past income records were not reliable in Roy's judgment. Hence, the decision regarding acquisition of Fabricare had to be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the price Roy Tyson should be willing to pay for Fabricare we need to analyze the valuation using several methods Not all methods will ne...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started