Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. In this problem you will use SP500 index futures to hedge against risks in your stock portfolio. Note that SP500 index is given

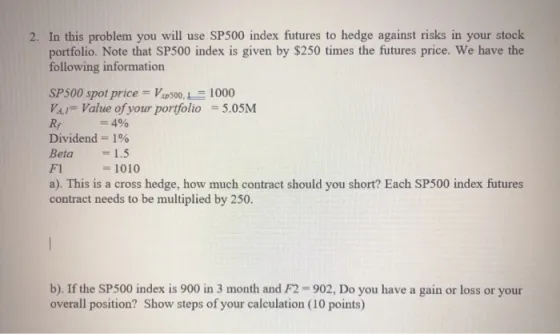

2. In this problem you will use SP500 index futures to hedge against risks in your stock portfolio. Note that SP500 index is given by $250 times the futures price. We have the following information SP500 spot price Vap500,1000 VAI Value of your portfolio = 5.05M Rf = 4% Dividend = 1% = 1.5 Beta F1 -1010 a). This is a cross hedge, how much contract should you short? Each SP500 index futures contract needs to be multiplied by 250. b). If the SP500 index is 900 in 3 month and F2-902, Do you have a gain or loss or your overall position? Show steps of your calculation (10 points)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate how many SP500 index futures contracts to short Value of portfolio 505 million Beta 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started