Answered step by step

Verified Expert Solution

Question

1 Approved Answer

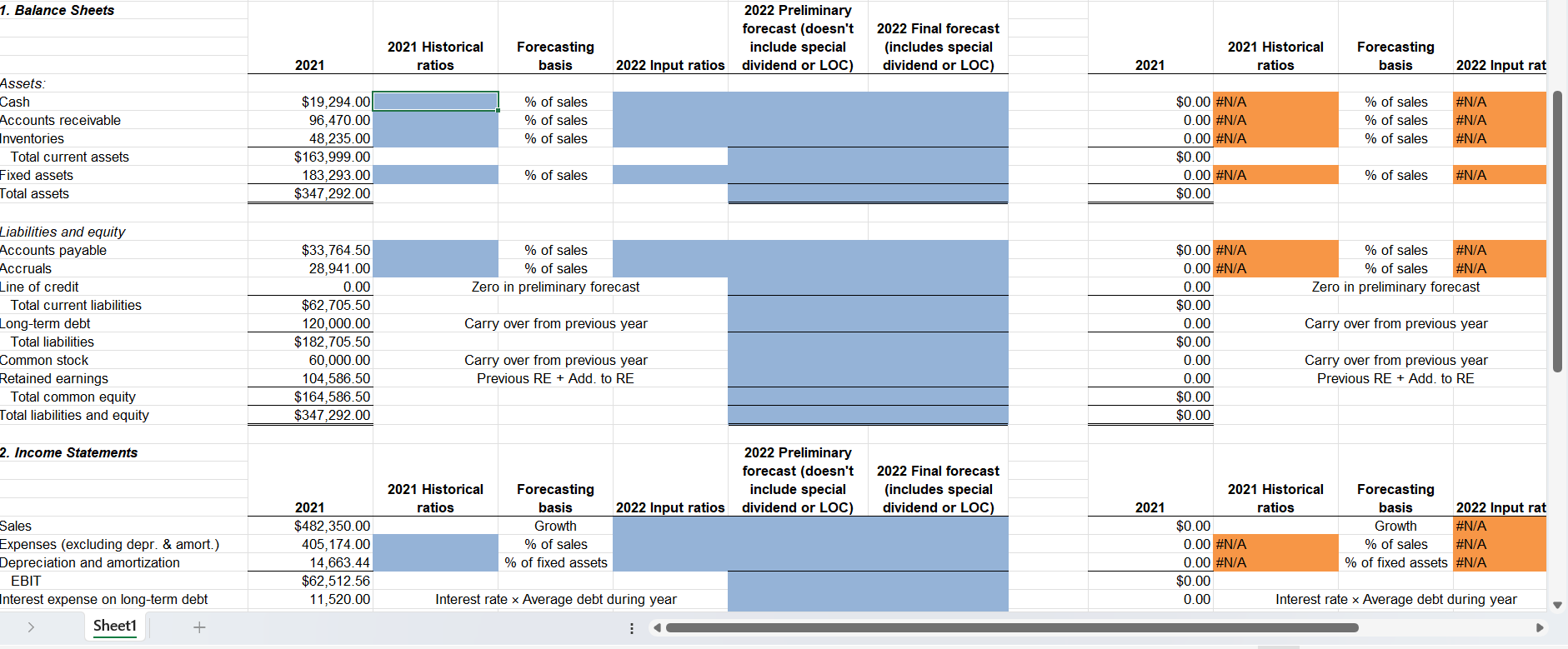

2. Income Statements Sales Expenses (excluding depr. & amort.) Depreciation and amortization EBIT Interest expense on long-term debt Interest expense on line of credit EBT

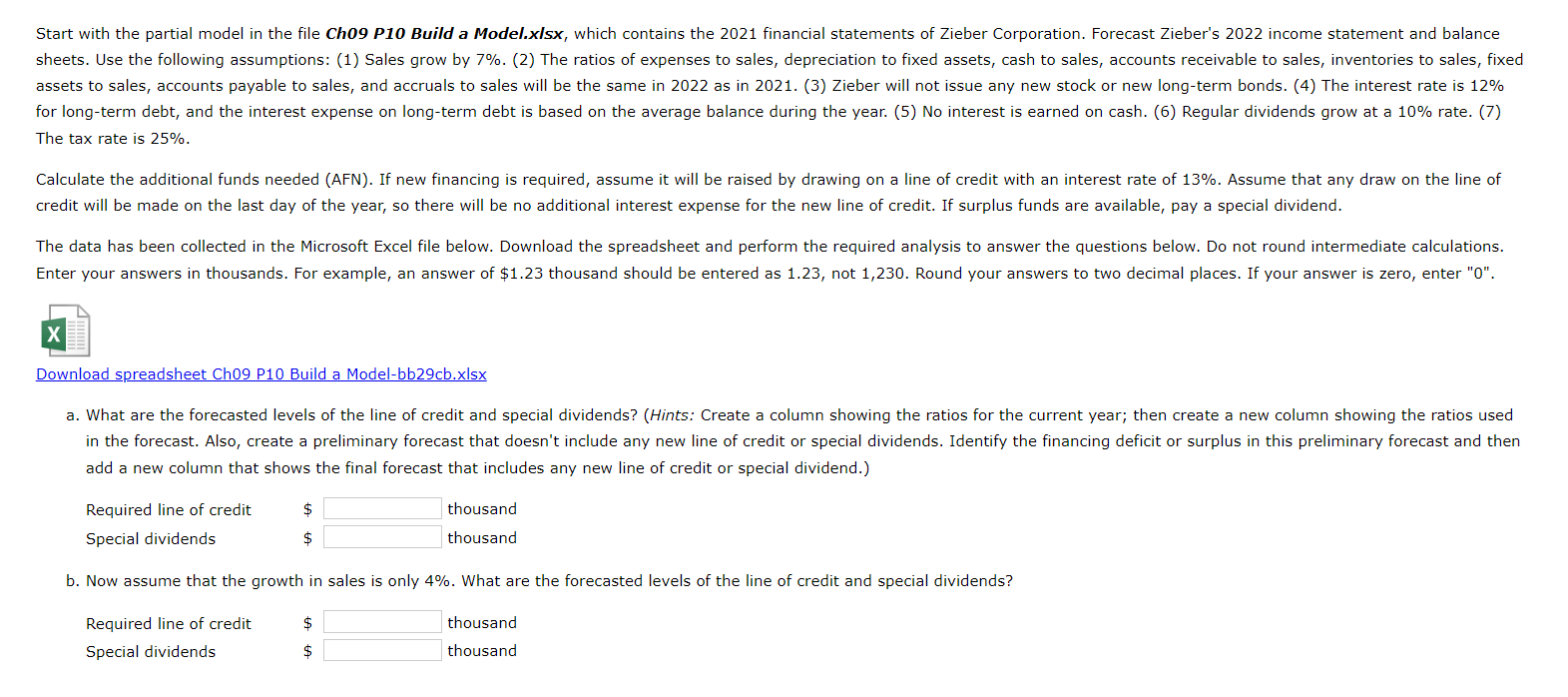

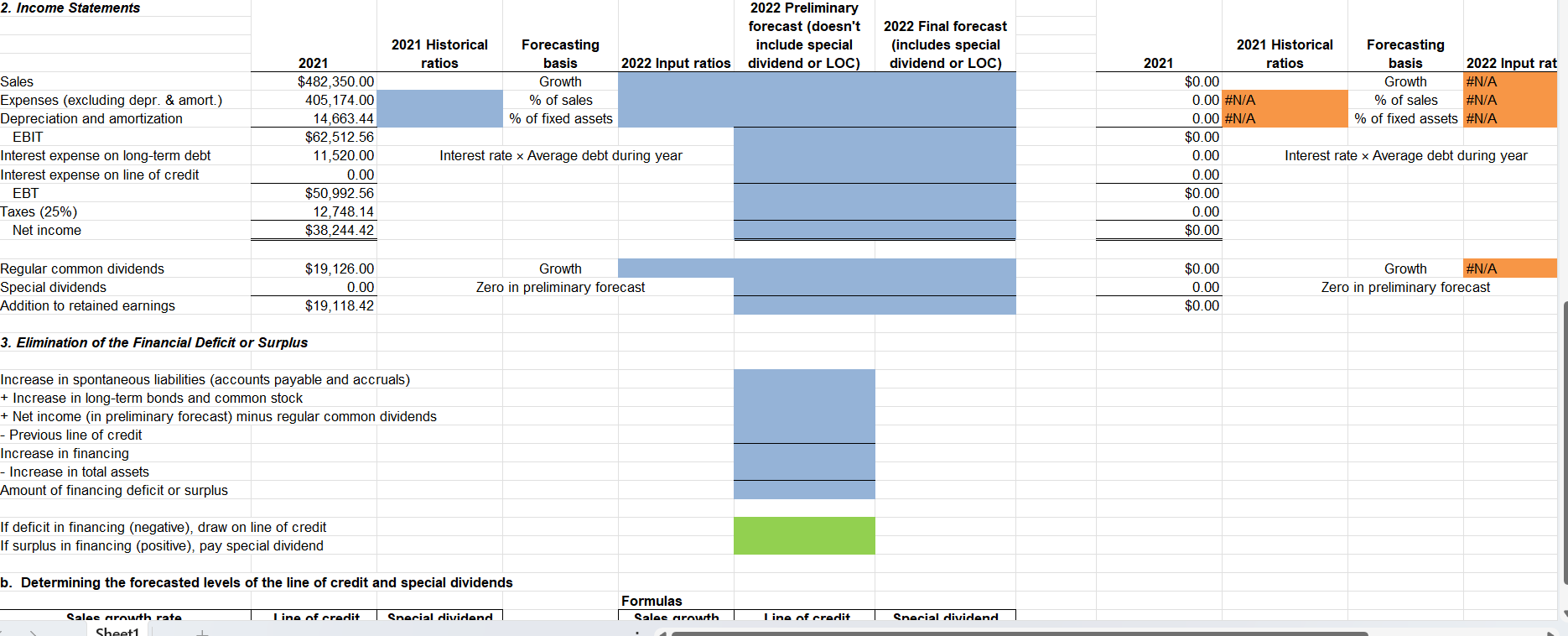

2. Income Statements Sales Expenses (excluding depr. \& amort.) Depreciation and amortization EBIT Interest expense on long-term debt Interest expense on line of credit EBT Taxes (25\%) Net income Regular common dividends Special dividends Addition to retained earnings Growth Zero in preliminary forecast 3. Elimination of the Financial Deficit or Surplus Increase in spontaneous liabilities (accounts payable and accruals) + Increase in long-term bonds and common stock + Net income (in preliminary forecast) minus regular common dividends - Previous line of credit Increase in financing - Increase in total assets Amount of financing deficit or surplus If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends The tax rate is 25%. Download spreadsheet Ch09 P10 Build a Model-bb29cb.xlsx add a new column that shows the final forecast that includes any new line of credit or special dividend.) Required line of credit Special dividends $ $ thousand thousand b. Now assume that the growth in sales is only 4%. What are the forecasted levels of the line of credit and special dividends? Required line of credit Special dividends $ $ thousand thousand If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends 2. Income Statements Sales Expenses (excluding depr. \& amort.) Depreciation and amortization EBIT Interest expense on long-term debt Interest expense on line of credit EBT Taxes (25\%) Net income Regular common dividends Special dividends Addition to retained earnings Growth Zero in preliminary forecast 3. Elimination of the Financial Deficit or Surplus Increase in spontaneous liabilities (accounts payable and accruals) + Increase in long-term bonds and common stock + Net income (in preliminary forecast) minus regular common dividends - Previous line of credit Increase in financing - Increase in total assets Amount of financing deficit or surplus If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends The tax rate is 25%. Download spreadsheet Ch09 P10 Build a Model-bb29cb.xlsx add a new column that shows the final forecast that includes any new line of credit or special dividend.) Required line of credit Special dividends $ $ thousand thousand b. Now assume that the growth in sales is only 4%. What are the forecasted levels of the line of credit and special dividends? Required line of credit Special dividends $ $ thousand thousand If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends

2. Income Statements Sales Expenses (excluding depr. \& amort.) Depreciation and amortization EBIT Interest expense on long-term debt Interest expense on line of credit EBT Taxes (25\%) Net income Regular common dividends Special dividends Addition to retained earnings Growth Zero in preliminary forecast 3. Elimination of the Financial Deficit or Surplus Increase in spontaneous liabilities (accounts payable and accruals) + Increase in long-term bonds and common stock + Net income (in preliminary forecast) minus regular common dividends - Previous line of credit Increase in financing - Increase in total assets Amount of financing deficit or surplus If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends The tax rate is 25%. Download spreadsheet Ch09 P10 Build a Model-bb29cb.xlsx add a new column that shows the final forecast that includes any new line of credit or special dividend.) Required line of credit Special dividends $ $ thousand thousand b. Now assume that the growth in sales is only 4%. What are the forecasted levels of the line of credit and special dividends? Required line of credit Special dividends $ $ thousand thousand If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends 2. Income Statements Sales Expenses (excluding depr. \& amort.) Depreciation and amortization EBIT Interest expense on long-term debt Interest expense on line of credit EBT Taxes (25\%) Net income Regular common dividends Special dividends Addition to retained earnings Growth Zero in preliminary forecast 3. Elimination of the Financial Deficit or Surplus Increase in spontaneous liabilities (accounts payable and accruals) + Increase in long-term bonds and common stock + Net income (in preliminary forecast) minus regular common dividends - Previous line of credit Increase in financing - Increase in total assets Amount of financing deficit or surplus If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends The tax rate is 25%. Download spreadsheet Ch09 P10 Build a Model-bb29cb.xlsx add a new column that shows the final forecast that includes any new line of credit or special dividend.) Required line of credit Special dividends $ $ thousand thousand b. Now assume that the growth in sales is only 4%. What are the forecasted levels of the line of credit and special dividends? Required line of credit Special dividends $ $ thousand thousand If deficit in financing (negative), draw on line of credit If surplus in financing (positive), pay special dividend b. Determining the forecasted levels of the line of credit and special dividends Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started