Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2 Intro The stock price for Chevrolet is $35. An investor believes that the stock price will experience significant volatility in the following six months

#2

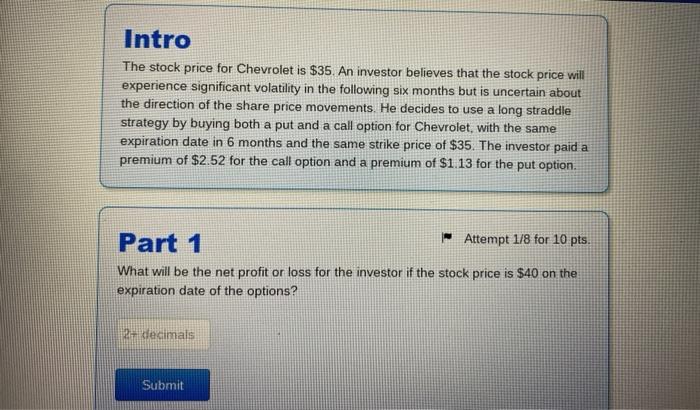

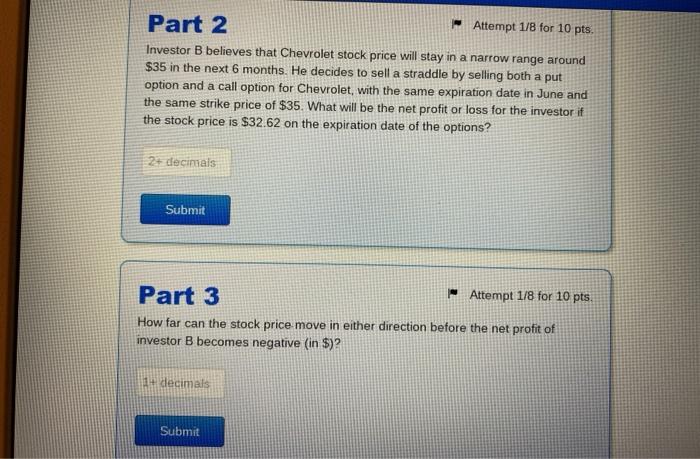

Intro The stock price for Chevrolet is $35. An investor believes that the stock price will experience significant volatility in the following six months but is uncertain about the direction of the share price movements. He decides to use a long straddle strategy by buying both a put and a call option for Chevrolet, with the same expiration date in months and the same strike price of $35. The investor paid a premium of $2.52 for the call option and a premium of $1.13 for the put option. Part 1 - Attempt 1/8 for 10 pts. What will be the net profit or loss for the investor if the stock price is $40 on the expiration date of the options? 2- decimals Submit Part 2 Attempt 1/8 for 10 pts. Investor B believes that Chevrolet stock price will stay in a narrow range around $35 in the next 6 months. He decides to sell a straddle by selling both a put option and a call option for Chevrolet, with the same expiration date in June and the same strike price of $35. What will be the net profit or loss for the investor if the stock price is $32.62 on the expiration date of the options? 2+ decimals Submit Part 3 Attempt 1/8 for 10 pts. How far can the stock price move in either direction before the net profit of investor B becomes negative (in $)? 1. decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started