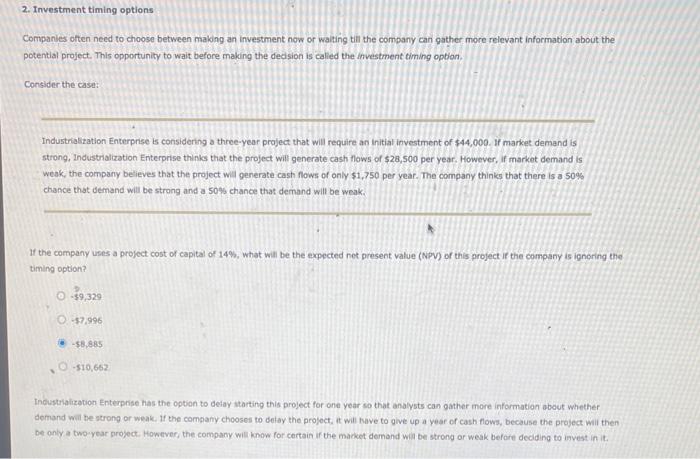

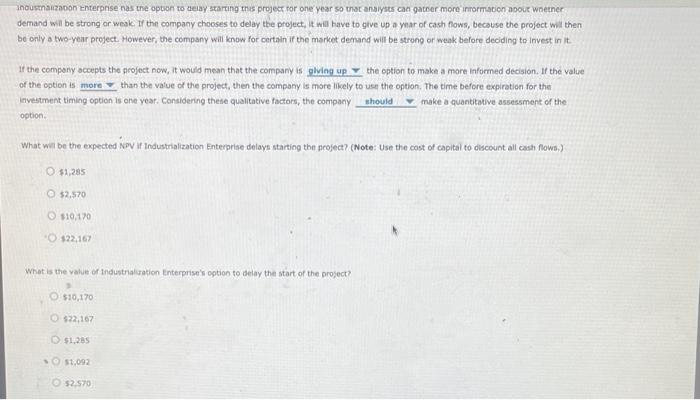

2. Investment timing options Companies often need to choose between making an investment now or walting till the company can gather more relevant information about the potential project. This opportunity to wait before making the deasion is called the investment timing option Consider the case Industrialization Enterprise is considering a three-year project that will require an initial investment of $44,000. 1 market demand is strong, Industrialization Enterprise thinks that the project will generate cash flows of $28,500 per year. However, if market demand is weak, the company believes that the project will generate cash flows of only $1,750 per year. The company thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak, If the company uses a project cost of capital of 14%, what will be the expected net present value (NPV) of this project if the company is ignoring the timing option? -$9,329 -$7,996 -$8.885 -$10,662 Industrialization Enterprise has the option to delay starting this project for one year so that analysts can gather more information about whether demand will be strong or weak. If the company chooses to delay the project, it will have to give up a year of cash flows, because the project will then be only a two-year project. However, the company will know for certain if the market demand will be strong or weak before deciding to invest in it Industnanzacion Enterprise nas the option to diay starting this project for one year so that analysts can gather more information about whether demand will be strong or weak. If the company chooses to delay the project, it will have to give up a year of cash flows, because the project will then be only a two-year project. However, the company will know for certain in the market demand will be strong or wank before deciding to invest in it If the company accepts the project now, it would mean that the company is giving up the option to make a more informed decision. If the valve of the option is more than the value of the project, then the company is more likely to use the option. The time before expiration for the Investment timing option is one yeat. Considering these qualitative factors, the company should make a quantitative assessment of the option What will be the expected NPV if Industrialization Enterprise delays starting the project? (Note: Use the cost of capital to discount all cash nows $1,285 @ $2,570 $10,170 $22,167 What is the value of Industriation Enterprise's option to delay the start of the project? $10,170 $22,167 $1,285 51,092 52.570