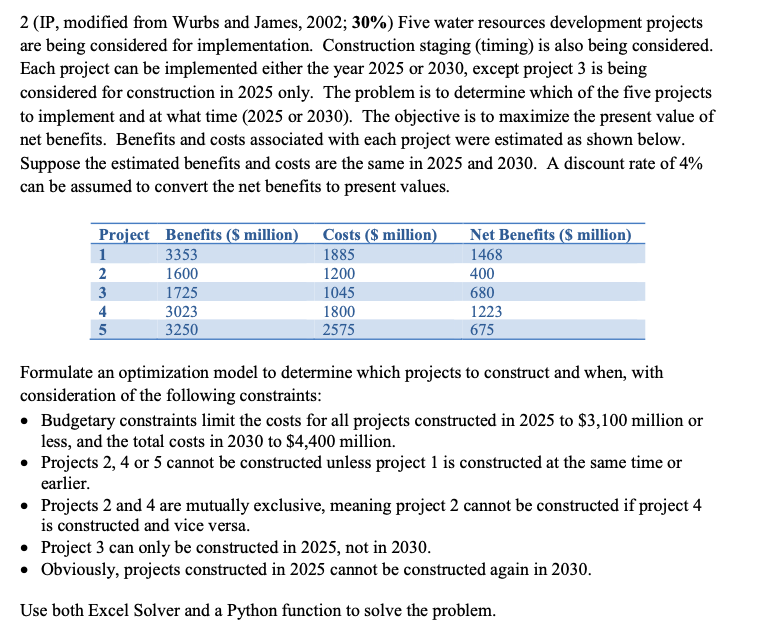

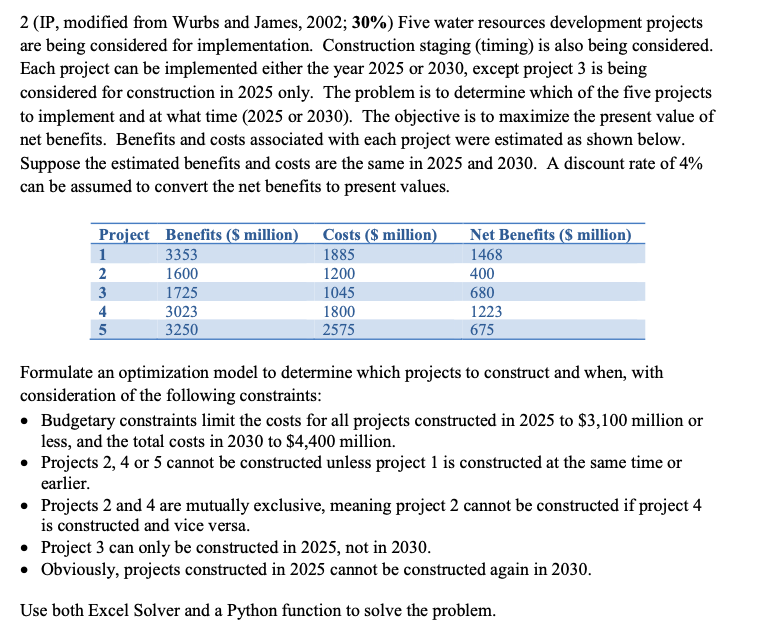

2 (IP, modified from Wurbs and James, 2002;30\%) Five water resources development projects are being considered for implementation. Construction staging (timing) is also being considered. Each project can be implemented either the year 2025 or 2030 , except project 3 is being considered for construction in 2025 only. The problem is to determine which of the five projects to implement and at what time (2025 or 2030). The objective is to maximize the present value of net benefits. Benefits and costs associated with each project were estimated as shown below. Suppose the estimated benefits and costs are the same in 2025 and 2030. A discount rate of 4% can be assumed to convert the net benefits to present values. Formulate an optimization model to determine which projects to construct and when, with consideration of the following constraints: - Budgetary constraints limit the costs for all projects constructed in 2025 to $3,100 million or less, and the total costs in 2030 to $4,400 million. - Projects 2, 4 or 5 cannot be constructed unless project 1 is constructed at the same time or earlier. - Projects 2 and 4 are mutually exclusive, meaning project 2 cannot be constructed if project 4 is constructed and vice versa. - Project 3 can only be constructed in 2025, not in 2030. - Obviously, projects constructed in 2025 cannot be constructed again in 2030. Use both Excel Solver and a Python function to solve the problem. 2 (IP, modified from Wurbs and James, 2002;30\%) Five water resources development projects are being considered for implementation. Construction staging (timing) is also being considered. Each project can be implemented either the year 2025 or 2030 , except project 3 is being considered for construction in 2025 only. The problem is to determine which of the five projects to implement and at what time (2025 or 2030). The objective is to maximize the present value of net benefits. Benefits and costs associated with each project were estimated as shown below. Suppose the estimated benefits and costs are the same in 2025 and 2030. A discount rate of 4% can be assumed to convert the net benefits to present values. Formulate an optimization model to determine which projects to construct and when, with consideration of the following constraints: - Budgetary constraints limit the costs for all projects constructed in 2025 to $3,100 million or less, and the total costs in 2030 to $4,400 million. - Projects 2, 4 or 5 cannot be constructed unless project 1 is constructed at the same time or earlier. - Projects 2 and 4 are mutually exclusive, meaning project 2 cannot be constructed if project 4 is constructed and vice versa. - Project 3 can only be constructed in 2025, not in 2030. - Obviously, projects constructed in 2025 cannot be constructed again in 2030. Use both Excel Solver and a Python function to solve the