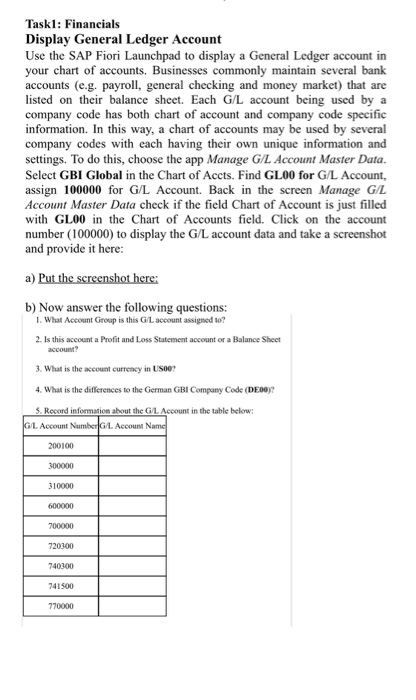

2. Is this account a Profit and Loss Statement account or a Balance Sheet account? Taskl: Financials Display General Ledger Account Use the SAP Fiori Launchpad to display a General Ledger account in your chart of accounts. Businesses commonly maintain several bank accounts (e.g. payroll, general checking and money market) that are listed on their balance sheet. Each G/L account being used by a company code has both chart of account and company code specific information. In this way, a chart of accounts may be used by several company codes with each having their own unique information and settings. To do this, choose the app Manage G/L Account Master Data. Select GBI Global in the Chart of Accts. Find GL00 for G/L Account, assign 100000 for G/L Account. Back in the screen Manage G/L Account Master Data check if the field Chart of Account is just filled with GL00 in the Chart of Accounts field. Click on the account number (100000) to display the G/L account data and take a screenshot and provide it here: a) Put the screenshot here: b) Now answer the following questions: 1. What Account Group is this GL account assigned to? 2. Is this account a Profit and Loss Statement account or a Balance Sheet account? 3. What is the account currency in USO 4. What is the differences to the German GBI Company Code (DE00)? 5. Record information about the GL, Account in the table below: GL. Account Number. Account Name 200100 300000 310000 600000 700000 720300 740300 741500 770000 2. Is this account a Profit and Loss Statement account or a Balance Sheet account? Taskl: Financials Display General Ledger Account Use the SAP Fiori Launchpad to display a General Ledger account in your chart of accounts. Businesses commonly maintain several bank accounts (e.g. payroll, general checking and money market) that are listed on their balance sheet. Each G/L account being used by a company code has both chart of account and company code specific information. In this way, a chart of accounts may be used by several company codes with each having their own unique information and settings. To do this, choose the app Manage G/L Account Master Data. Select GBI Global in the Chart of Accts. Find GL00 for G/L Account, assign 100000 for G/L Account. Back in the screen Manage G/L Account Master Data check if the field Chart of Account is just filled with GL00 in the Chart of Accounts field. Click on the account number (100000) to display the G/L account data and take a screenshot and provide it here: a) Put the screenshot here: b) Now answer the following questions: 1. What Account Group is this GL account assigned to? 2. Is this account a Profit and Loss Statement account or a Balance Sheet account? 3. What is the account currency in USO 4. What is the differences to the German GBI Company Code (DE00)? 5. Record information about the GL, Account in the table below: GL. Account Number. Account Name 200100 300000 310000 600000 700000 720300 740300 741500 770000