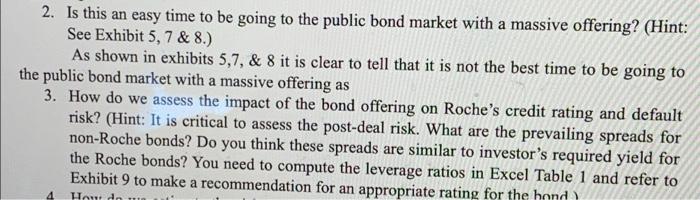

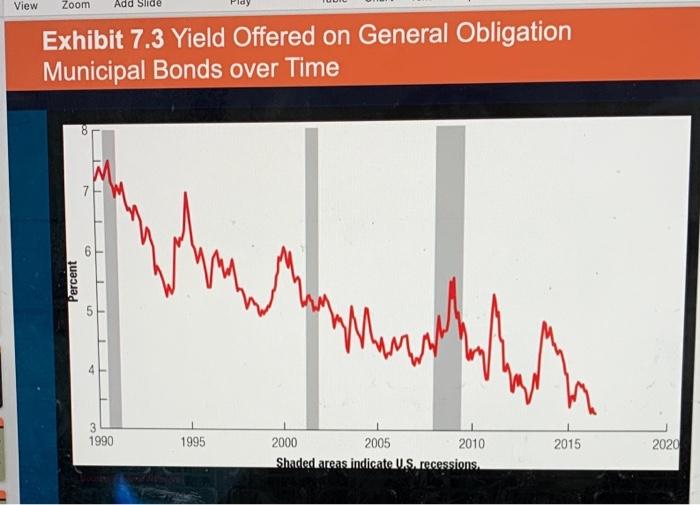

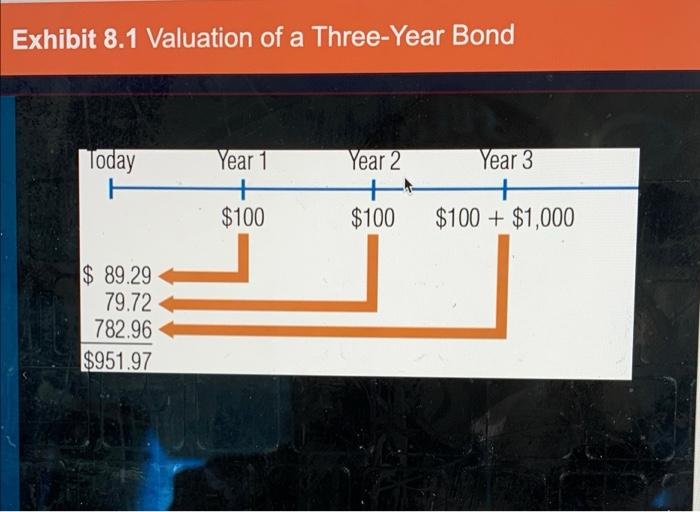

2. Is this an easy time to be going to the public bond market with a massive offering? (Hint: See Exhibit 5, 7 & 8.) As shown in exhibits 5,7, & 8 it is clear to tell that it is not the best time to be going to the public bond market with a massive offering as 3. How do we assess the impact of the bond offering on Roche's credit rating and default risk? (Hint: It is critical to assess the post-deal risk. What are the prevailing spreads for non-Roche bonds? Do you think these spreads are similar to investor's required yield for the Roche bonds? You need to compute the leverage ratios in Excel Table 1 and refer to Exhibit 9 to make a recommendation for an appropriate rating for the hond Houd View Zoom Add Slide Exhibit 7.3 Yield Offered on General Obligation Municipal Bonds over Time 5 3 1990 1995 2015 2020 2000 2005 2010 Shaded areas indicate Us recessions Zoom Exhibit 7.4 Risk Premiums of Junk Bonds versus Other Corporate Bonds over Time 24 22 20 18 16 14 12 10 Percentage Points High-yield 6 4 AAA 21 0 2000 2002 2004 2006 2010 2012 2014 2008 Year Exhibit 8.1 Valuation of a Three-Year Bond Today H Year 1 + $100 Year 2 + $100 Year 3 + $100 + $1,000 $ 89.29 79.72 782.96 $951.97 2. Is this an easy time to be going to the public bond market with a massive offering? (Hint: See Exhibit 5, 7 & 8.) As shown in exhibits 5,7, & 8 it is clear to tell that it is not the best time to be going to the public bond market with a massive offering as 3. How do we assess the impact of the bond offering on Roche's credit rating and default risk? (Hint: It is critical to assess the post-deal risk. What are the prevailing spreads for non-Roche bonds? Do you think these spreads are similar to investor's required yield for the Roche bonds? You need to compute the leverage ratios in Excel Table 1 and refer to Exhibit 9 to make a recommendation for an appropriate rating for the hond Houd View Zoom Add Slide Exhibit 7.3 Yield Offered on General Obligation Municipal Bonds over Time 5 3 1990 1995 2015 2020 2000 2005 2010 Shaded areas indicate Us recessions Zoom Exhibit 7.4 Risk Premiums of Junk Bonds versus Other Corporate Bonds over Time 24 22 20 18 16 14 12 10 Percentage Points High-yield 6 4 AAA 21 0 2000 2002 2004 2006 2010 2012 2014 2008 Year Exhibit 8.1 Valuation of a Three-Year Bond Today H Year 1 + $100 Year 2 + $100 Year 3 + $100 + $1,000 $ 89.29 79.72 782.96 $951.97