Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2 Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town.

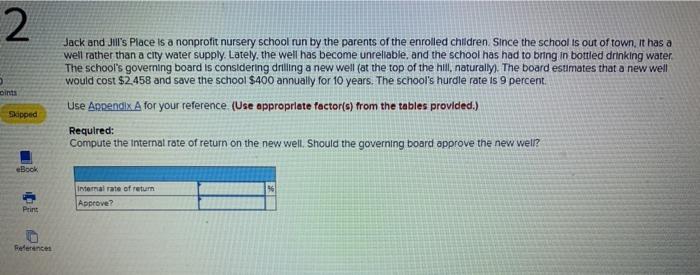

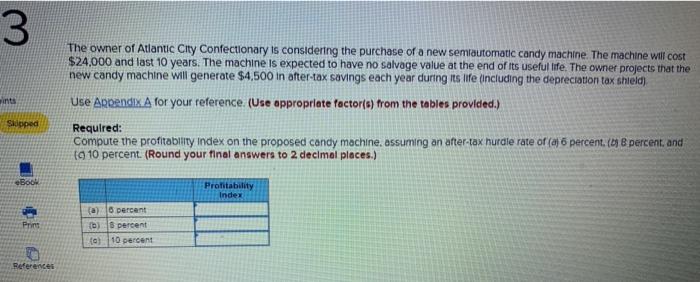

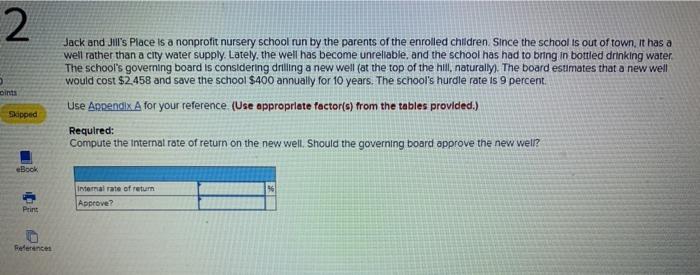

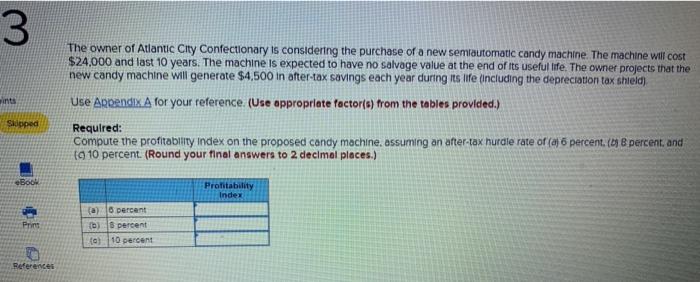

2 Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town. It has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water The school's governing board is considering drilling a new well (at the top of the hil, naturally). The board estimates that a new well would cost $2.458 and save the school $400 annually for 10 years. The school's hurdle rate is 9 percent. Use Appendix A for your reference (Use appropriate factor(s) from the tables provided.) Skipped Required: Compute the internal rate of return on the new well. Should the governing board approve the new well? eBook Internal rate of return Approve? Prins References 3 ints The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $24,000 and last 10 years. The machine is expected to have no salvage value at the end of tts useful life. The owner projects that the new candy machine will generate $4,500 in after-tax savings each year during its life (including the depreciation tax shield) Use Arpendix A for your reference (Use appropriate factor(s) from the tables provided.) Required: Compute the profitability Index on the proposed candy machine, assuming an after-tax hurdle rate of (a) 6 percent. (1) 8 percent and (9 10 percent. (Round your final answers to 2 decimal places.) Sipped eBook Profitability Index Pring (a) 10 percent (D) 6 percent 10 percent References

2 Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town. It has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water The school's governing board is considering drilling a new well (at the top of the hil, naturally). The board estimates that a new well would cost $2.458 and save the school $400 annually for 10 years. The school's hurdle rate is 9 percent. Use Appendix A for your reference (Use appropriate factor(s) from the tables provided.) Skipped Required: Compute the internal rate of return on the new well. Should the governing board approve the new well? eBook Internal rate of return Approve? Prins References 3 ints The owner of Atlantic City Confectionary is considering the purchase of a new semiautomatic candy machine. The machine will cost $24,000 and last 10 years. The machine is expected to have no salvage value at the end of tts useful life. The owner projects that the new candy machine will generate $4,500 in after-tax savings each year during its life (including the depreciation tax shield) Use Arpendix A for your reference (Use appropriate factor(s) from the tables provided.) Required: Compute the profitability Index on the proposed candy machine, assuming an after-tax hurdle rate of (a) 6 percent. (1) 8 percent and (9 10 percent. (Round your final answers to 2 decimal places.) Sipped eBook Profitability Index Pring (a) 10 percent (D) 6 percent 10 percent References

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started