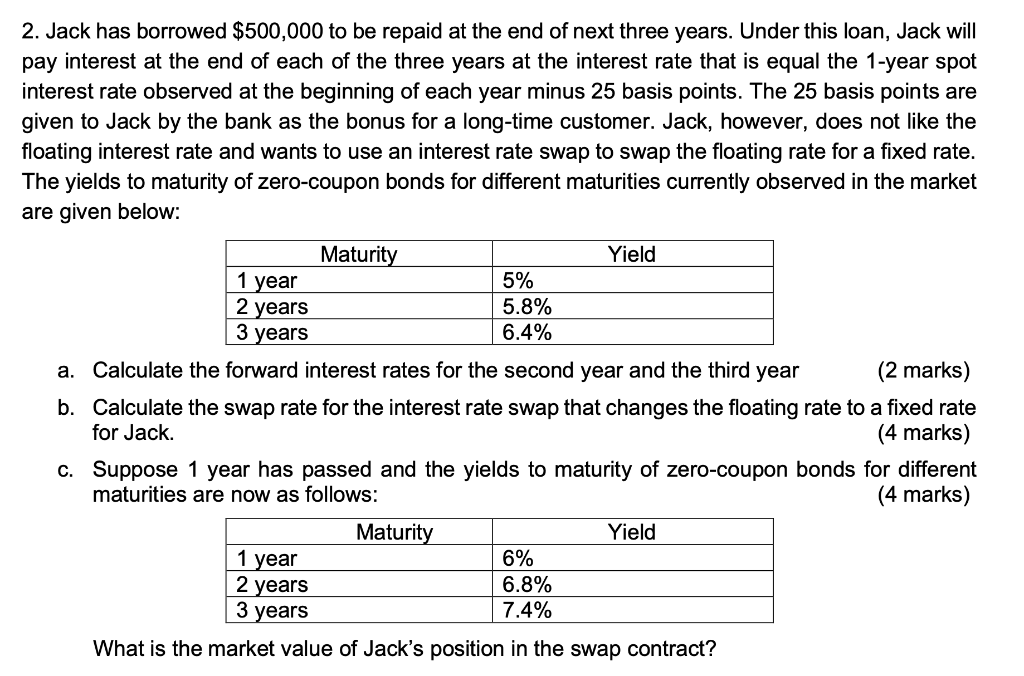

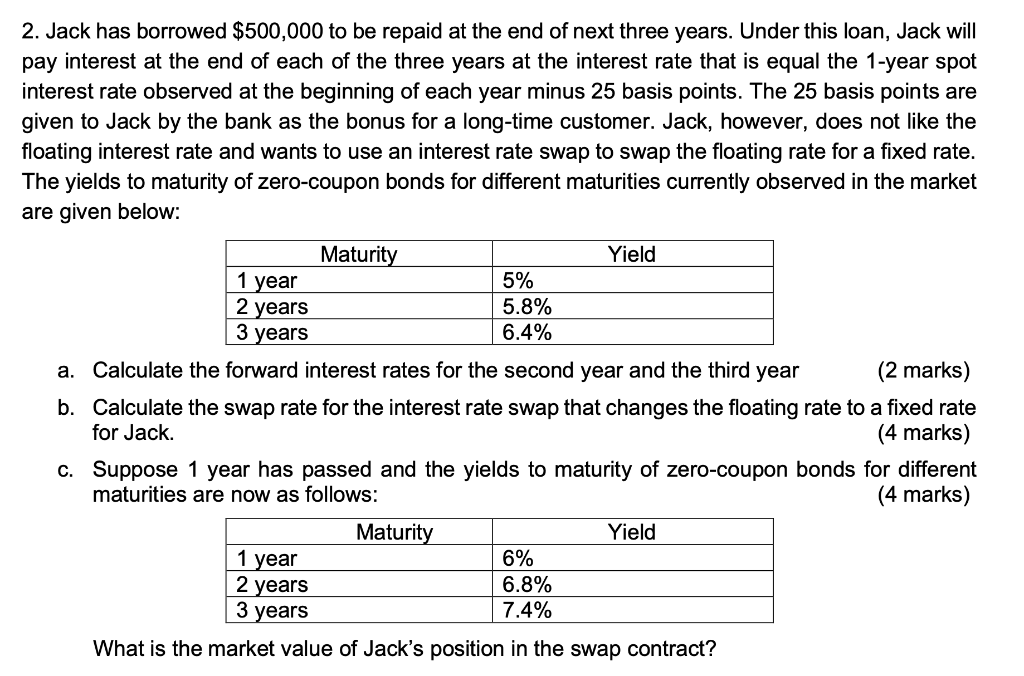

2. Jack has borrowed $500,000 to be repaid at the end of next three years. Under this loan, Jack will pay interest at the end of each of the three years at the interest rate that is equal the 1-year spot interest rate observed at the beginning of each year minus 25 basis points. The 25 basis points are given to Jack by the bank as the bonus for a long-time customer. Jack, however, does not like the floating interest rate and wants to use an interest rate swap to swap the floating rate for a fixed rate. The yields to maturity of zero-coupon bonds for different maturities currently observed in the market are given below: Maturity Yield 1 year 5% 5.8% 2 years 3 years 6.4% (2 marks) a. Calculate the forward interest rates for the second year and the third year b. Calculate the swap rate for the interest rate swap that changes the floating rate to a fixed rate for Jack. (4 marks) c. Suppose 1 year has passed and the yields to maturity of zero-coupon bonds maturities are now as follows: for different (4 marks) Maturity Yield 1 year 6% 2 years 6.8% 3 years 7.4% What is the market value of Jack's position in the swap contract? 2. Jack has borrowed $500,000 to be repaid at the end of next three years. Under this loan, Jack will pay interest at the end of each of the three years at the interest rate that is equal the 1-year spot interest rate observed at the beginning of each year minus 25 basis points. The 25 basis points are given to Jack by the bank as the bonus for a long-time customer. Jack, however, does not like the floating interest rate and wants to use an interest rate swap to swap the floating rate for a fixed rate. The yields to maturity of zero-coupon bonds for different maturities currently observed in the market are given below: Maturity Yield 1 year 5% 5.8% 2 years 3 years 6.4% (2 marks) a. Calculate the forward interest rates for the second year and the third year b. Calculate the swap rate for the interest rate swap that changes the floating rate to a fixed rate for Jack. (4 marks) c. Suppose 1 year has passed and the yields to maturity of zero-coupon bonds maturities are now as follows: for different (4 marks) Maturity Yield 1 year 6% 2 years 6.8% 3 years 7.4% What is the market value of Jack's position in the swap contract