Answered step by step

Verified Expert Solution

Question

1 Approved Answer

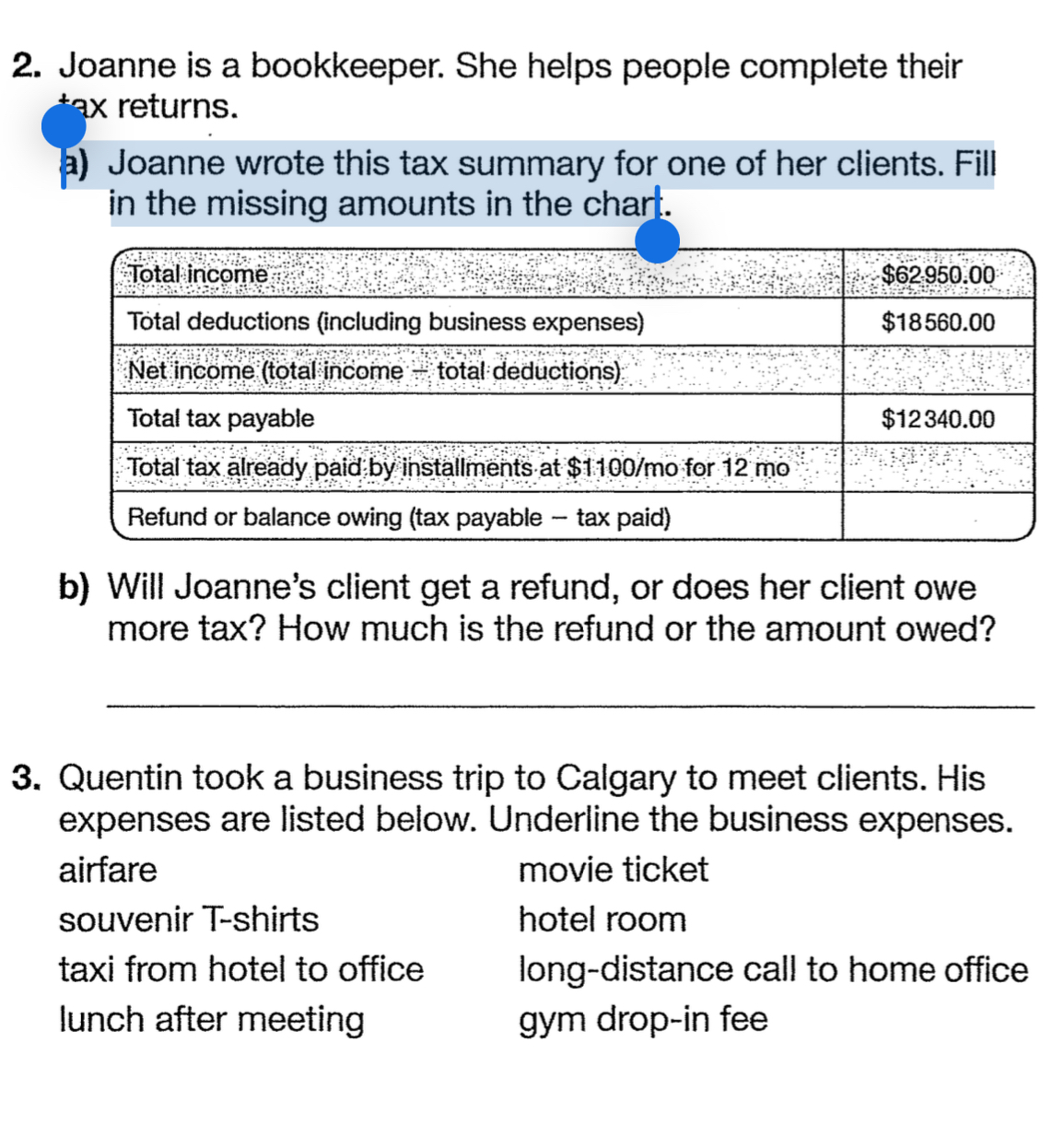

2. Joanne is a bookkeeper. She helps people complete their tax returns. a) Joanne wrote this tax summary for one of her clients. Fill

2. Joanne is a bookkeeper. She helps people complete their tax returns. a) Joanne wrote this tax summary for one of her clients. Fill in the missing amounts in the chart. Total income Total deductions (including business expenses) Net income (total income - total deductions) Total tax payable Total tax already paid by installments at $1100/mo for 12 mo Refund or balance owing (tax payable tax paid) $62.950.00 $18560.00 $12340.00 b) Will Joanne's client get a refund, or does her client owe more tax? How much is the refund or the amount owed? 3. Quentin took a business trip to Calgary to meet clients. His expenses are listed below. Underline the business expenses. airfare souvenir T-shirts taxi from hotel to office lunch after meeting movie ticket hotel room long-distance call to home office gym drop-in fee

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Total income 6295000 Total deductions incl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started