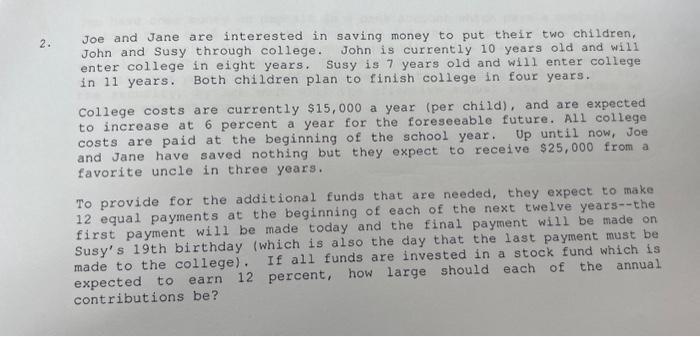

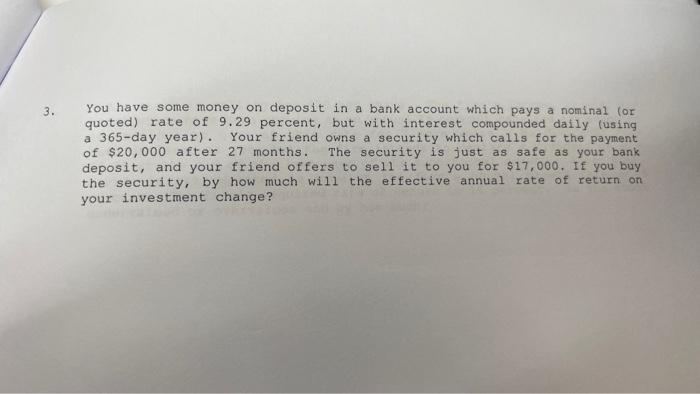

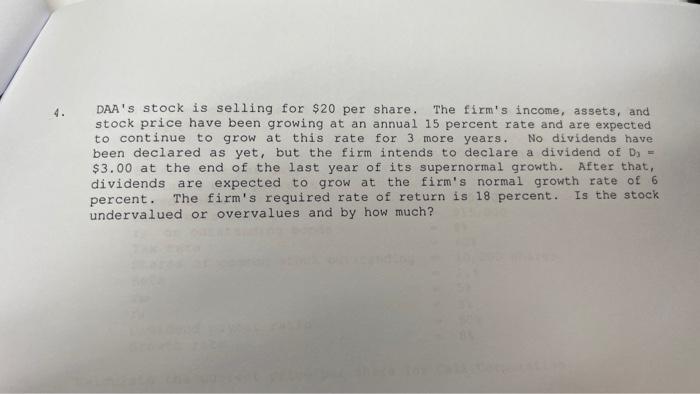

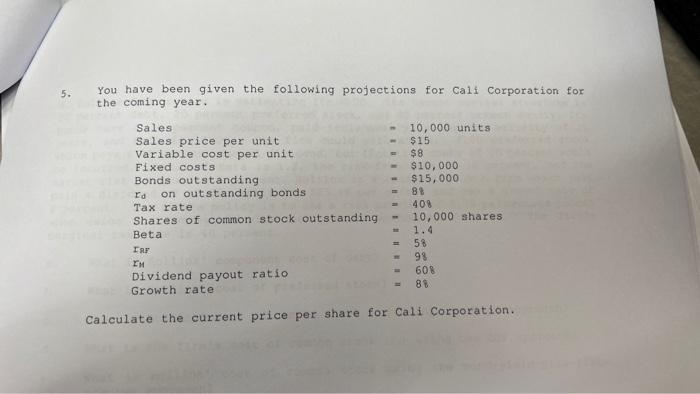

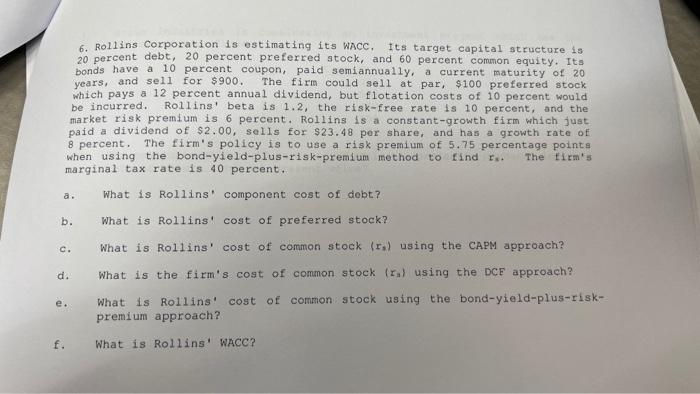

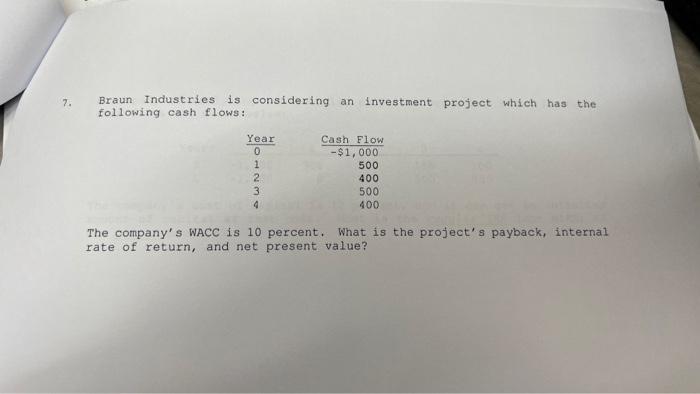

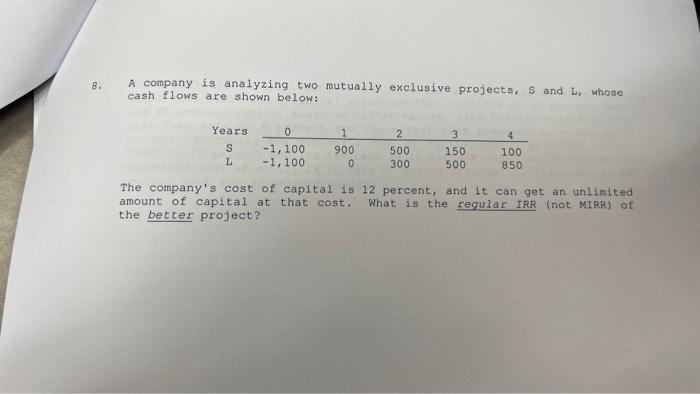

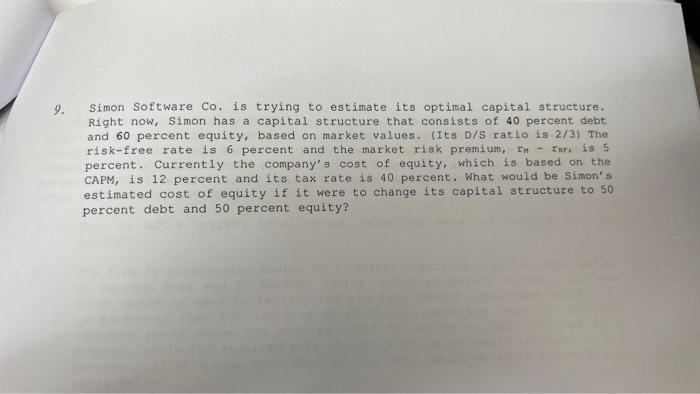

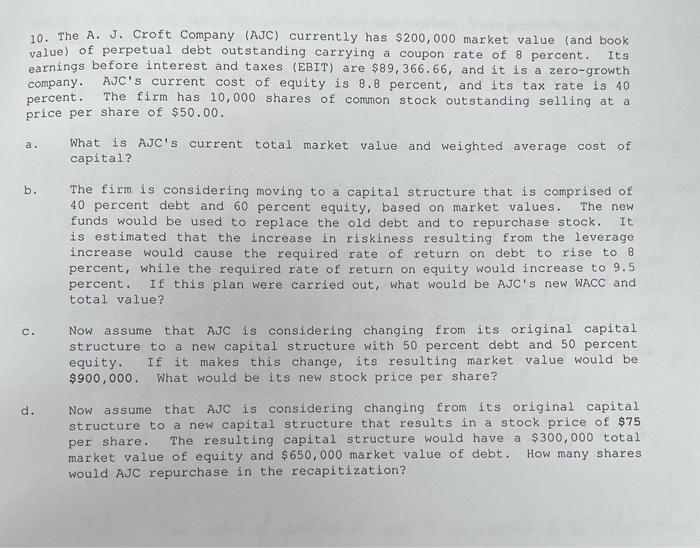

2. Joe and Jane are interested in saving money to put their two children, John and Susy through college. John is currently 10 years old and will enter college in eight years. Susy is 7 years old and will enter college in 11 years. Both children plan to finish college in four years. College costs are currently $15,000 a year (per child), and are expected to increase at 6 percent a year for the foreseeable future. All college costs are paid at the beginning of the school year. Up until now, Joe and Jane have saved nothing but they expect to receive $25,000 from a favorite uncle in three years. To provide for the additional funds that are needed, they expect to make 12 equal payments at the beginning of each of the next twelve years--the first payment will be made today and the final payment will be made on Susy's 19 th birthday (which is also the day that the last payment must be made to the college). If all funds are invested in a stock fund which is expected to earn 12 percent, how large should each of the annual contributions be? You have some money on deposit in a bank account which pays a nominal for quoted) rate of 9.29 percent, but with interest compounded dafly lusing a 365-day year). Your friend owns a security which calls for the payment of $20,000 after 27 months. The security is just as safe as your bank deposit, and your friend offers to sell it to you for $17,000. If you buy the security, by how much will the effective annual rate of return on your investment change? DAA's stock is selling for $20 per share. The firm's income, assets, and stock price have been growing at an annual 15 percent rate and are expected to continue to grow at this rate for 3 more years. No dividends have been declared as yet, but the firm intends to declare a dividend of Dy = $3.00 at the end of the last year of its supernormal growth. After that, dividends are expected to grow at the firm's normal growth rate of 6 percent. The firm's required rate of return is 18 percent. Is the stock undervalued or overvalues and by how much? You have been given the following projections for Cali Corporation for the coming year. Calculate the current price per share for Cali Corporation. 6. Rollins Corporation is estimating its WACC, Its target capital structure is 20 percent debt, 20 percent preferred stock, and 60 percent common equity. Its bonds have a 10 percent coupon, paid semiannually, a current maturity of zo years, and sell for $900. The firm could sell at par, \$100 preferred stock which pays a 12 percent annual dividend, but flotation costs of 10 percent would be incurred. Rolilins' beta is 1.2, the rfsk-free rate is 10 percent, and the market risk premium is 6 percent. Rollins is a constant-growth firm which just. paid a dividend of $2.00, sells for $23.48 per share, and has a growth rate of 8 percent. The firm's policy is to use a risk premium of 5.75 percentage points when using the bond-yield-plus-risk-premium mothod to find fs. The fitm's marginal tax rate is 40 percent. a. What is Rollins' component cost of dobt? b. What is Rollins' cost of preferred stock? c. What is Rollins' cost of common stock {rn} using the CAPM approach? d. What is the firm's cost of common stock {ta) using the DCE approach? e. What is Rollins' cost of common stock using the bond-yield-plus-riskpremium approach? f. What is Rollins' WACC? Braun Industries is considering an investment project which has the following cash flows: The company's WACC is 10 percent. What is the project's payback, internal rate of return, and net present value? A company is analyzing two mutually exclusive projects, S and L, whose cash flows are shown below: The company's cost of capital is 12 percent, and it can get an unlimited amount of capital at that cost. What is the regular IRR (not MIRR) of the better project? 9. Simon Software Co, is trying to estimate its optimal capital structure. Right now, Simon has a capital structure that consists of 40 percent debt and 60 percent equity, based on market values. (Its D/S ratio is 2/3) The risk-free rate is 6 percent and the market risk premium, IM Inr. is is5 percent. Currently the company's cost of equity, which is based on the CAPM, is 12 percent and its tax rate is 40 percent. What would be simon's estimated cost of equity if it were to change its capital structure to 50 percent debt and 50 percent equity? 10. The A. J. Croft Company (AJC) currently has $200,000 market value (and book value) of perpetual debt outstanding carrying a coupon rate of 8 percent. Its earnings before interest and taxes (EBIT) are $89,366.66, and it is a zero-growth company. AJC's current cost of equity is 8.8 percent, and its tax rate is 40 percent. The firm has 10,000 shares of common stock outstanding selling at a price per share of $50.00. a. What is AJC's current total market value and weighted average cost of capital? b. The firm is considering moving to a capital structure that is comprised of 40 percent debt and 60 percent equity, based on market values. The new funds would be used to replace the old debt and to repurchase stock. It. is estimated that the increase in riskiness resulting from the leverage increase would cause the required rate of return on debt to rise to 8 percent, while the required rate of return on equity would increase to 9.5 percent. If this plan were carried out, what would be AJC's new WACC and total value? c. Now assume that AJC is considering changing from its original capital structure to a new capital structure with 50 percent debt and 50 percent equity. If it makes this change, its resulting market value would be $900,000. What would be its new stock price per share? d. Now assume that AJC is considering changing from its original capital structure to a new capital structure that results in a stock price of $75 per share. The resulting capital structure would have a $300,000 total market value of equity and $650,000 market value of debt. How many shares would AJC repurchase in the recapitization