Answered step by step

Verified Expert Solution

Question

1 Approved Answer

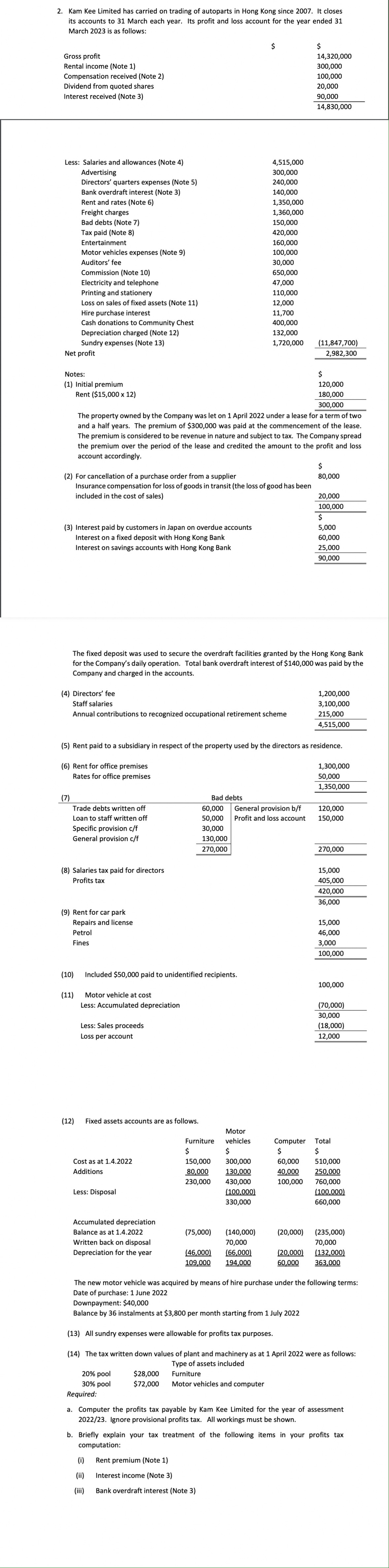

2. Kam Kee Limited has carried on trading of autoparts in Hong Kong since 2007. It closes its accounts to 31 March each year. Its

2. Kam Kee Limited has carried on trading of autoparts in Hong Kong since 2007. It closes its accounts to 31 March each year. Its profit and loss account for the year ended 31 1+1) Rent($15,00012) The property owned by the Company was let on 1 April 2022 under a lease for a term of two and a half years. The premium of $300,000 was paid at the commencement of the lease. The premium is considered to be revenue in nature and subject to tax. The Company spread the premium over the period of the lease and credited the amount to the profit and loss account accordingly. The fixed deposit was used to secure the overdraft facilities granted by the Hong Kong Bank for the Company's daily operation. Total (4) Directors' fee Staff salaries Annual contributions to recognized occupational retirement scheme 1,200,000 3,100,000 (5) Rent paid to a subsidiary in respect of the property used by the directors as residence. Fixed acsots arrouinte aro ac follnwe The new motor vehicle was a Downpayment: $40,000 (13) All sundry expenses were allowable for profits tax purposes. (14) The tax written down values of plant and machinery as at 1 April 2022 were as follows: 20% pool $28,000 Fype of assets included 30% pool Required: a. Computer the profits tax payable by Kam Kee Limited for the year of assessment 2022/23. Ignore provisional profits tax. All workings must be shown. b. Briefly explain your tax treatment of the following items in your profits tax (i) Rent premium (Note 1) (ii) Interest income (Note 3) (iii) Bank overdraft interest (Note 3)

2. Kam Kee Limited has carried on trading of autoparts in Hong Kong since 2007. It closes its accounts to 31 March each year. Its profit and loss account for the year ended 31 1+1) Rent($15,00012) The property owned by the Company was let on 1 April 2022 under a lease for a term of two and a half years. The premium of $300,000 was paid at the commencement of the lease. The premium is considered to be revenue in nature and subject to tax. The Company spread the premium over the period of the lease and credited the amount to the profit and loss account accordingly. The fixed deposit was used to secure the overdraft facilities granted by the Hong Kong Bank for the Company's daily operation. Total (4) Directors' fee Staff salaries Annual contributions to recognized occupational retirement scheme 1,200,000 3,100,000 (5) Rent paid to a subsidiary in respect of the property used by the directors as residence. Fixed acsots arrouinte aro ac follnwe The new motor vehicle was a Downpayment: $40,000 (13) All sundry expenses were allowable for profits tax purposes. (14) The tax written down values of plant and machinery as at 1 April 2022 were as follows: 20% pool $28,000 Fype of assets included 30% pool Required: a. Computer the profits tax payable by Kam Kee Limited for the year of assessment 2022/23. Ignore provisional profits tax. All workings must be shown. b. Briefly explain your tax treatment of the following items in your profits tax (i) Rent premium (Note 1) (ii) Interest income (Note 3) (iii) Bank overdraft interest (Note 3) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started