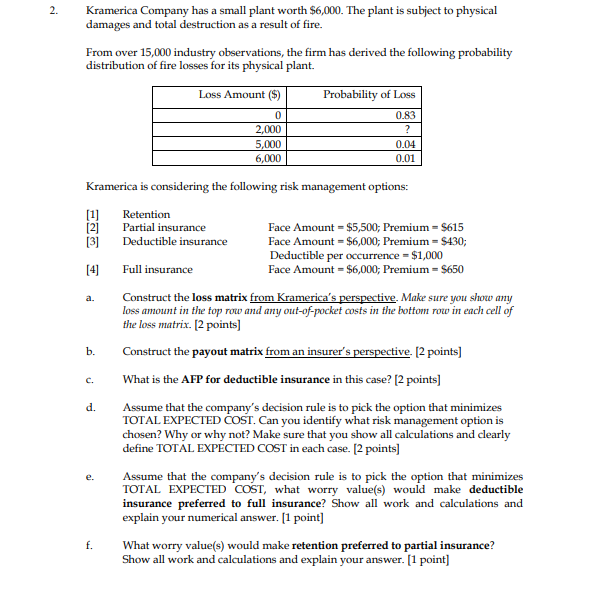

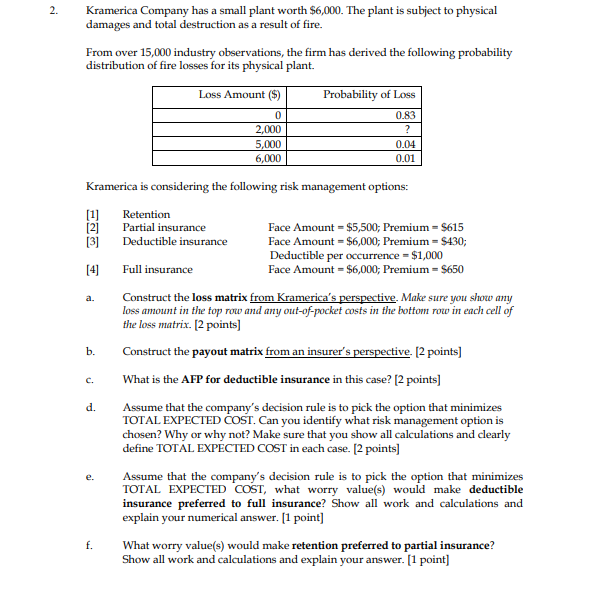

2. Kramerica Company has a small plant worth $6,000. The plant is subject to physical damages and total destruction as a result of fire. From over 15,000 industry observations, the firm has derived the following probability distribution of fire losses for its physical plant. Loss Amount ($) Probability of Loss 0 2,000 5,000 6,000 0.83 ? 0.04 0.01 4 a. b. Kramerica is considering the following risk management options: [1] Retention [2] Partial insurance Face Amount = $5,500; Premium - $615 [3] Deductible insurance Face Amount = $6,000; Premium - $430; Deductible per occurrence = $1,000 Full insurance Face Amount = $6,000; Premium = $650 Construct the loss matrix from Kramerica's perspective. Make sure you show any loss amount in the top row and any out-of-pocket costs in the bottom row in each cell of the loss matrix. [2 points) Construct the payout matrix from an insurer's perspective. (2 points] What is the AFP for deductible insurance in this case? (2 points) Assume that the company's decision rule is to pick the option that minimizes TOTAL EXPECTED COST. Can you identify what risk management option is chosen? Why or why not? Make sure that you show all calculations and clearly define TOTAL EXPECTED COST in each case. [2 points) Assume that the company's decision rule is to pick the option that minimizes TOTAL EXPECTED COST, what worry value(s) would make deductible insurance preferred to full insurance? Show all work and calculations and explain your numerical answer. [1 point] What worry value(s) would make retention preferred to partial insurance? Show all work and calculations and explain your answer. [1 point] c. d. f. 2. Kramerica Company has a small plant worth $6,000. The plant is subject to physical damages and total destruction as a result of fire. From over 15,000 industry observations, the firm has derived the following probability distribution of fire losses for its physical plant. Loss Amount ($) Probability of Loss 0 2,000 5,000 6,000 0.83 ? 0.04 0.01 4 a. b. Kramerica is considering the following risk management options: [1] Retention [2] Partial insurance Face Amount = $5,500; Premium - $615 [3] Deductible insurance Face Amount = $6,000; Premium - $430; Deductible per occurrence = $1,000 Full insurance Face Amount = $6,000; Premium = $650 Construct the loss matrix from Kramerica's perspective. Make sure you show any loss amount in the top row and any out-of-pocket costs in the bottom row in each cell of the loss matrix. [2 points) Construct the payout matrix from an insurer's perspective. (2 points] What is the AFP for deductible insurance in this case? (2 points) Assume that the company's decision rule is to pick the option that minimizes TOTAL EXPECTED COST. Can you identify what risk management option is chosen? Why or why not? Make sure that you show all calculations and clearly define TOTAL EXPECTED COST in each case. [2 points) Assume that the company's decision rule is to pick the option that minimizes TOTAL EXPECTED COST, what worry value(s) would make deductible insurance preferred to full insurance? Show all work and calculations and explain your numerical answer. [1 point] What worry value(s) would make retention preferred to partial insurance? Show all work and calculations and explain your answer. [1 point] c. d. f