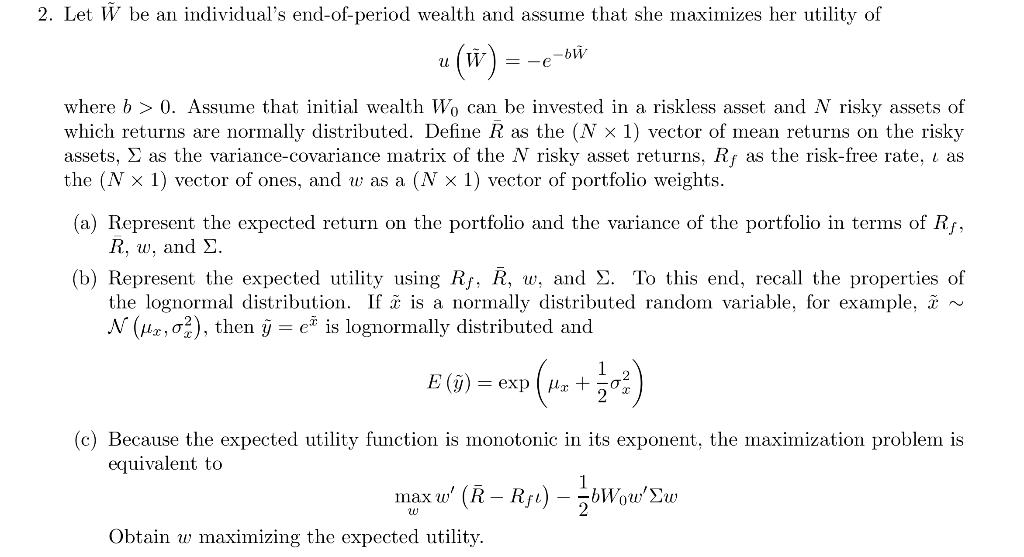

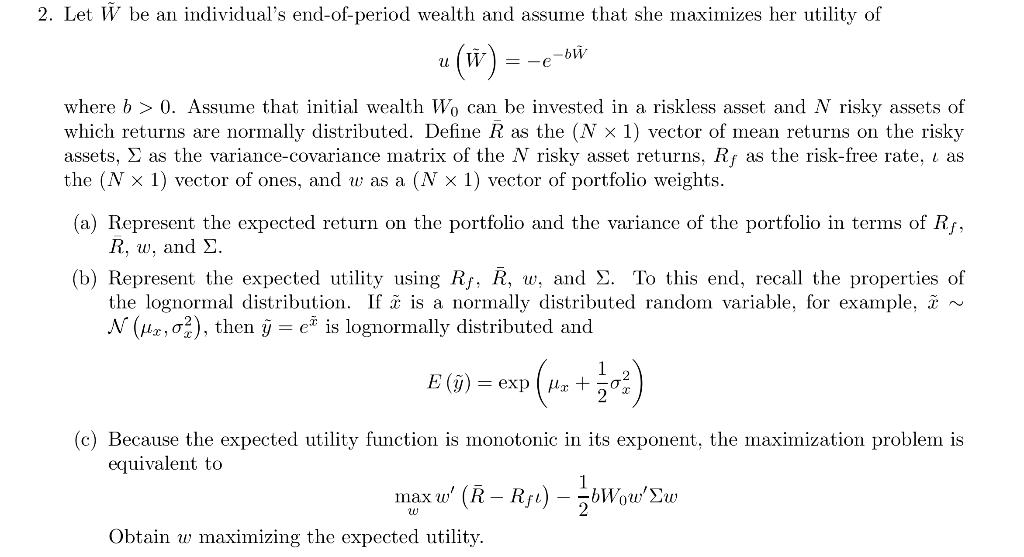

2. Let W be an individual's end-of-period wealth and assume that she maximizes her utility of u(w) -be = -e where b > 0. Assume that initial wealth Wo can be invested in a riskless asset and N risky assets of which returns are normally distributed. Define R as the (N * 1) vector of mean returns on the risky assets, as the variance-covariance matrix of the N risky asset returns, R, as the risk-free rate, e as the (N X 1) vector of ones, and was a (N X 1) vector of portfolio weights. (a) Represent the expected return on the portfolio and the variance of the portfolio in terms of Rf, R, w, and (b) Represent the expected utility using Rj, , w, and . To this end, recall the properties of the lognormal distribution. If is a normally distributed random variable, for example, I ~ N (H2,02), then = ei is lognormally distributed and E' (t) = exp(-: +32) (c) Because the expected utility function is monotonic in its exponent, the maximization problem is equivalent to maxw" (R R51) - Wowlw Obtain w maximizing the expected utility. 2. Let W be an individual's end-of-period wealth and assume that she maximizes her utility of u(w) -be = -e where b > 0. Assume that initial wealth Wo can be invested in a riskless asset and N risky assets of which returns are normally distributed. Define R as the (N * 1) vector of mean returns on the risky assets, as the variance-covariance matrix of the N risky asset returns, R, as the risk-free rate, e as the (N X 1) vector of ones, and was a (N X 1) vector of portfolio weights. (a) Represent the expected return on the portfolio and the variance of the portfolio in terms of Rf, R, w, and (b) Represent the expected utility using Rj, , w, and . To this end, recall the properties of the lognormal distribution. If is a normally distributed random variable, for example, I ~ N (H2,02), then = ei is lognormally distributed and E' (t) = exp(-: +32) (c) Because the expected utility function is monotonic in its exponent, the maximization problem is equivalent to maxw" (R R51) - Wowlw Obtain w maximizing the expected utility