Answered step by step

Verified Expert Solution

Question

1 Approved Answer

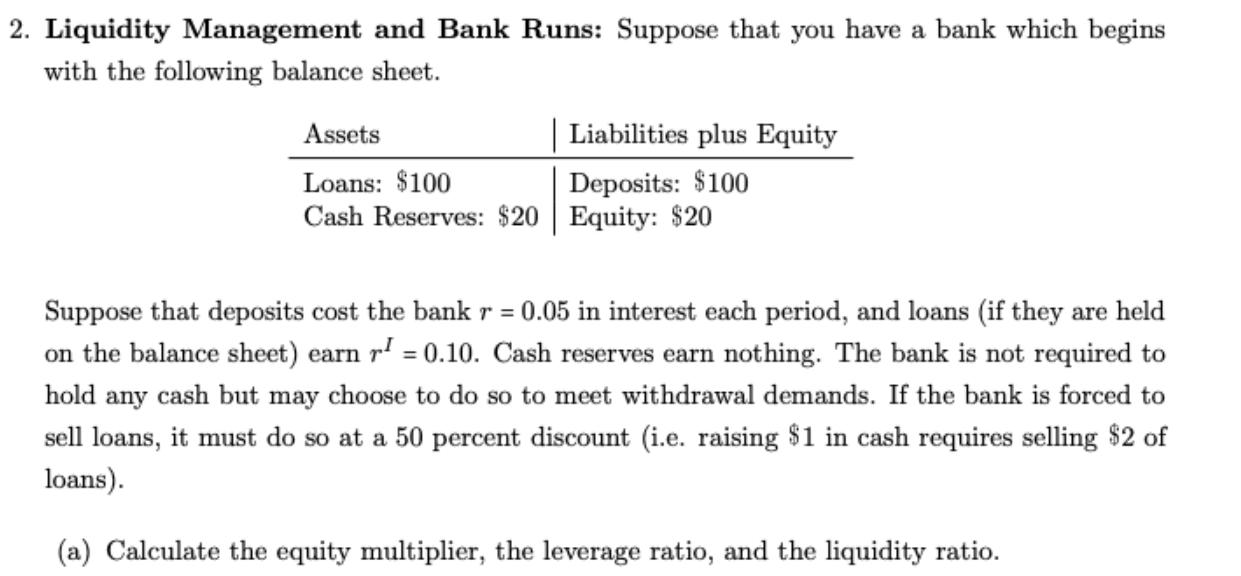

2. Liquidity Management and Bank Runs: Suppose that you have a bank which begins with the following balance sheet. | Liabilities plus Equity Assets

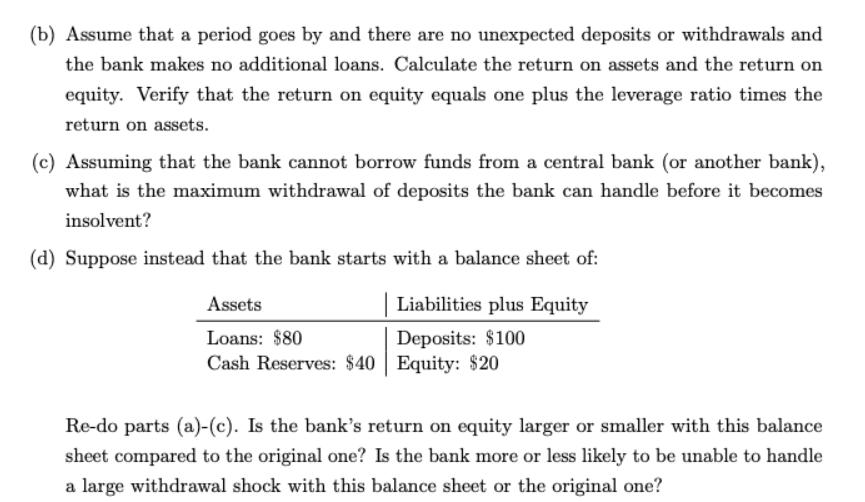

2. Liquidity Management and Bank Runs: Suppose that you have a bank which begins with the following balance sheet. | Liabilities plus Equity Assets Loans: $100 Deposits: $100 Cash Reserves: $20 Equity: $20 Suppose that deposits cost the bank r = 0.05 in interest each period, and loans (if they are held on the balance sheet) earn r=0.10. Cash reserves earn nothing. The bank is not required to hold any cash but may choose to do so to meet withdrawal demands. If the bank is forced to sell loans, it must do so at a 50 percent discount (i.e. raising $1 in cash requires selling $2 of loans). (a) Calculate the equity multiplier, the leverage ratio, and the liquidity ratio. (b) Assume that a period goes by and there are no unexpected deposits or withdrawals and the bank makes no additional loans. Calculate the return on assets and the return on equity. Verify that the return on equity equals one plus the leverage ratio times the return on assets. (c) Assuming that the bank cannot borrow funds from a central bank (or another bank), what is the maximum withdrawal of deposits the bank can handle before it becomes insolvent? (d) Suppose instead that the bank starts with a balance sheet of: Assets Liabilities plus Equity Loans: $80 Deposits: $100 Cash Reserves: $40 Equity: $20 Re-do parts (a)-(c). Is the bank's return on equity larger or smaller with this balance sheet compared to the original one? Is the bank more or less likely to be unable to handle a large withdrawal shock with this balance sheet or the original one?

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Equity multiplier Total AssetsEquity 100 2020 6 Leverage ratio Total AssetsEquity 100 2020 6 Liqui...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started