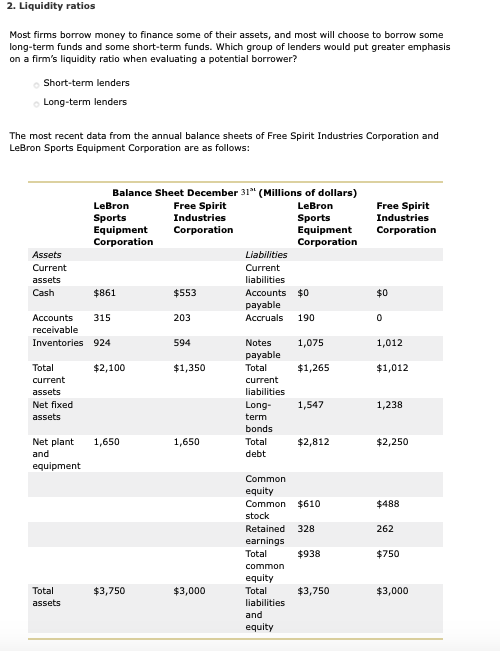

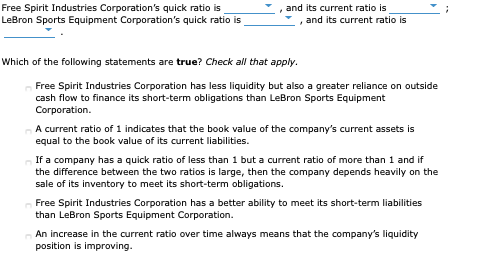

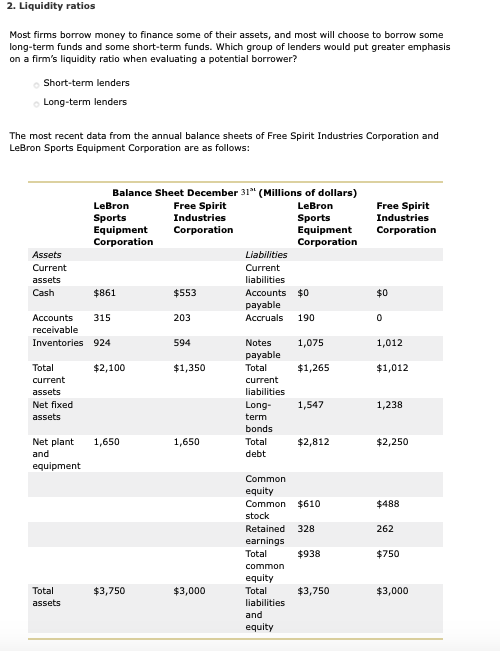

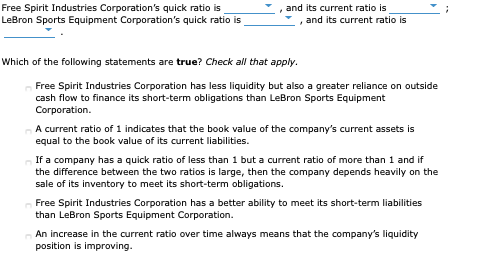

2. Liquidity ratios Most firms borrow money to finance some of their assets, and most will choose to borrow some long-term funds and some short-term funds. Which group of lenders would put greater emphasis on a firm's liquidity ratio when evaluating a potential borrower? Short-term lenders Long-term lenders The most recent data from the annual balance sheets of Free Spirit Industries Corporation and LeBron Sports Equipment Corporation are as follows: Free Spirit Industries Corporation 1,012 $1,012 Balance Sheet December 31" (Millions of dollars) LeBron Free Spirit LeBron Sports Industries Sports Equipment Corporation Equipment Corporation Corporation Assets Liabilities Current Current assets liabilities Cash $861 $553 Accounts $0 payable Accounts 315 203 Accruals 190 receivable Inventories 924 594 Notes 1,075 payable Total $2,100 $1,350 $1,265 current current assets liabilities Net fixed Long 1,547 assets term bonds Net plant 1,650 1,650 Total $2,812 and debt equipment Common equity Common $610 stock Retained 328 earnings Total $938 common equity Total $3,750 $3,000 Total $3,750 assets liabilities 1,238 $2,250 $488 262 $750 $3,000 and equity Free Spirit Industries Corporation's quick ratio is LeBron Sports Equipment Corporation's quick ratio is , and its current ratio is , and its current ratio is Which of the following statements are true? Check all that apply. Free Spirit Industries Corporation has less liquidity but also a greater reliance on outside cash flow to finance its short-term obligations than LeBron Sports Equipment Corporation. A current ratio of 1 indicates that the book value of the company's current assets is equal to the book value of its current liabilities. If a company has a quick ratio of less than 1 but a current ratio of more than 1 and if the difference between the two ratios is large, then the company depends heavily on the sale of its inventory to meet its short-term obligations. Free Spirit Industries Corporation has a better ability to meet its short-term liabilities than LeBron Sports Equipment Corporation. An increase in the current ratio over time always means that the company's liquidity position is improving