Answered step by step

Verified Expert Solution

Question

1 Approved Answer

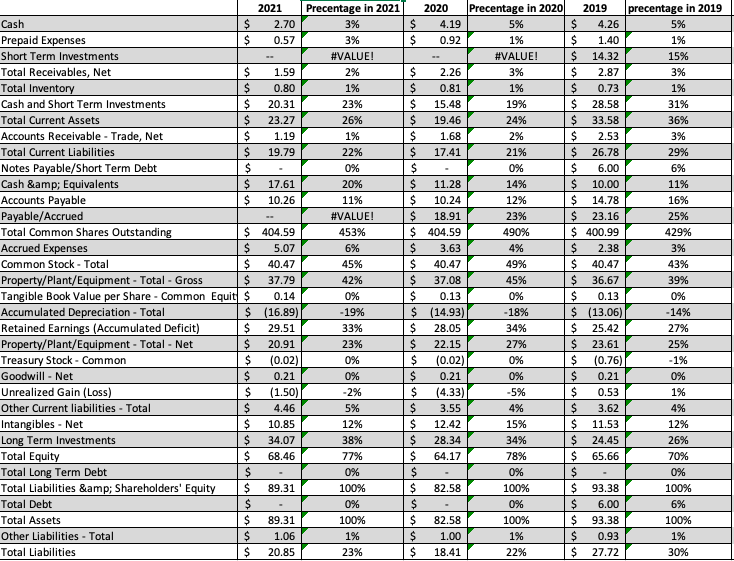

2- List the largest class of assets and largest class of liabilities of the company? 3) Determine the proportion of current and non-current portions of

2- List the largest class of assets and largest class of liabilities of the company?

3) Determine the proportion of current and non-current portions of assets relative to Total Assets.

4) Determine the proportion of current and non-current portions of liabilities relative to Total Liabilities.

Cash Prepaid Expenses Short Term Investments Total Receivables, Net Total Inventory Cash and Short Term Investments Total Current Assets Accounts Receivable - Trade, Net Total Current Liabilities Notes Payable/Short Term Debt Cash & Equivalents Accounts Payable Payable/Accrued Total Common Shares Outstanding Accrued Expenses Common Stock - Total Retained Earnings (Accumulated Deficit) Property/Plant/Equipment - Total - Net Treasury Stock - Common Goodwill - Net $ $ Unrealized Gain (Loss) Other Current liabilities - Total Intangibles - Net Long Term Investments Total Equity Total Long Term Debt Total Liabilities & Shareholders' Equity Total Debt Total Assets Other Liabilities - Total Total Liabilities $ $ 1.59 $ 0.80 $ 20.31 $ 23.27 $ 1.19 $ 19.79 $ 404.59 $ 5.07 $ 40.47 Property/Plant/Equipment - Total - Gross $ 37.79 0.14 Tangible Book Value per Share - Common Equit $ Accumulated Depreciation - Total $ (16.89) $ 29.51 $ 20.91 $ 17.61 $ 10.26 $ $ $ $ $ $ $ $ 2021 $ 2.70 0.57 $ es (0.02) 0.21 (1.50) 4.46 10.85 34.07 68.46 89.31 $ 89.31 $ 1.06 $ 20.85 Precentage in 2021 3% 3% #VALUE! 2% 1% 23% 26% 1% 22% 0% 20% 11% #VALUE! 453% 6% 45% 42% 0% -19% 33% 23% 0% 0% -2% 5% 12% 38% 77% 0% 100% 0% 100% 1% 23% $ $ $ 2.26 $ 0.81 $ 15.48 $ 19.46 $ 1.68 $ 17.41 $ $ $ $ 11.28 $ 10.24 18.91 404.59 $ 3.63 $ 40.47 $ 37.08 $ 0.13 2020 4.19 0.92 $ (14.93) $ 28.05 $ 22.15 $ $ (0.02) $ 0.21 $ (4.33) $ 3.55 $ 12.42 $ 28.34 $ 64.17 $ $ $ $ $ 82.58 82.58 1.00 18.41 Precentage in 2020 5% 1% #VALUE! 3% 1% 19% 24% 2% 21% 0% 14% 12% 23% 490% 4% 49% 45% 0% -18% 34% 27% 0% 0% -5% 4% 15% 34% 78% 0% 100% 0% 100% 1% 22% $ 4.26 $ 1.40 $ 14.32 $ 2.87 SSSS $ 0.73 $ 28.58 33.58 $ $ 2.53 $ 26.78 $ 6.00 $ 10.00 $ 14.78 23.16 $ 400.99 |es|e is es $ sles $ $ 2.38 40.47 36.67 0.13 $ (13.06) $ 25.42 $ 23.61 (0.76) 0.21 0.53 $ 3.62 $ 11.53 $ 24.45 $ 65.66 $ iseses. 2019 $ $ $ $ $ ester $ 93.38 $ 6.00 $ 93.38 $ 0.93 $ 27.72 sess precentage in 2019 5% 1% 15% 3% 1% 31% 36% 3% 29% 6% 11% 16% 25% 429% 3% 43% 39% 0% -14% 27% 25% -1% 0% 1% 4% 12% 26% 70% 0% 100% 6% 100% 1% 30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started