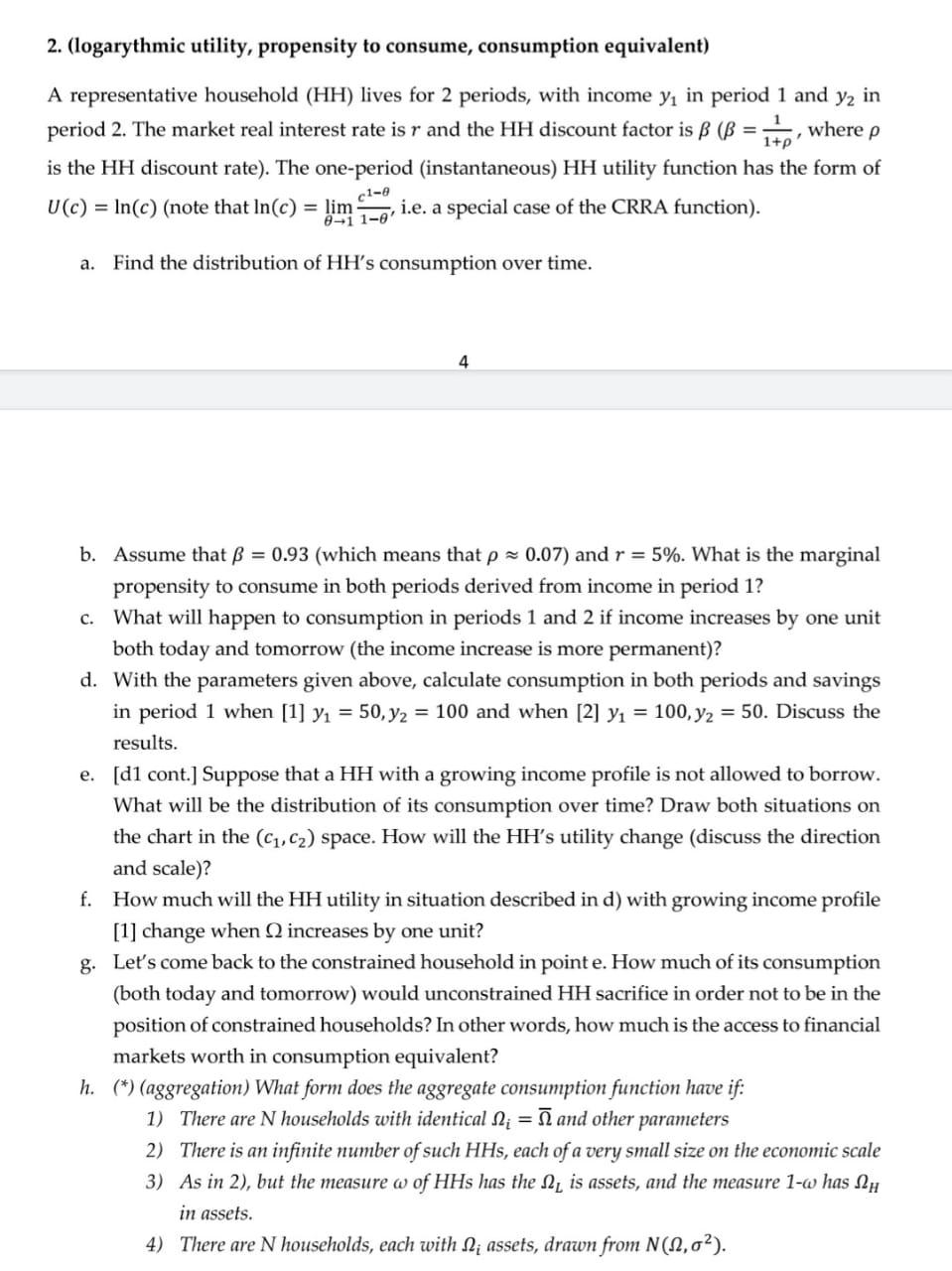

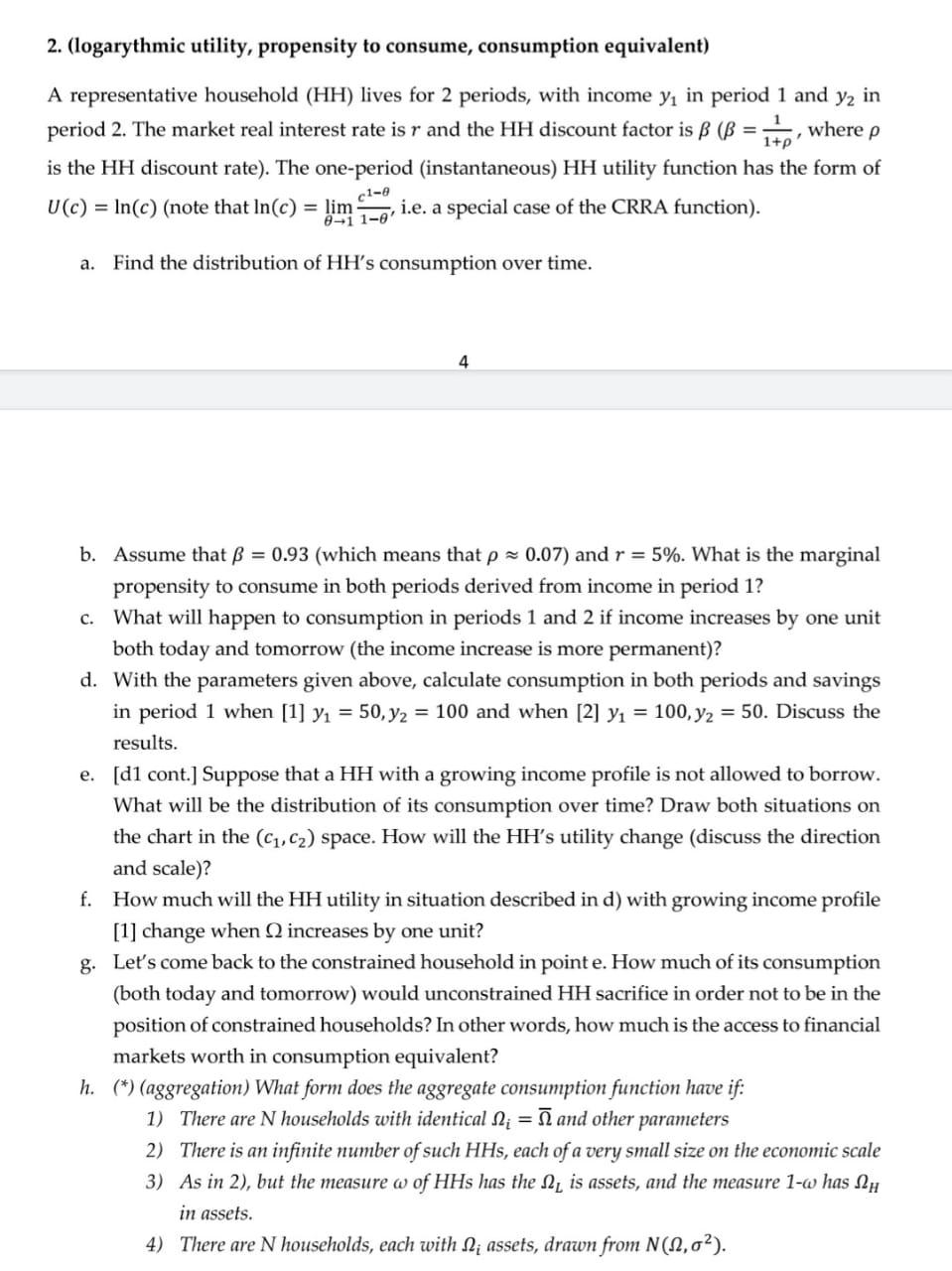

2. (logarythmic utility, propensity to consume, consumption equivalent) A representative household (HH) lives for 2 periods, with income y in period 1 and y2 in period 2. The market real interest rate is r and the HH discount factor is B ( = 1+2, where p is the HH discount rate). The one-period (instantaneous) HH utility function has the form of U(C) = ln(C) (note that In(c) = lim 1-2, i.e. a special case of the CRRA function). a. Find the distribution of HH's consumption over time. 4 b. Assume that B = 0.93 (which means that p = 0.07) and r = 5%. What is the marginal propensity to consume in both periods derived from income in period 1? c. What will happen to consumption in periods 1 and 2 if income increases by one unit both today and tomorrow (the income increase is more permanent)? d. With the parameters given above, calculate consumption in both periods and savings in period 1 when [1] y = 50, y2 = 100 and when [2] y = 100, y2 = 50. Discuss the results. e. [d1 cont.] Suppose that a HH with a growing income profile is not allowed to borrow. What will be the distribution of its consumption over time? Draw both situations on the chart in the (C1,C2) space. How will the HH's utility change (discuss the direction and scale)? f. How much will the HH utility in situation described in d) with growing income profile [1] change when Q increases by one unit? g. Let's come back to the constrained household in point e. How much of its consumption (both today and tomorrow) would unconstrained HH sacrifice in order not to be in the position of constrained households? In other words, how much is the access to financial markets worth in consumption equivalent? h. (*) (aggregation) What form does the aggregate consumption function have if: 1) There are N households with identical li = 7 and other parameters 2) There is an infinite number of such HHs, each of a very small size on the economic scale 3) As in 2), but the measure w of HHs has the Ry is assets, and the measure 1-w has 2 in assets. 4) There are N households, each with li assets, drawn from N(1,02). 2. (logarythmic utility, propensity to consume, consumption equivalent) A representative household (HH) lives for 2 periods, with income y in period 1 and y2 in period 2. The market real interest rate is r and the HH discount factor is B ( = 1+2, where p is the HH discount rate). The one-period (instantaneous) HH utility function has the form of U(C) = ln(C) (note that In(c) = lim 1-2, i.e. a special case of the CRRA function). a. Find the distribution of HH's consumption over time. 4 b. Assume that B = 0.93 (which means that p = 0.07) and r = 5%. What is the marginal propensity to consume in both periods derived from income in period 1? c. What will happen to consumption in periods 1 and 2 if income increases by one unit both today and tomorrow (the income increase is more permanent)? d. With the parameters given above, calculate consumption in both periods and savings in period 1 when [1] y = 50, y2 = 100 and when [2] y = 100, y2 = 50. Discuss the results. e. [d1 cont.] Suppose that a HH with a growing income profile is not allowed to borrow. What will be the distribution of its consumption over time? Draw both situations on the chart in the (C1,C2) space. How will the HH's utility change (discuss the direction and scale)? f. How much will the HH utility in situation described in d) with growing income profile [1] change when Q increases by one unit? g. Let's come back to the constrained household in point e. How much of its consumption (both today and tomorrow) would unconstrained HH sacrifice in order not to be in the position of constrained households? In other words, how much is the access to financial markets worth in consumption equivalent? h. (*) (aggregation) What form does the aggregate consumption function have if: 1) There are N households with identical li = 7 and other parameters 2) There is an infinite number of such HHs, each of a very small size on the economic scale 3) As in 2), but the measure w of HHs has the Ry is assets, and the measure 1-w has 2 in assets. 4) There are N households, each with li assets, drawn from N(1,02)