Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Marshall LLP is an establishod independent audit firm operating sololy in the North East region of the UK and provides audit and protessional services

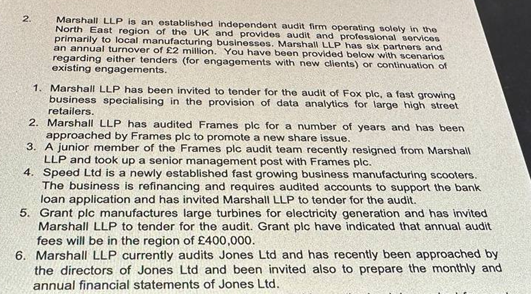

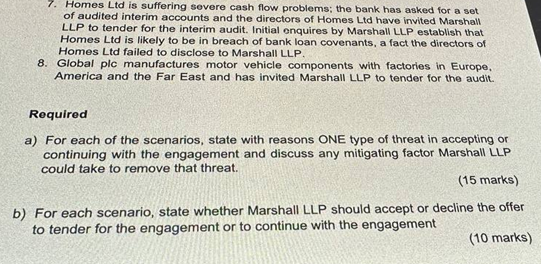

2. Marshall LLP is an establishod independent audit firm operating sololy in the North East region of the UK and provides audit and protessional services primarily to local manufacturing businesses. Marshal LLP has six partners and an annual turnover of 82 million. You have been provided below with scenarios regarding either tenders (for engagements with new clients) or continuation of existing engagements. 1. Marshall LLP has been invited to tender for the audit of Fox plc, a fast growing business specialising in the provision of data analytics for large high street retailers. 2. Marshall LLP has audited Frames ple for a number of years and has been approached by Frames plc to promote a new share issue. 3. A junior member of the Frames plc audit team recently resigned from Marshall LLP and took up a senior management post with Frames plc. 4. Speed Ltd is a newly established fast growing business manufacturing scooters. The business is refinancing and requires audited accounts to support the bank loan application and has invited Marshall LLP to tender for the audit. 5. Grant plc manufactures large turbines for electricity generation and has invited Marshall LLP to tender for the audit. Grant ple have indicated that annual audit fees will be in the region of 400,000. 6. Marshall LLP currently audits Jones Ltd and has recently been approached by the directors of Jones Ltd and been invited also to prepare the monthly and annual financial statements of Jones Ltd. 7. Homes Ltd is suffering sovere cash flow problems; the bank has asked for a set of audited interim accounts and the directors of Homes Ltd have irvited Marshall LLP to tender for the interim audit. Initial enquires by Marshall LLP establish that Homes Ltd is likely to be in breach of bank loan covenants, a fact the directors of Homes Ltd failed to disclose to Marshall LLP. 8. Global plc manufactures motor vehicle components with factories in Europe. America and the Far East and has invited Marshall LLP to tender for the audit. Required a) For each of the scenarios, state with reasons ONE type of threat in accepting or continuing with the engagement and discuss any mitigating factor Marshall LLP could take to remove that threat. (15 marks) b) For each scenario, state whether Marshall LLP should accept or decline the offer to tender for the engagement or to continue with the engagement (10 marks

2. Marshall LLP is an establishod independent audit firm operating sololy in the North East region of the UK and provides audit and protessional services primarily to local manufacturing businesses. Marshal LLP has six partners and an annual turnover of 82 million. You have been provided below with scenarios regarding either tenders (for engagements with new clients) or continuation of existing engagements. 1. Marshall LLP has been invited to tender for the audit of Fox plc, a fast growing business specialising in the provision of data analytics for large high street retailers. 2. Marshall LLP has audited Frames ple for a number of years and has been approached by Frames plc to promote a new share issue. 3. A junior member of the Frames plc audit team recently resigned from Marshall LLP and took up a senior management post with Frames plc. 4. Speed Ltd is a newly established fast growing business manufacturing scooters. The business is refinancing and requires audited accounts to support the bank loan application and has invited Marshall LLP to tender for the audit. 5. Grant plc manufactures large turbines for electricity generation and has invited Marshall LLP to tender for the audit. Grant ple have indicated that annual audit fees will be in the region of 400,000. 6. Marshall LLP currently audits Jones Ltd and has recently been approached by the directors of Jones Ltd and been invited also to prepare the monthly and annual financial statements of Jones Ltd. 7. Homes Ltd is suffering sovere cash flow problems; the bank has asked for a set of audited interim accounts and the directors of Homes Ltd have irvited Marshall LLP to tender for the interim audit. Initial enquires by Marshall LLP establish that Homes Ltd is likely to be in breach of bank loan covenants, a fact the directors of Homes Ltd failed to disclose to Marshall LLP. 8. Global plc manufactures motor vehicle components with factories in Europe. America and the Far East and has invited Marshall LLP to tender for the audit. Required a) For each of the scenarios, state with reasons ONE type of threat in accepting or continuing with the engagement and discuss any mitigating factor Marshall LLP could take to remove that threat. (15 marks) b) For each scenario, state whether Marshall LLP should accept or decline the offer to tender for the engagement or to continue with the engagement (10 marks Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started