Answered step by step

Verified Expert Solution

Question

1 Approved Answer

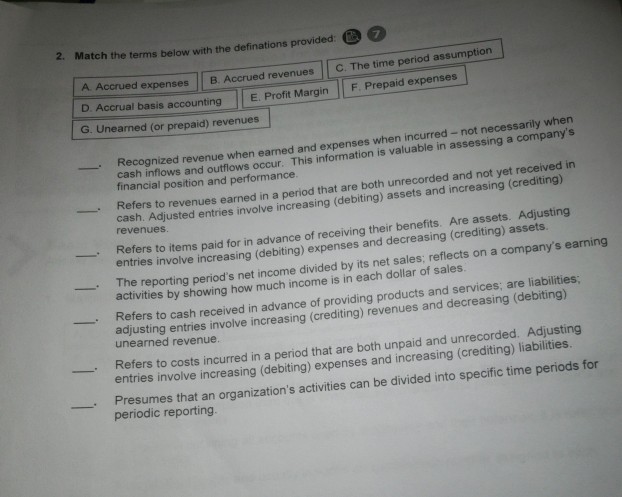

2. Match the terms below with the definations provided A Accrued expenses B. Accrued revenues C. The time period assumption Accrual basis accounting E. Profit

2. Match the terms below with the definations provided A Accrued expenses B. Accrued revenues C. The time period assumption Accrual basis accounting E. Profit Margin G. Unearned (or prepaid) revenues F. Prepaid expenses Recognized revenue when earned and expenses when incurred - not necessarily when cash inflows and outflows occur. This information is valuable in assessing a company's financial position and performance. Refers to revenues earned in a period that are both unrecorded and not yet received in cash. Adjusted entries involve increasing (debiting) assets and increasing (crediting) revenues Refers to items paid for in advance of receiving their benefits. Are assets. Adjusting entries involve increasing (debiting) expenses and decreasing (crediting) assets. The reporting period's net income divided by its net sales; reflects on a company's earning activities by showing how much income is in each dollar of sales. Refers to cash received in advance of providing products and services; are liabilities; adjusting entries involve increasing (crediting) revenues and decreasing (debiting) unearned revenue. Refers to costs incurred in a period that are both unpaid and unrecorded. Adjusting Presumes that an organization's activities can be divided into specific time periods for entries involve increasing (debiting) expenses and increasing (crediting) liabilities periodic reporting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started