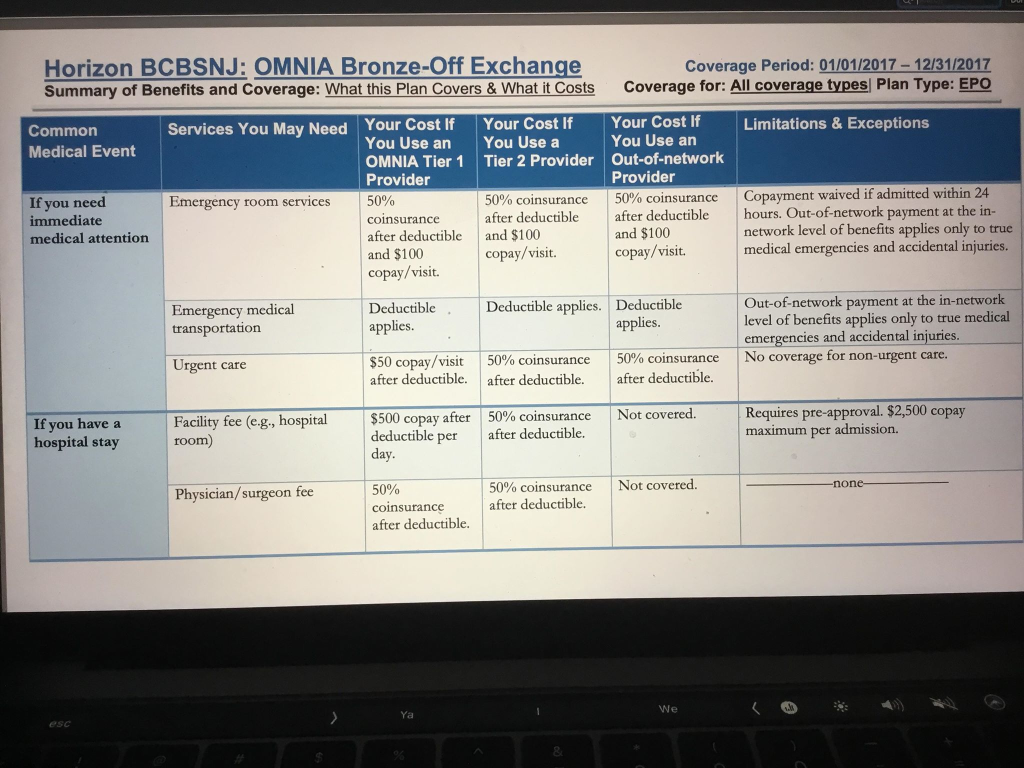

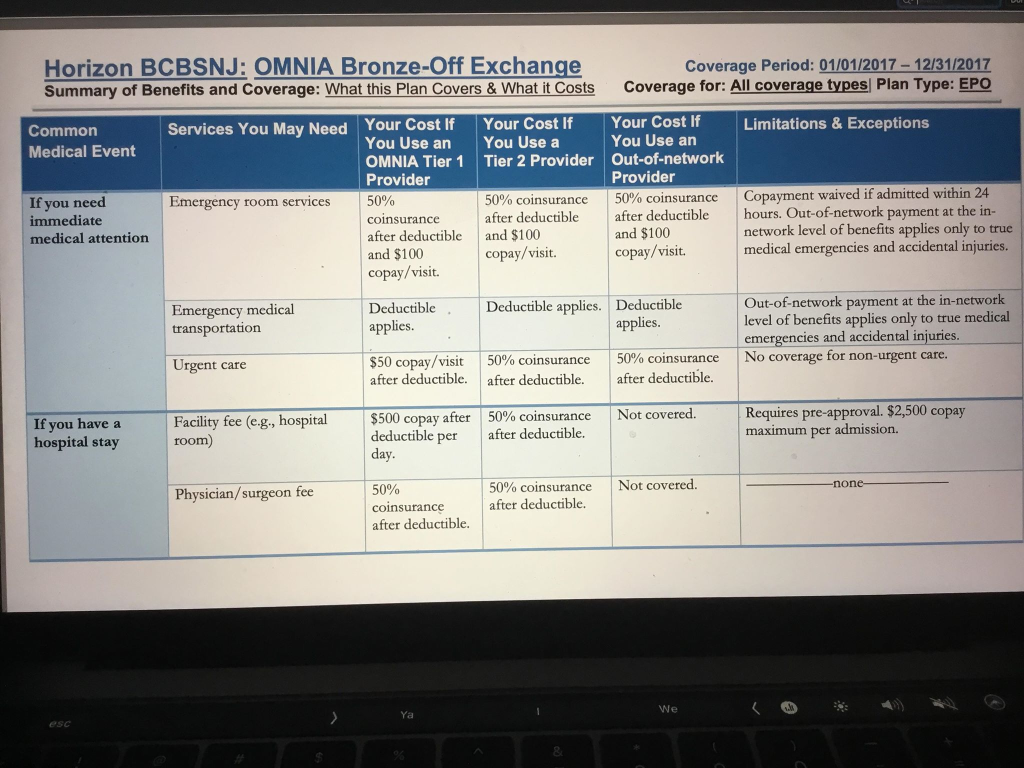

2) Max fractured his wrist and had to be taken to the Emergency room. If the total bill for treatment was $1500, how much would Michael have to pay from his pocket. Assume there were no other medical bills for the year. 3) If Max had fractured his wrist in a year when they had already incurred $7000 in medical expense Not including premiums and penalties). How much of the $1500 for emergency treatment would the insurance cover? (Assume the individual out of pocket limit has not been reached) 4). For this question, assume this year the family has already incurred medical expense of $7000 (Not including premiums and penalties). They incur $1000 for a visit to a doctor's office visit. The doctor was listed as a Tier 2 provider. How much will the insurance cover? (Assume the individual out of pocket limit has not been reached) 5) For this question, assume this year the family has already incurred medical expense of $14.300 (Not including premiums and penalties). They incur $1500 for a visit to a doctor's office visit. The doctor was listed as a Tier 2 provider. How much will the insurance cover? Horizon BCBSNJ: OMNIA Bronze-Off Exchange Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2017 - 12/31/2017 Coverage for: All coverage types Plan Type: EPO Limitations & Exceptions Common Medical Event Your Cost If You Use a Tier 2 Provider If you need immediate medical attention Services You May Need Your Cost If You Use an OMNIA Tier 1 Provider Emergency room services 50% coinsurance after deductible and $100 copay/visit Your Cost If You Use an Out-of-network Provider 50% coinsurance after deductible and $100 copay/visit. 50% coinsurance after deductible and $100 copay/visit. Copayment waived if admitted within 24 hours. Out-of-network payment at the in- network level of benefits applies only to true medical emergencies and accidental injuries. Emergency medical transportation Deductible applies. Deductible applies. Deductible applies. Out-of-network payment at the in-network level of benefits applies only to true medical emergencies and accidental injuries. No coverage for non-urgent care, Urgent care $50 copay/visit after deductible. 50% coinsurance after deductible. 50% coinsurance after deductible. Not covered. If you have a hospital stay Facility fee (e.g., hospital room) $500 copay after deductible per day. 50% coinsurance after deductible. Requires pre-approval. $2,500 copay maximum per admission. Physician/surgeon fee Not covered. -none- 50% coinsurance after deductible 50% coinsurance after deductible We 2) Max fractured his wrist and had to be taken to the Emergency room. If the total bill for treatment was $1500, how much would Michael have to pay from his pocket. Assume there were no other medical bills for the year. 3) If Max had fractured his wrist in a year when they had already incurred $7000 in medical expense Not including premiums and penalties). How much of the $1500 for emergency treatment would the insurance cover? (Assume the individual out of pocket limit has not been reached) 4). For this question, assume this year the family has already incurred medical expense of $7000 (Not including premiums and penalties). They incur $1000 for a visit to a doctor's office visit. The doctor was listed as a Tier 2 provider. How much will the insurance cover? (Assume the individual out of pocket limit has not been reached) 5) For this question, assume this year the family has already incurred medical expense of $14.300 (Not including premiums and penalties). They incur $1500 for a visit to a doctor's office visit. The doctor was listed as a Tier 2 provider. How much will the insurance cover? Horizon BCBSNJ: OMNIA Bronze-Off Exchange Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage Period: 01/01/2017 - 12/31/2017 Coverage for: All coverage types Plan Type: EPO Limitations & Exceptions Common Medical Event Your Cost If You Use a Tier 2 Provider If you need immediate medical attention Services You May Need Your Cost If You Use an OMNIA Tier 1 Provider Emergency room services 50% coinsurance after deductible and $100 copay/visit Your Cost If You Use an Out-of-network Provider 50% coinsurance after deductible and $100 copay/visit. 50% coinsurance after deductible and $100 copay/visit. Copayment waived if admitted within 24 hours. Out-of-network payment at the in- network level of benefits applies only to true medical emergencies and accidental injuries. Emergency medical transportation Deductible applies. Deductible applies. Deductible applies. Out-of-network payment at the in-network level of benefits applies only to true medical emergencies and accidental injuries. No coverage for non-urgent care, Urgent care $50 copay/visit after deductible. 50% coinsurance after deductible. 50% coinsurance after deductible. Not covered. If you have a hospital stay Facility fee (e.g., hospital room) $500 copay after deductible per day. 50% coinsurance after deductible. Requires pre-approval. $2,500 copay maximum per admission. Physician/surgeon fee Not covered. -none- 50% coinsurance after deductible 50% coinsurance after deductible We