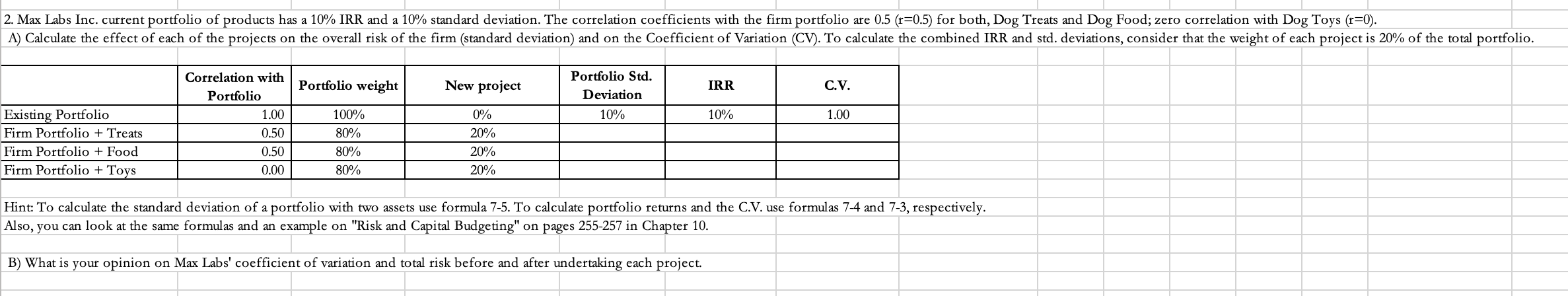

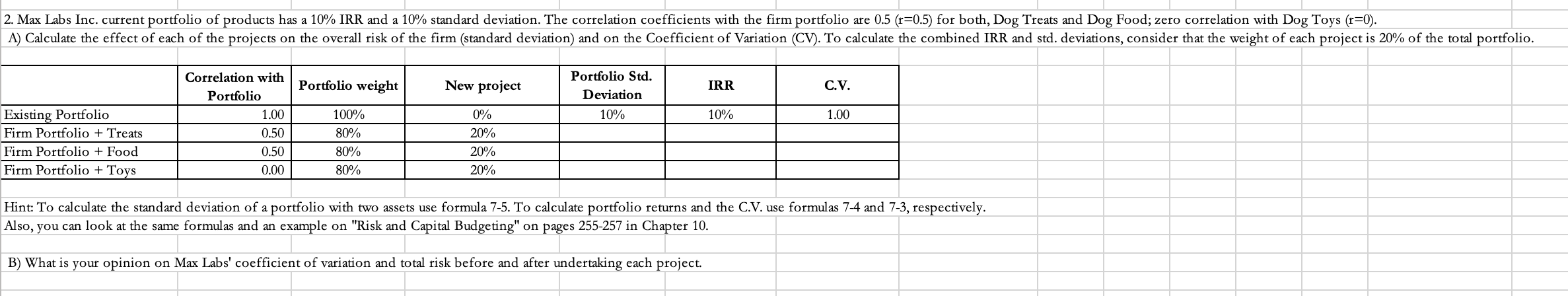

2. Max Labs Inc. current portfolio of products has a 10% IRR and a 10% standard deviation. The correlation coefficients with the firm portfolio are 0.5 (r=0.5) for both, Dog Treats and Dog Food; zero correlation with Dog Toys (r=0). A) Calculate the effect of each of the projects on the overall risk of the firm (standard deviation) and on the Coefficient of Variation (CV). To calculate the combined IRR and std. deviations, consider that the weight of each project is 20% of the total portfolio. Portfolio Std Correlation with Portfolio weight New project C.V IRR Deviation Portfolio 100% Existing Portfolio 1.00 0% 10% 10% 1.00 Firm Portfolio + Treats 0.50 80% 20% Firm Portfolio + Food 0.50 80% 20% Firm Portfolio + Toys 20% 0.00 80% Hint: To calculate the standard deviation of a portfolio with two assets use formula 7-5. To calculate portfolio returns and the C.V. use formulas 7-4 and 7-3, respectively. Also, you can look at the same formulas and an example on "Risk and Capital Budgeting" on pages 255-257 in Chapter 10. B) What is your opinion on Max Labs' coefficient of variation and total risk before and after undertaking each project 2. Max Labs Inc. current portfolio of products has a 10% IRR and a 10% standard deviation. The correlation coefficients with the firm portfolio are 0.5 (r=0.5) for both, Dog Treats and Dog Food; zero correlation with Dog Toys (r=0). A) Calculate the effect of each of the projects on the overall risk of the firm (standard deviation) and on the Coefficient of Variation (CV). To calculate the combined IRR and std. deviations, consider that the weight of each project is 20% of the total portfolio. Portfolio Std Correlation with Portfolio weight New project C.V IRR Deviation Portfolio 100% Existing Portfolio 1.00 0% 10% 10% 1.00 Firm Portfolio + Treats 0.50 80% 20% Firm Portfolio + Food 0.50 80% 20% Firm Portfolio + Toys 20% 0.00 80% Hint: To calculate the standard deviation of a portfolio with two assets use formula 7-5. To calculate portfolio returns and the C.V. use formulas 7-4 and 7-3, respectively. Also, you can look at the same formulas and an example on "Risk and Capital Budgeting" on pages 255-257 in Chapter 10. B) What is your opinion on Max Labs' coefficient of variation and total risk before and after undertaking each project