Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2. Mehra and Prescott find that a plausible equity risk premium consistent with a standard general equilibrium model is far lower than the historically observed

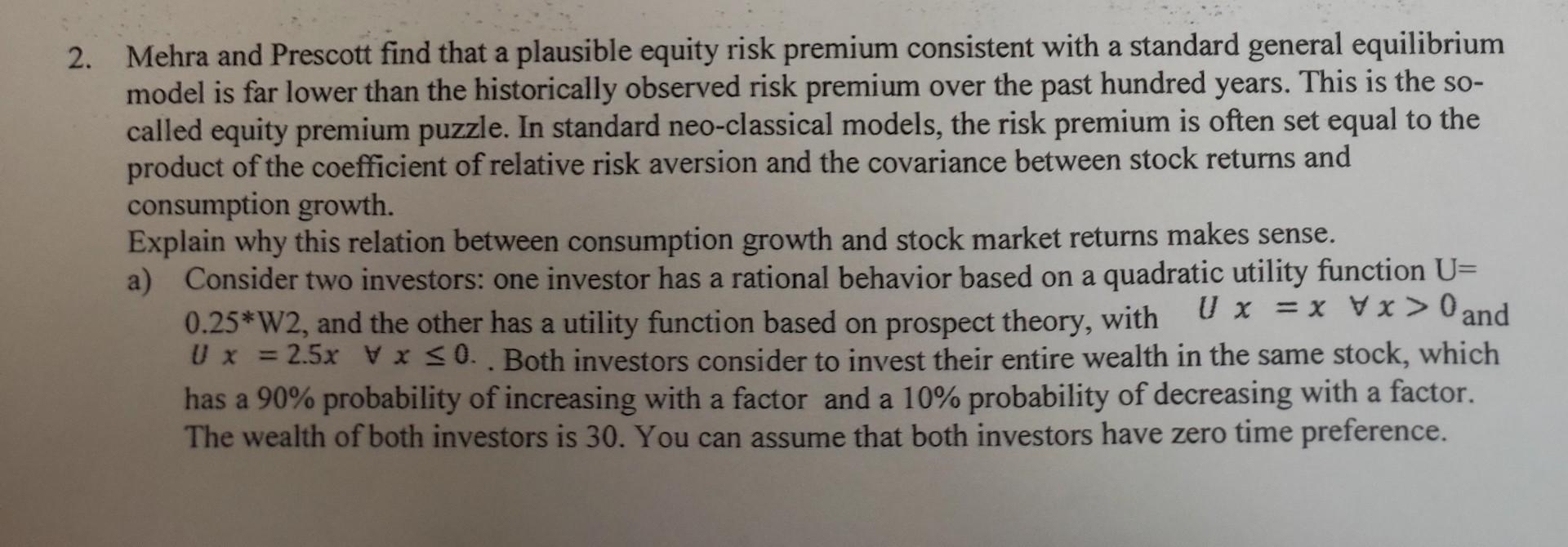

2. Mehra and Prescott find that a plausible equity risk premium consistent with a standard general equilibrium model is far lower than the historically observed risk premium over the past hundred years. This is the socalled equity premium puzzle. In standard neo-classical models, the risk premium is often set equal to the product of the coefficient of relative risk aversion and the covariance between stock returns and consumption growth. Explain why this relation between consumption growth and stock market returns makes sense. a) Consider two investors: one investor has a rational behavior based on a quadratic utility function U= 0.25W2, and the other has a utility function based on prospect theory, with Ux=xx>0 and Ux=2.5xx0. Both investors consider to invest their entire wealth in the same stock, which has a 90% probability of increasing with a factor and a 10% probability of decreasing with a factor. The wealth of both investors is 30 . You can assume that both investors have zero time preference. Calculate the expected utility of the rational investor (in terms of the quadratic utility function) of investing his wealth in this stock for resp. one and two periods. b) Calculate the expected utility of the other investor (in terms of prospect theory utility) of investing his wealth in this stock for resp. one and two periods

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started