Answered step by step

Verified Expert Solution

Question

1 Approved Answer

#2. Milano Pizza Club owns a chain of three identical restaurants for their Milan style pizza. Each store currently has $540,000 in debt outstanding.

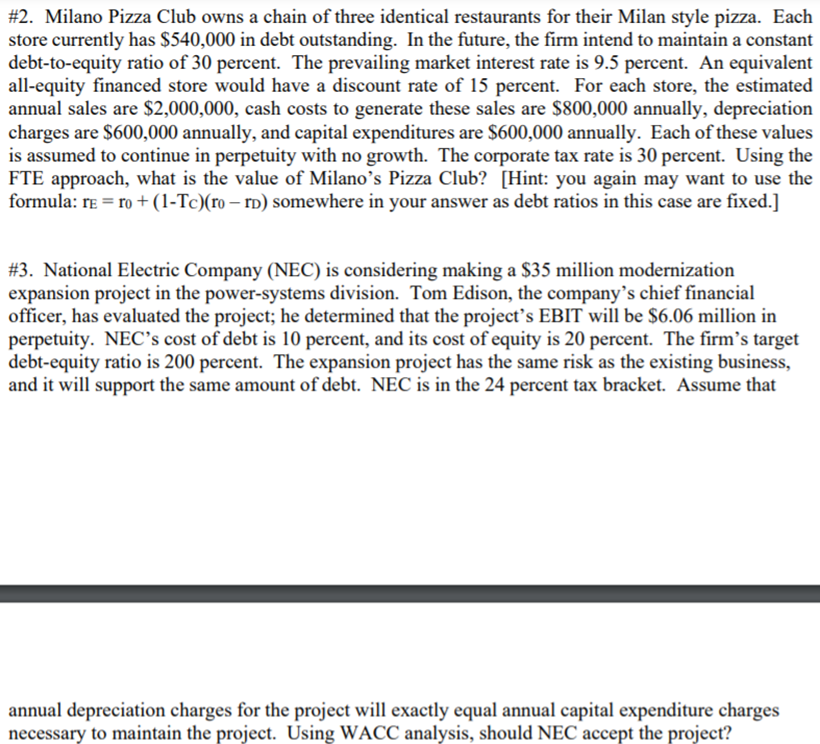

#2. Milano Pizza Club owns a chain of three identical restaurants for their Milan style pizza. Each store currently has $540,000 in debt outstanding. In the future, the firm intend to maintain a constant debt-to-equity ratio of 30 percent. The prevailing market interest rate is 9.5 percent. An equivalent all-equity financed store would have a discount rate of 15 percent. For each store, the estimated annual sales are $2,000,000, cash costs to generate these sales are $800,000 annually, depreciation charges are $600,000 annually, and capital expenditures are $600,000 annually. Each of these values is assumed to continue in perpetuity with no growth. The corporate tax rate is 30 percent. Using the FTE approach, what is the value of Milano's Pizza Club? [Hint: you again may want to use the formula: re=ro + (1-Tc)(ro - rD) somewhere in your answer as debt ratios in this case are fixed.] #3. National Electric Company (NEC) is considering making a $35 million modernization expansion project in the power-systems division. Tom Edison, the company's chief financial officer, has evaluated the project; he determined that the project's EBIT will be $6.06 million in perpetuity. NEC's cost of debt is 10 percent, and its cost of equity is 20 percent. The firm's target debt-equity ratio is 200 percent. The expansion project has the same risk as the existing business, and it will support the same amount of debt. NEC is in the 24 percent tax bracket. Assume that annual depreciation charges for the project will exactly equal annual capital expenditure charges necessary to maintain the project. Using WACC analysis, should NEC accept the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started